Publishing was briefly delayed due to a technical issue that has now been resolved. Thank you for your patience. Massive deliveries from Comex sparked today’s $42 surge in the gold market.

Alasdair Macleod’s latest audio interview has now been released (link below)!

Massive Comex deliveries

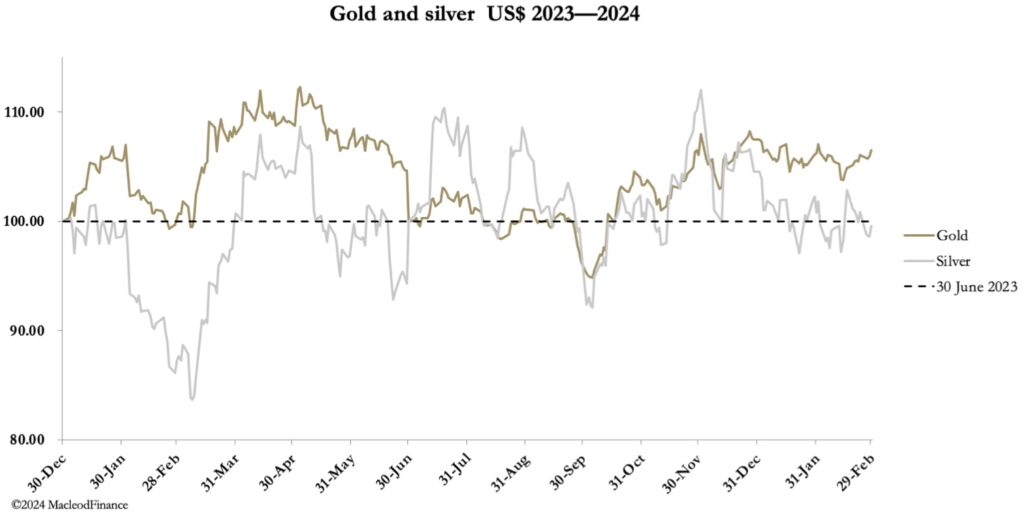

March 2 (King World News) – Alasdair Macleod: In price terms, all was quiet for gold this week, but yesterday saw a ten-dollar rise. In European trading this morning, gold was $2047, up $16 from last Friday’s close, while silver at $22.62 was down 22 cents.

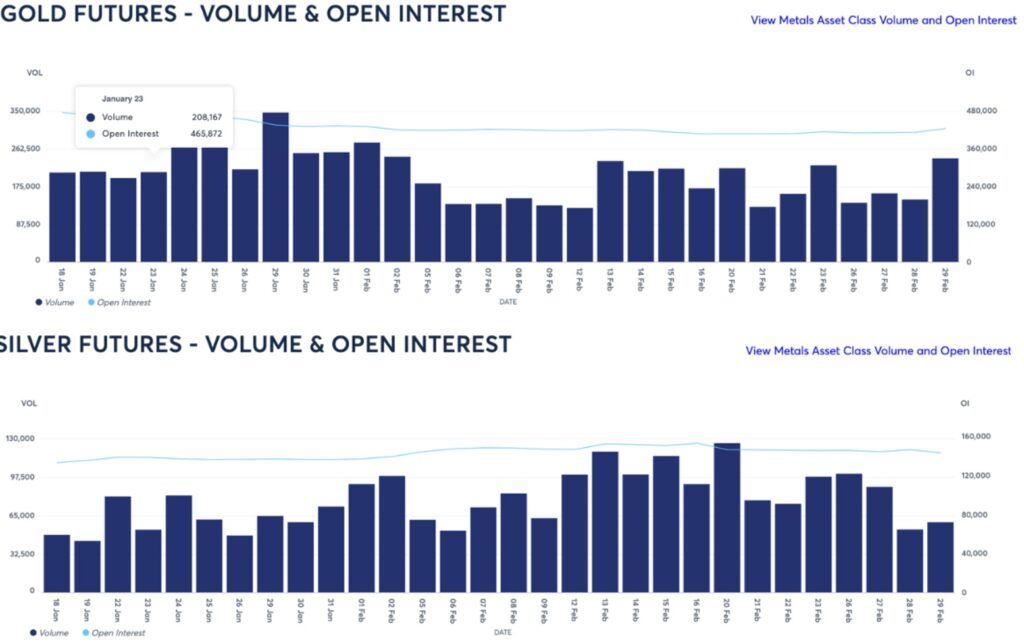

Comex turnover in both contracts was subdued until yesterday when it improved markedly for gold, but less so for silver. These are illustrated next.

The stand-out feature is the acceleration of deliveries — 2,005 gold contracts were stood for delivery this week, making the total for February 18,118 contracts, representing over 1.81 million ounces (56.35 tonnes). In silver, yesterday the figure was a huge 2,858 contracts of 5,000 ounces each (444.47 tonnes), making the total for February 563 tonnes. When Comex set up these contracts, this was never expected; contracts were meant to be closed at expiry and delivery was the notional means of tying the paper contract to the metal.

This problem has been building for some time. The question which arises is where is it all going? We know that central banks are adding to their reserves, and for some of the minor ones a Comex contract allows them to jump the queue for delivery from the refiners. To this we can almost certainly add ultra-high net worth individuals and their family offices, not so much in the west, but one suspects in Asia, where new billionaires are being created: think India. Chinese demand continues apace, where deliveries out of the Shanghai Gold Exchange in January were a whopping 271tonnes, only the second highest figure to 285.5 tonnes in July 2015. In the last twelve months, these deliveries totalled 3,344 tonnes which is approximately annual global goldmine output.

Other than mine output and scrap, the only offset is ETF liquidation which according to the World Gold Council was 51 tonnes in January, making 234.6 tonnes over the preceding twelve months. As a marker of public interest in gold, it explains why despite gold holding above the $2,000 level in a bullish trend, no one seems interested. The technical chart is next.

This chart is technically very positive. But a short-term dip below $2000 cannot be ruled out and might well occur if it is perceived that the outlook for lower US interest rates is further deferred. Any such meme would be likely encouraged by bullion bank traders as an opportunity to cover their paper shorts.

To follow interest rate expectations could be very misleading. The problem is becoming less one of inflation and more one of a massive debt trap for the US Treasury. This will inevitably lead to pressure for higher US bond yields. Many investment strategists are aware of the problem but believe that the Fed will somehow manage to suppress yields through QE and perhaps yield curve control. That could become a very dangerous position to take.

Instead of thinking about the disadvantage of low yielding gold, whose lease rate is usually under two per cent, compared with higher yields for US T-bills for a carry trade that will not occur, thoughts should turn to the value of dollar credit when the issuer cannot pay down its debt and instead just rolls the accumulating interest cost up.

This appears to be understood by all those Chinese citizens who take out the equivalent of annual global mine production on their own, and the new uber-rich Indians and others in Asia and beyond. A liquidity crisis in physical gold appears to be about to be matched by a US Government debt crisis undermining the dollar’s value…To continue listening to Alasdair Macleod discuss the huge trading on Friday that lifted the gold price close to the $2,100 level CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.