Will Fed cut rates 25 or 50 as US dollar tumbles and gold continues its historic run.

Will Fed Cut Rates 25 Or 50?

September 16 (King World News) – Peter Boockvar: The debate here on the Fed doesn’t have to be binary. It’s not 25 or 50 bps in cuts, take it or leave it. I say that because the signaling by Jay Powell in the press conference will likely be just as important. For example, the Fed might cut 25 bps but maybe Powell says they will be ready to cut 50 bps at one of the following few meetings if the data warrants it. Or, they might cut 50 bps but Powell will say don’t get used to that cadence and they were more interested in front loading the first cut, thus implying only 25 bps cuts come next. Bottom line, what they announce at 2pm EST Wednesday could be enhanced or blunted by what Powell says at 2:30pm.

If my chips were on the table, I’d say Powell does the latter and goes 50 bps but warns markets (in his own way) that for now this is a rate ‘tweaking’ cycle, not the beginning of something pronounced that the market is currently pricing in. The reality of circumstances can of course change that as events unfold but that’s how I think he’ll stage it at least on Wednesday…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

US Dollar In Trouble?

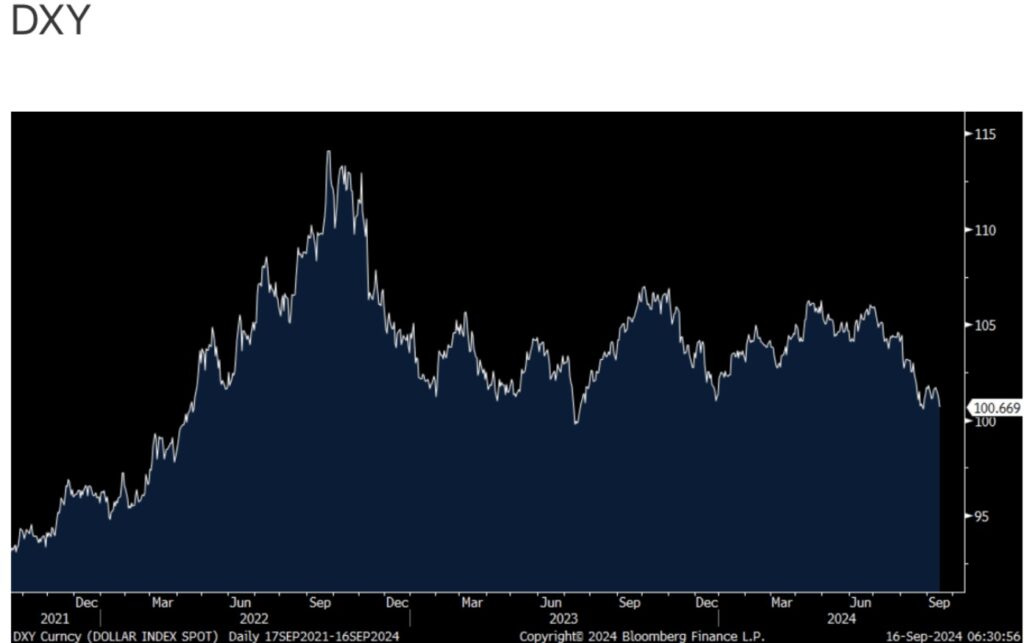

Ahead of the meeting, the euro/yen heavy US dollar index is knocking on 100 again as it retests the last August lows. If it breaks below 100, go back to July 2023 the last time it did and if it closes below 99.77, go back to April 2022 the last time it was weaker.

US dollar Closing In On Major Breakdown

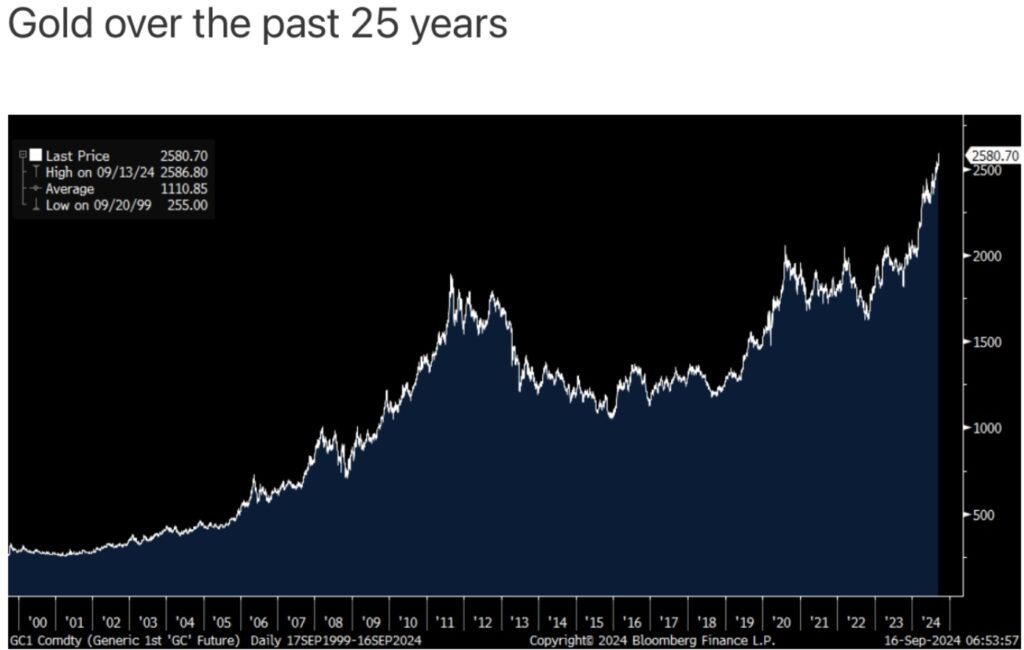

Gold Continues Its Historic Run

Yes, the Fed is about to start cutting interest rates, helping to explain some of the weakness. I say ‘some’ because other central banks, outside of the BoJ, are cutting too and just maybe there is something else going on. Like worries about US debts and deficits reaching a point of no return. We’ll see but the ever rising price of gold is quite the sign that something is up, particularly with foreign central bank desires to diversify away from their holdings of the US dollar and into other things like that shiny yellow metal.

Gold Continues To Hit Record Highs

Gold And The Death Of The Dollar!

***To listen to the top trends forecaster in the world discuss gold and the death of the dollar CLICK HERE OR ON THE IMAGE BELOW.

Gold Shorts Squeezed As Gold Hits Record High $2,600+!

***To listen to Alasdair Macleod discuss the short squeeze in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

Stock Market Bubble To Pop!

***To listen to the man who helps oversee $150 billion discuss everything from inflation to global markets, a new launch and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.