What’s next after physical gold liquidity crisis erupts in London and New York?

Gold Demand

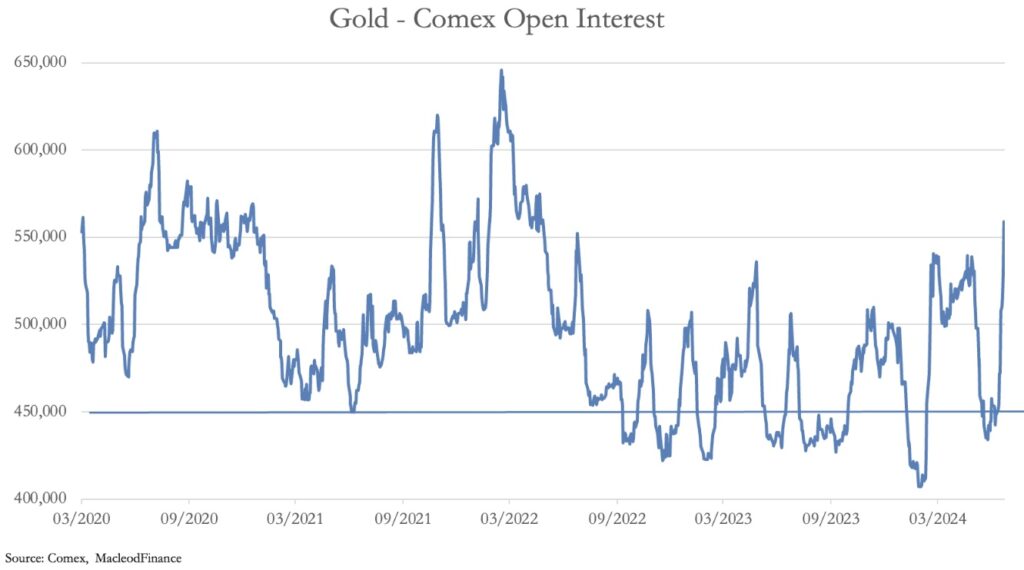

July 12 (King World News) – Alasdair Macleod: Gold is rising to challenge all-time highs, with Open Interest on Comex soaring faster than ever seen before. It reflects a physical liquidity crisis.

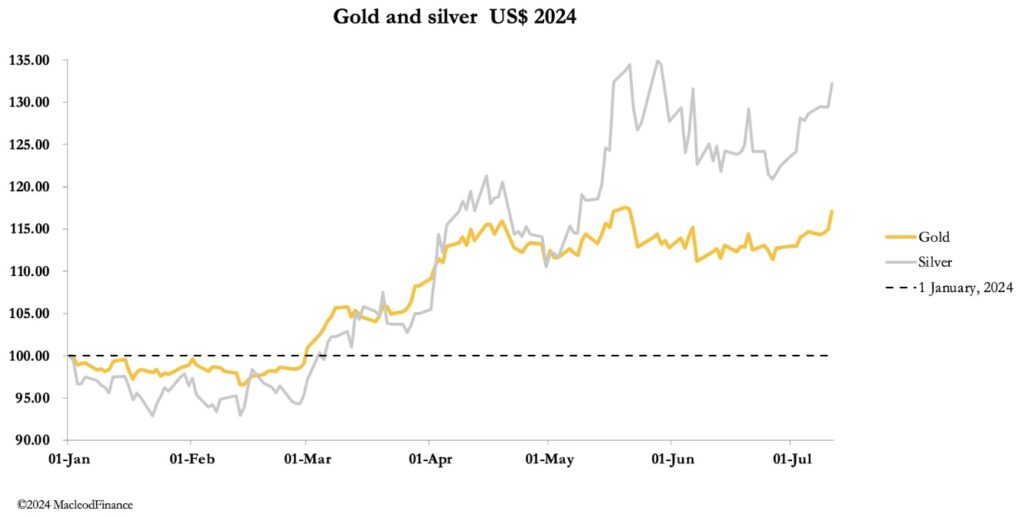

After a volatile week so far, gold and silver opened lower this morning in European trade. Gold traded at $2407 after touching $2424 yesterday (Thursday), up $15 from last Friday’s close. Silver peaked at $31.75 yesterday, falling back to $30.85 this morning, down 35 cents on balance. But these numbers belie the true performance.

The notable development is the rapid expansion of gold’s Open Interest, which is next:

Since the last Commitment of Traders figures (2 July) Open Interest has soared by 104,153 contracts. We shall find out tonight which category of buyer is driving this demand when the new COT figures for last Tuesday are released.

We know from the 2 July numbers that the Managed Money category was already marginally bullish on balance, from the next chart:

The pecked line is the long-term average net long position at about 110,000 contracts. At 150,185 contracts on 2 July this category was marginally bullish. Given that Open Interest has soared by over 104,000 contracts, the question is what share of the longs are down to extra Managed Money demand?

This is important, because when this category is bullish, it is usually followed by a gut-wrenching decline in the price as the Swaps category which takes the short side drives prices lower, forcing managed money to panic and sell their positions.

Managed Money is basically comprised of hedge funds, who are pair traders, buying gold/selling dollars or vice-versa. They don’t take delivery and are essentially momentum-driven or changing their view on the dollar’s trade weighted index. There is almost certainly some momentum-driven interest, but there’s little evidence of dollar bearishness. Something else is going on.

Physical Gold Liquidity Crisis Erupts In London & New York

The answer lies in the exchange-for-physical (EFP) statistics, which reflect arbitrage principally between Comex and London. An EFP is a private agreement between two parties where one party accepts physical in exchange with the other party for matching futures contracts. The problem with EFP statistics is there is no way of knowing which are sellers of futures for physical, and which are buyers. But the recent expansion of these deals is notable, reflecting an arbitrage whereby Comex contracts are being swapped for London forwards, which are stood for delivery there, with the bullion being shipped to China and elsewhere.

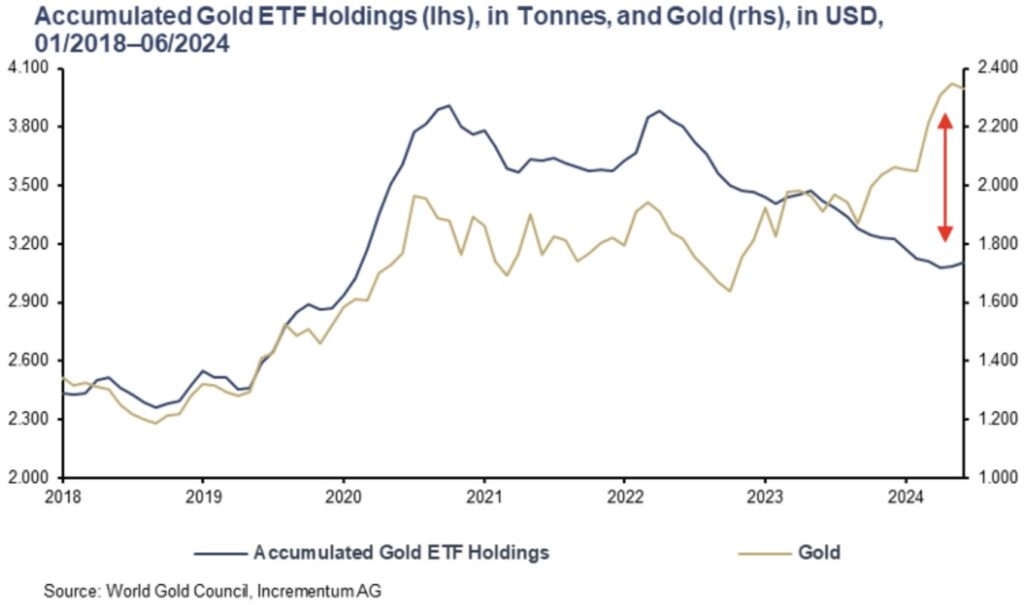

The point is that prices are being driven by a growing physical liquidity crisis in New York and London, almost certainly more than a sudden bullishness on the part of hedge funds. To add to this bad news for the bullion bank establishment, after over three years, the public are turning net buyers of ETFs, initially reducing this source of market supply, but then potentially squeezing it further with renewed demand. The following chart from Incrementum shows the potential problem:

Since the price bottomed in late-2022, while the price has risen it has absorbed an extra supply of some 400 ETF tonnes. If that supply reverses to net demand, then this would have serious liquidity issues for Comex and London, where physical liquidity is already depleted.

The ETF turnaround is extremely likely, judging by the technical chart below:

Having found support at the 55-day moving average, the price now appears to be embarking on the next up-leg. This is bound to attract ETF investment from pension and other mutual funds around the world, being the early recognizers of developing investment trends. At the same time, the public seeing that for whatever reason gold is going up is likely to stop selling.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.