Here is a look at what is happening today that is impacting markets.

June 11 (King World News) – Peter Boockvar: In the NY May survey of Consumer Expectations survey seen yesterday, the answers to the inflation guesses were mixed. The one yr view fell one tenth m/o/m to 3.2%, was unchanged out to three years at 2.8% and rose two tenths for the 5 yr time horizon to 3%. So mix it all up and we’re looking at expectations of around 3% inflation, still well above the 2% statistical hopes of the Federal Reserve.

Price expectations for the necessities remain high. For gas, 4.8%, food, 5.3%, rent, 9.1%, medical care, 9.1% and college at 8.4%. As for home prices, they were unchanged at 3.3%. Whether realized or not (rent growth obviously now much less), the perception impacts consumer behavior.

The job market results were mixed too. Unemployment expectations rose 140 bps to 38.6% for those seeing an increase and that is above the 12 month average of 37.8% but “the mean perceived probability of losing one’s job in the next 12 months decreased 2.7% percentage points to 12.4%, falling below the 12 month trailing average of 13.2%.” Off the lowest level since April 2021, the probability of “finding a job if one’s current job was lost increased by 1.3 percentage points to 52.2%.” There was little change in expectations for earnings and household income.

Spending expectations did slip by two tenths to 5% but has been steady between 5-5.2% over the last 6 months. Expectations for future credit access “deteriorated, with a larger share of respondents expecting tighter credit conditions a year from now, and a smaller share expecting easier conditions.” There was a drop though in those who think they’ll miss a minimum debt payment over the coming three months.

Also of note, “Perceptions about households’ current financial situations improved, with more respondents reporting being better off than a year ago and fewer respondents reporting being worse off. Year ahead expectations also improved.”

Finally, and file this with other stock market sentiment indicators, expectations for stock prices that they’ll be higher 12 months from now rose to the highest since May 2021 at 40.5%.

Bottom Line

My bottom line, we know the upper income consumer/saver is benefiting from interest income and higher stock prices while lower to middle income consumers are price conscious, value seeking and prioritizing spend on non-discretionary stuff.

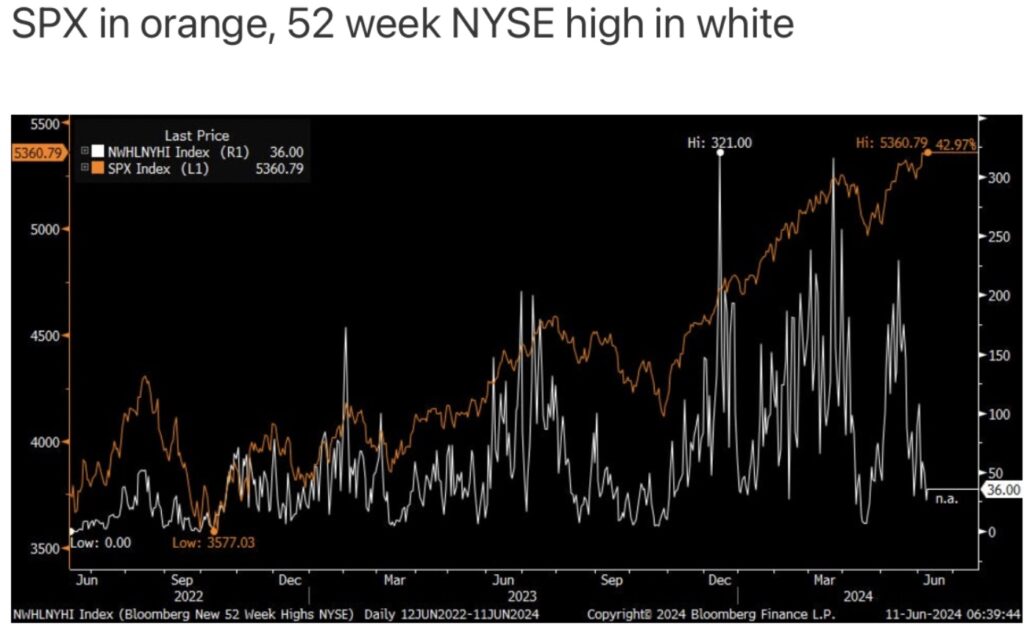

With regards to the stock market, you can drive a truck thru the headline record high in the S&P 500 and the number of stocks hitting 52 week highs on the NYSE.

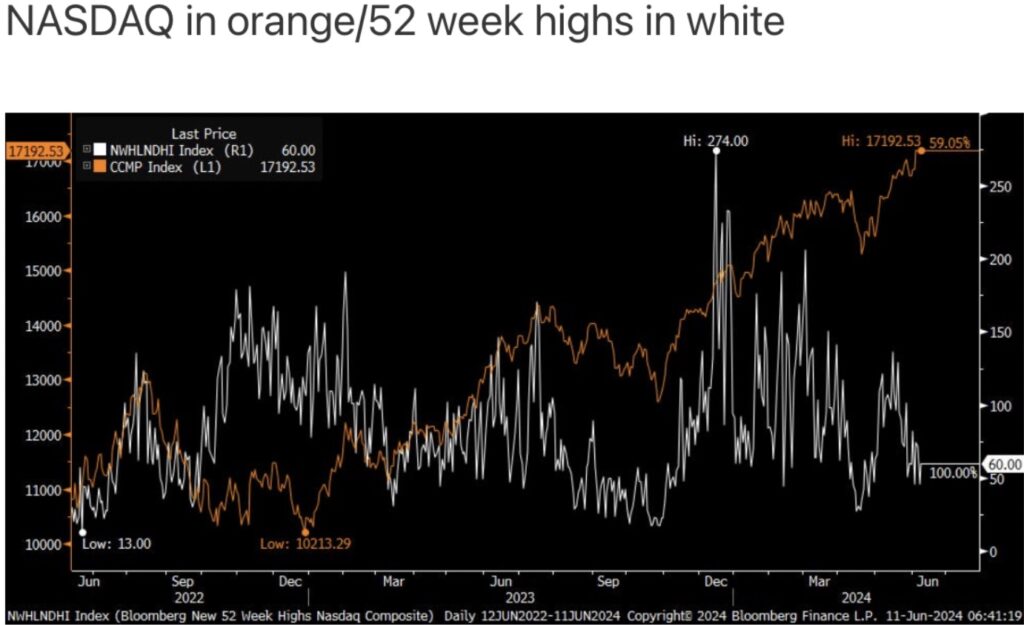

I include also the 52 week high count for the NASDAQ which is at just 60 names.

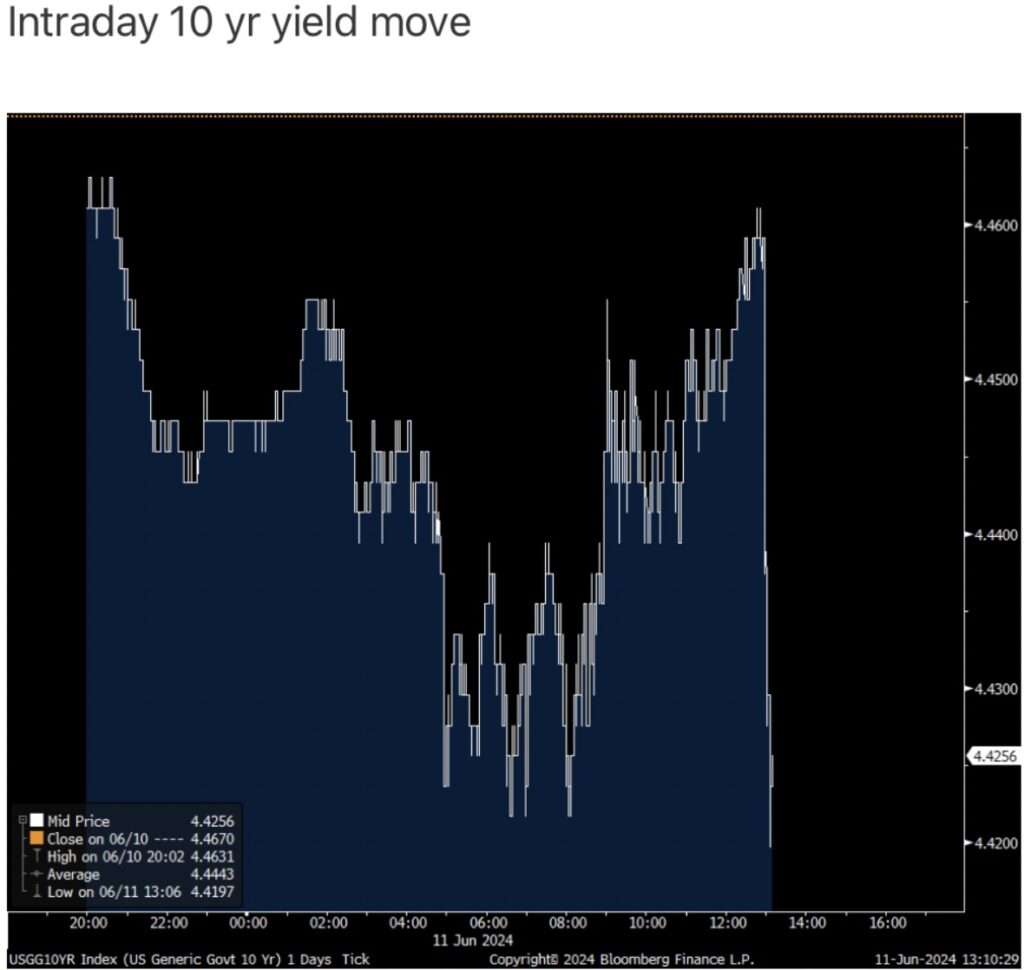

The 10 yr note auction was solid. The yield of 4.438% was 2 bps below the when issued pricing.

The bid to cover of 2.67 was well above the 12 month average of 2.49 and the highest since February 2022. Also, direct and indirect bidders took almost 89% of the auction, leaving dealers with about 11% and that is the least since August 2023.

Bottom line, after a soft 3 yr auction, this is the best 10 yr auction we’ve seen in a while, and as stated the best bid to cover since February 2022. As I always say, I wish we can hear the messaging from the buyers to discover their motive, whether buying is strong or weak. Either way, the US Treasury is finally smiling after many, many months with at best mediocre auctions. The 10 yr yield is at the low of the day in response, down a few bps from right before the results were reported. It seems that the 4.50% 10 yr level is a swing level that the market is carving out.

Market Sniffing Out A Softer Inflation Number Tomorrow?

Is the market sniffing out a softer CPI tomorrow? Worried about economic growth? Believing the Fed is going to follow its peers with rate cuts? Happy that the Fed has more than cut in half its QT of US Treasuries?

Finally, and maybe a factor in the better auction, the total sale was $39b after $42b was sold in May so there was a bit less supply than the last one.

I’m still sticking to my belief that a bond bear market is going to continue and a 5% retest in the 10 yr yield will happen this year.

Friday’s Gold & Silver Takedown

To listen to James Turk discuss Friday’s orchestrated $82.50 takedown in the gold market and $2.20 in silver CLICK HERE OR ON THE IMAGE BELOW.

Friday’s Gold & Silver Takedown

To listen to Alasdair Macleod discuss Friday’s orchestrated gold and silver takedown as well as what the Chinese are up to and more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.