What is unfolding in the gold market is truly historic. Here is a quick look.

September 16 (King World News) – Alasdair Macleod: Gold and silver drifted lower this week, before a modest recovery this morning which can be put down to bear closing. In European trading this morning, gold was $1918, unchanged from last Friday’s close after testing the $1900 level yesterday. Silver was $23.05, down 3 cents, after testing $22.30. Comex volumes in gold were moderately healthy, and they picked up in silver yesterday on the sell-off.

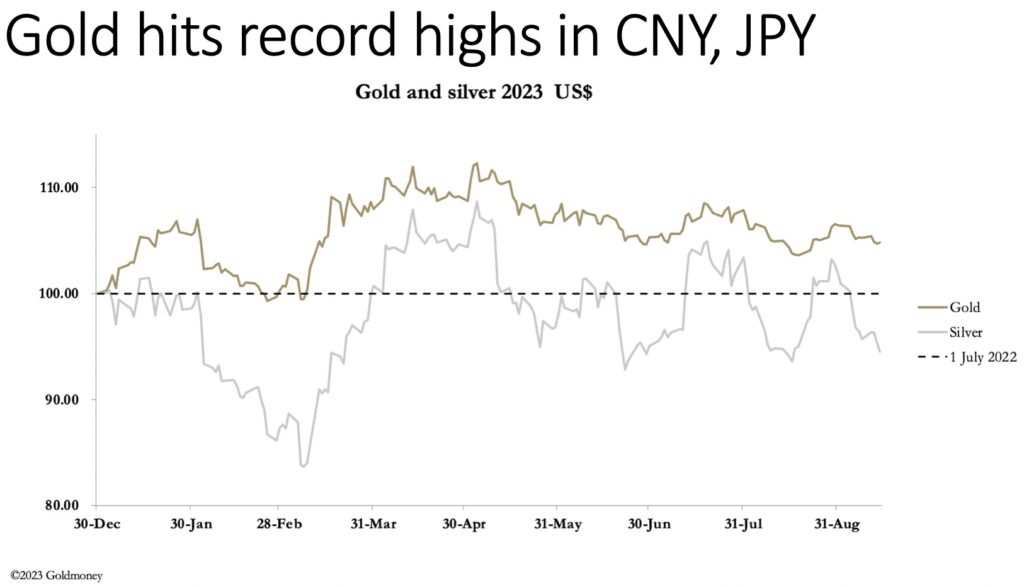

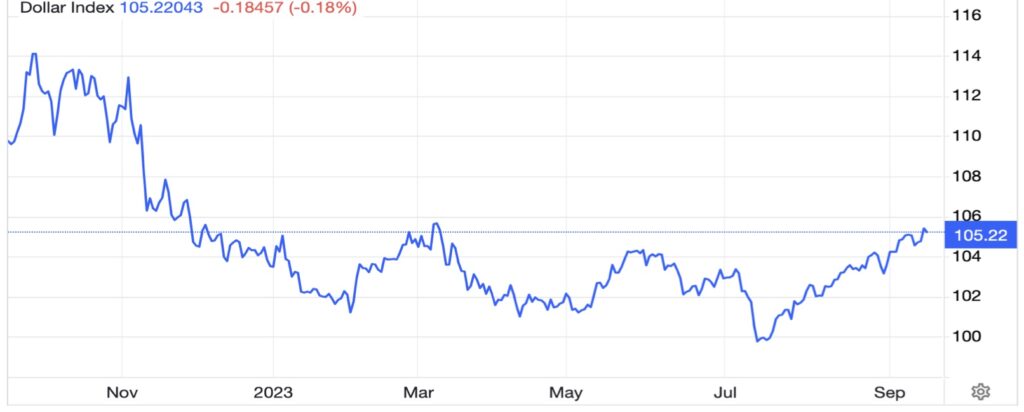

The performance of gold and silver has been disappointing for dollar bulls, but looking at it from the bears’ point of view prices refused to go lower yesterday when the ECB raised its deposit rates and the dollar’s TWI powered ahead. The TWI is next.

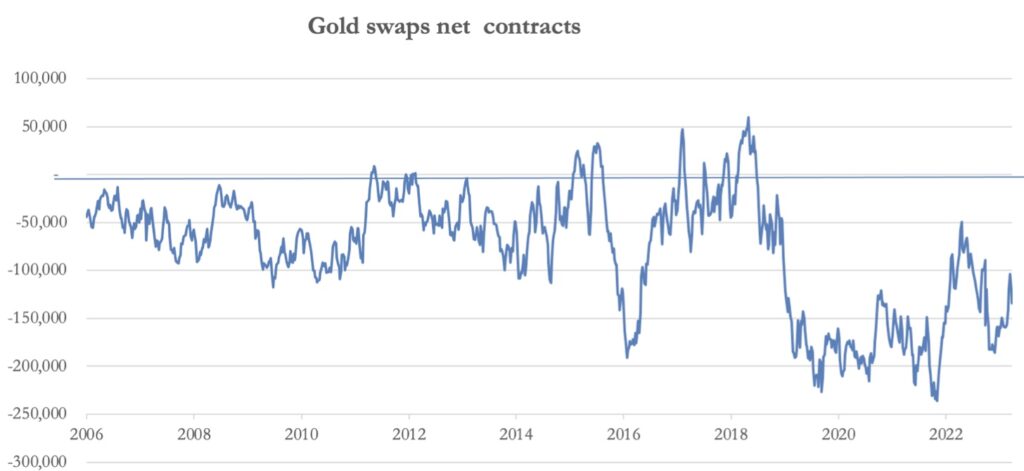

Perhaps the bears need a little more time. Their hopes will devolve on interest rates and bond yields going higher or at least remaining firm, which is seen to be bearish for gold. The short positions of the Swaps on Comex have reduced in value, but probably not enough. The next chart is of their net position, and it can be seen that before 2019 the average net short position was less than today.

With de-dollarisation by the Global South, it would appear to be a struggle for the Swaps to reduce their shorts much more.

China Gold Premiums Skyrocket To 6% More Than US

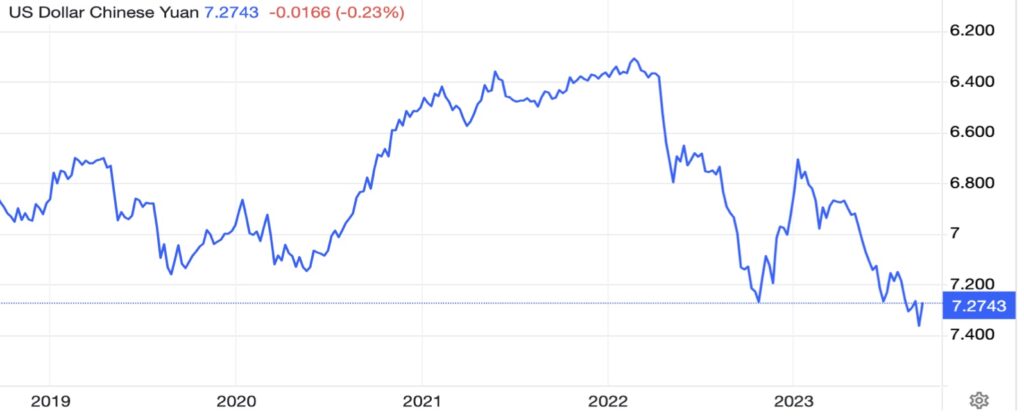

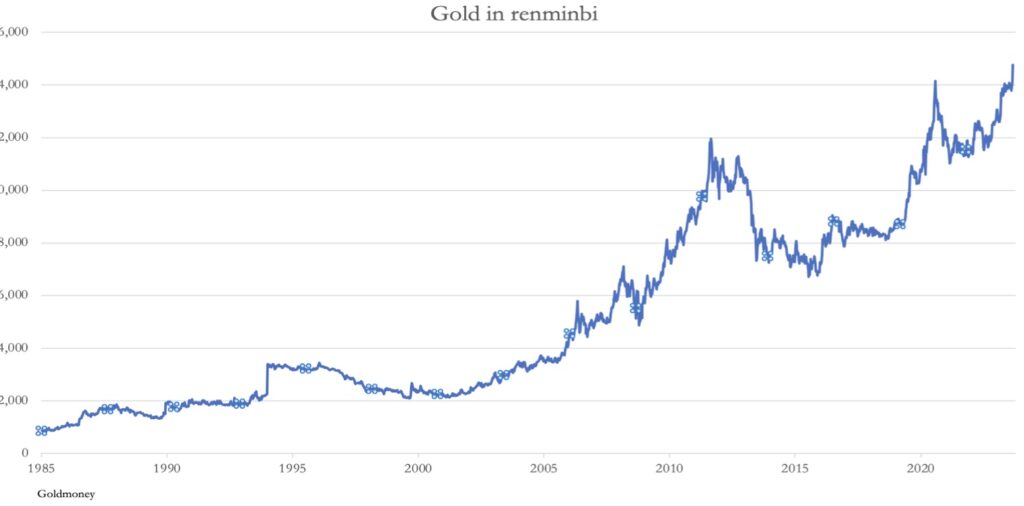

One story consistently hitting the headlines this week has been the gold price premiums on the Shanghai Gold Exchange, hitting as much as 6% — taking it to over $2000 equivalent. Certainly, the demand on the SGE is real, but this is driven by gold being the only hedge available to resident Chinese against a falling yuan (due to currency controls). Our next chart shows how weak the yuan has been, despite zero price inflation.

With the recent dip below the 7.27 level, which had steadied the rate in October 2022, you can see why the Chinese public would be bearish on the yuan and bullish for gold. And here is the price on the SGE, which hit a record Y14,765 yesterday.

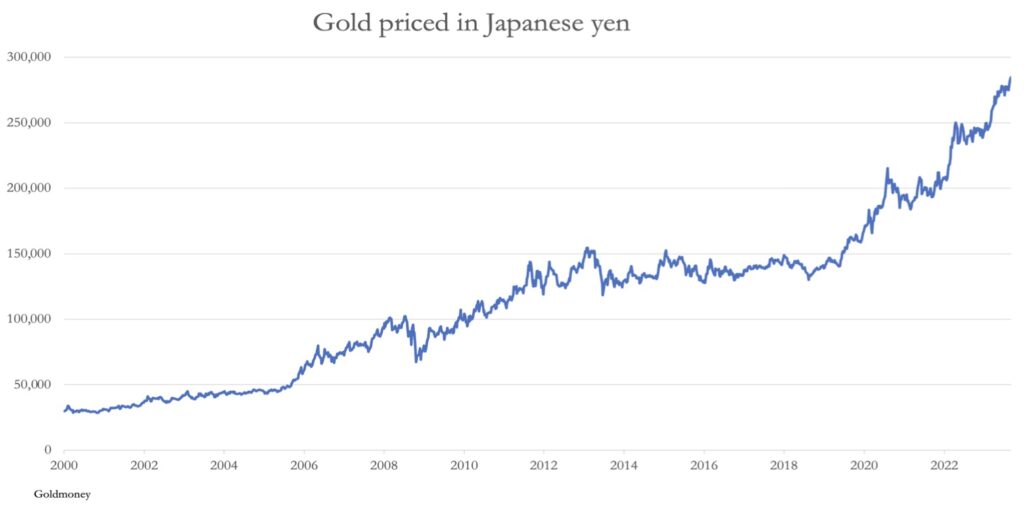

The other story gaining traction is the price in Japanese yen, which is also hitting new records due to the weakness of the currency. This is next.

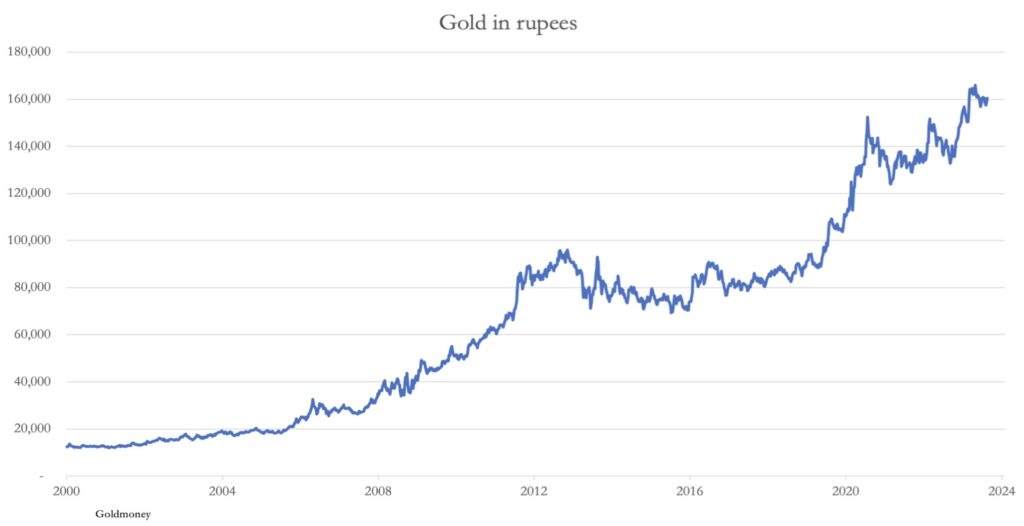

And next up is the price in Indian rupees.

Not quite at all-time highs, but the trend is clear.

This goes to show that it is only in the dollar and a few of the leading currencies that gold disappoints. And it would be a mistake to think that the BRICS currency story is dead. Under Russia’s chairmanship from January, we can expect it to resurface. There is also a strong possibility that Russia may seek to stabilise the rouble through a gold standard, having failed to persuade the BRICS naDons to do so with a trade settlement currency first.

As if to echo these thoughts, central banks have been continually buying bullion reserves. According to World Gold Council data, in July central banks added 44 tonnes. We await to see how central banks have responded to lower dollar prices over the last month…Alasdair Macleod discusses the shocking chart below and much more in this week’s audio interview CLICK HERE.

Eric Pomboy Sent King World News This Remarkable Chart Showing A Historic Divergence Between Gold Price In China $2,020 vs US $1,909!

Be sure to CLICK HERE to listen to Alasdair Macleod’s powerful audio interview about what is happening in China and the West in the gold market.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.