Gold shorts continue to get squeezed as the price of gold futures closed the week at a record high above $2,600. Silver also had a very impressive week closing above $31, close to an important breakout level that will propel the price to the $40-$50 area.

Gold Shorts Squeezed

September 14 (King World News) – Alasdair Macleod: Not only are the charts foretelling higher prices, but runaway US debt and increasing threat of an all-out war against Russia are fuelling a global panic out of dollars into gold.

Gold finally broke out above its tight consolidation range into new high ground yesterday and saw overnight demand taking it to $2570 this morning. That’s up $73 from last Friday’s close. Silver was at $30.15, up $2.25 on the same time scale.

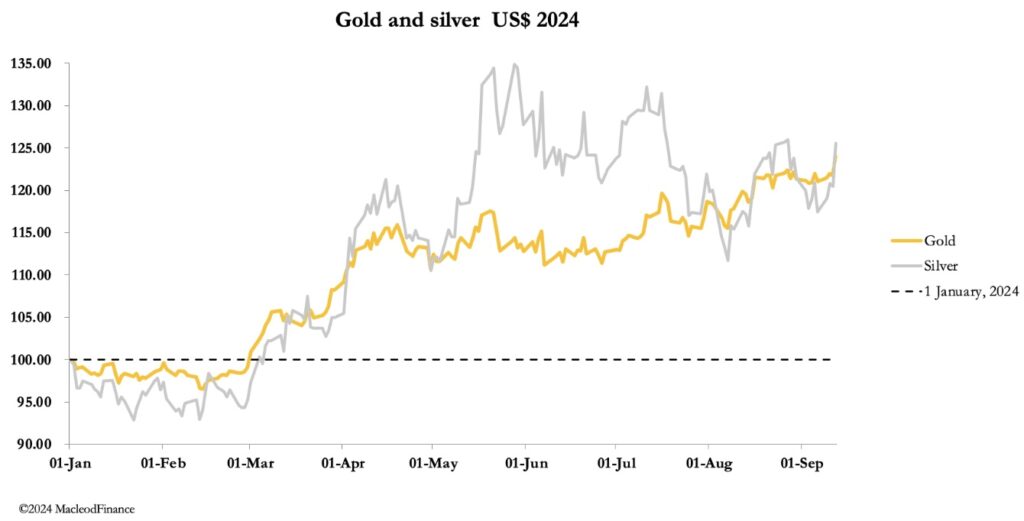

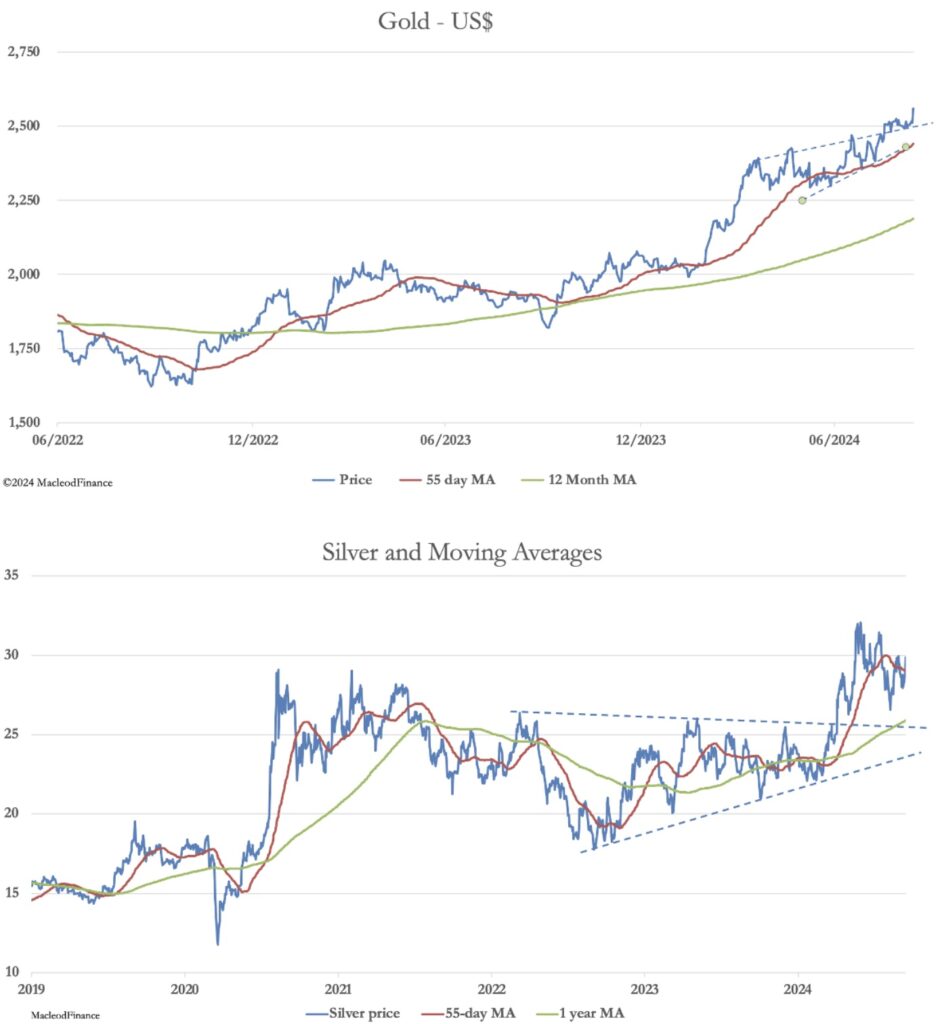

By way of an update, the technical charts for gold and silver follow:

Both charts are bullish, capable of supporting significant further price rises. I’ve commented on them frequently in these market reports recently, so it is unnecessary to repeat the analysis, other than to say that silver has some catching up to do with gold having finally broken out of a nearly four-year bull market consolidation last April. And with a gold/silver ratio currently at over 85, a rising gold price should turbocharge silver.

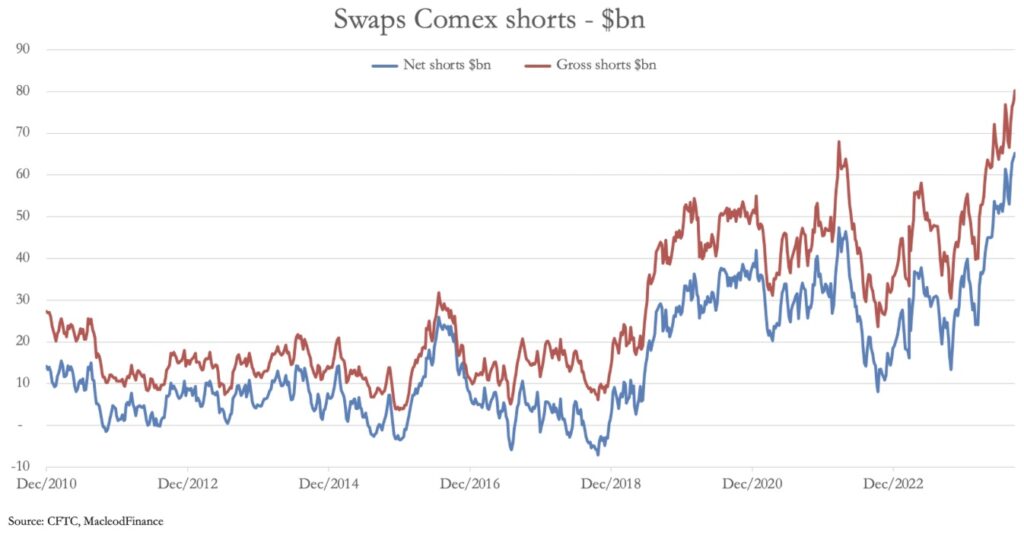

Collectively, the bullion establishment is always short of both gold and silver and is being badly squeezed by these developments. The next chart shows the estimated positions of the Swaps category on Comex for 3 September (the last Commitment of Traders figures) adjusted for an estimated increase in their positions and for the gold price today:

The gross short position is estimated at $80 billion split between 26 traders — that’s $3.08 billion on average each. Some will have an even higher exposure and will almost certainly be forced to close their shorts in a rising market. It will be a crisis for them, requiring write-downs against precious bank equity capital.

There is an assumption that these losses are hedged in London’s OTC market. This is bound to be true where bullion banks have bought out-of-the-money options to cap potential losses. But that merely passes the potential losses onto other bullion banks.

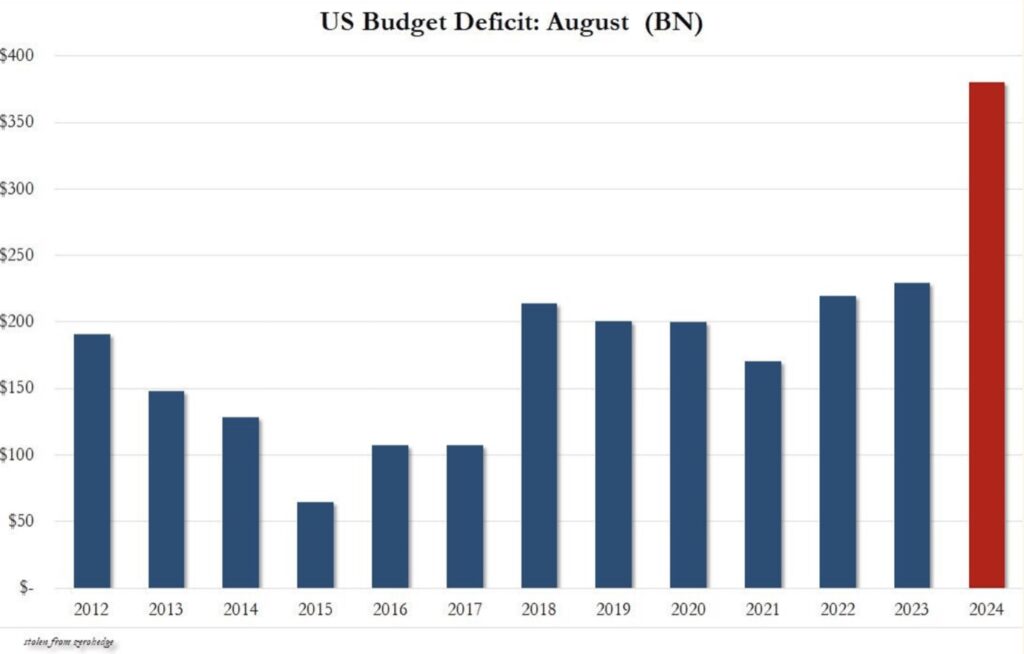

Gold’s price breakout coincides with the US budget deficit for August at an astonishing $380 billion compared with estimates of less than $300 billion. It was even announced at 0500 EST instead of its usual time of 1400 EST on Thursday, presumably to avoid negative headlines during market hours. The chart below is taken from a Zerohedge article on the subject:

The August deficit was nearly double the August deficits during the covid years. Furthermore, with the US economy stalling, defence spending rising, and interest costs now estimated to be $1.2 trillion for this tax year to end-September, on average monthly deficits will be heading significantly higher next year. Furthermore, with USG debt already standing at $35.3 trillion it’s hardly surprising that holders of the dollar are losing faith in it in favour of gold.

The second news item is potentially more serious. There is mounting pressure on America to authorise the deployment of American and British missiles for Ukraine to attack deep into Russia. Both the new UK defence secretary and Anthony Blinken have agreed between them in Kyiv that it is necessary, and Putin has responded to a Russian journalist that these missiles would represent NATO’s direct involvement in a war against Russia.

The problem for NATO is that Ukraine is losing, and the invasion of Kursk is turning out to be a huge strategic error. There is a reluctance on the American part to accept this reality ahead of the presidential election. Instead, the policy appears to be to poke the bear to increase his anger.

Oh, and good luck to all in the bullion bank establishment on this Friday 13th! To continue listening to Alasdair Macleod discuss the short squeeze in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

Stock Market Bubble To Pop!

***To listen to the man who helps oversee $150 billion discuss everything from inflation to global markets, a new launch and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.