Look at what is happening with silver and Canadian junior exploration companies as another inflation wave is about to hit.

May 22 (King World News) – Graddhy out of Sweden: Been saying lately that Silver will break out soon. It then broke out above blue line. And it is now above black line $30 level.

With these breakouts, silver has now resumed its secular bull market.

Historical chart. Generational opportunity, and threat.

So it begins.

You Must Be Invested Now

Graddhy out of Sweden: This ratio chart shows how historically undervalued commodities companies are vs the commodities index CRB. This chart is setting up a hugely profitable move.

BUCKLE UP CANADIAN JUNIOR INVESTORS:

Undervalued Canadian Venture Stock Exchange Ready For Massive Upside Reversal

This commodities bull is your ticket out of the rat race.

But, you have to be in it to win it. NOW. Not in 2 years.

Fantastic chart really.

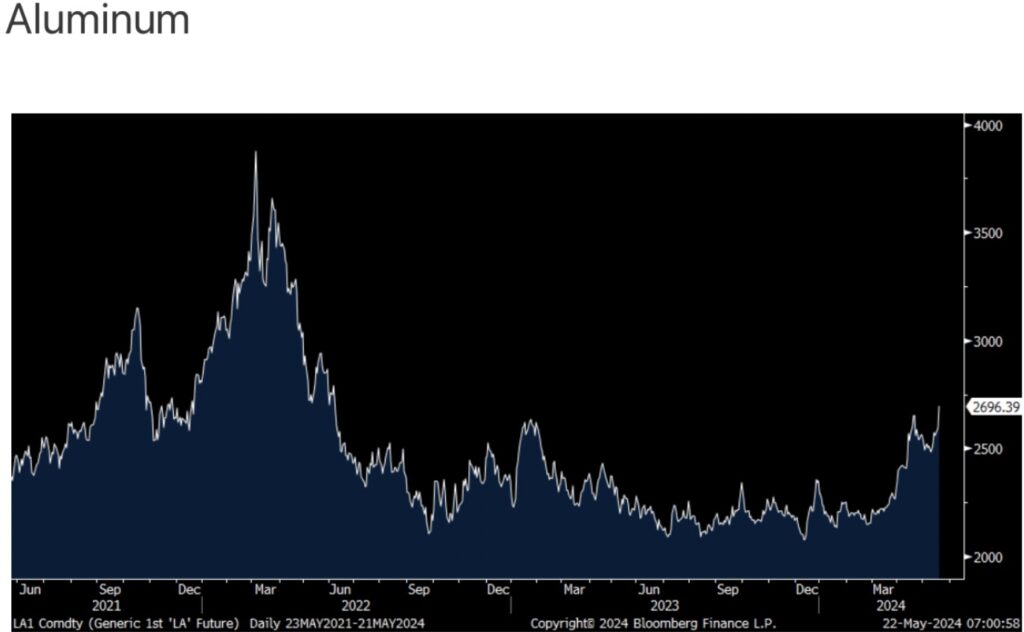

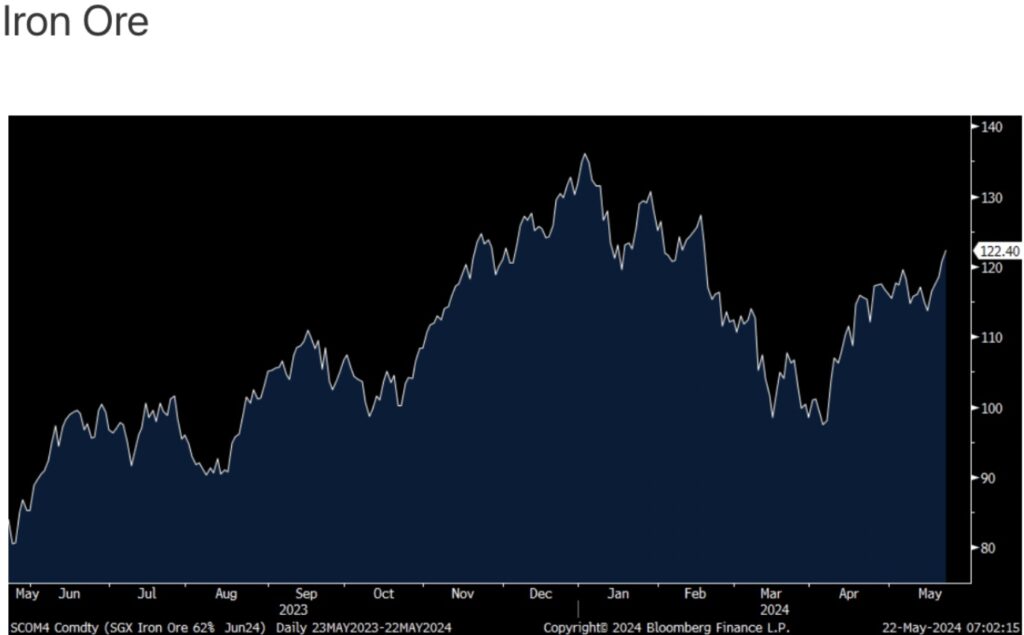

All Metals Now Rallying

Peter Boockvar: It’s not just copper, gold and silver that are rallying. Aluminum yesterday closed at the highest level since June 2022 at almost $2,700 per metric ton. Iron ore this morning is at a 3 month high.

More “Transitory” Inflation:

Aluminum Hits 1 Year High

Iron-Ore Hits 3 Month High

King World News note: We are in the early stages of a commodity boom that will fuel inflation as well as the gold and silver bull markets. As for the undervalued high-quality junior exploration companies, they are preparing to slingshot higher as Graddhy noted in his last chart.

Billionaire Lassonde Says Gold Headed Thousands Of Dollars Higher

To listen to billionaire Pierre Lassonde discuss what he is buying right now as well as the wild trading he expects to see in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss this week’s explosive upside action in gold, silver and mining shares and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.