This 1980 indicator says gold bull market has a long way to go.

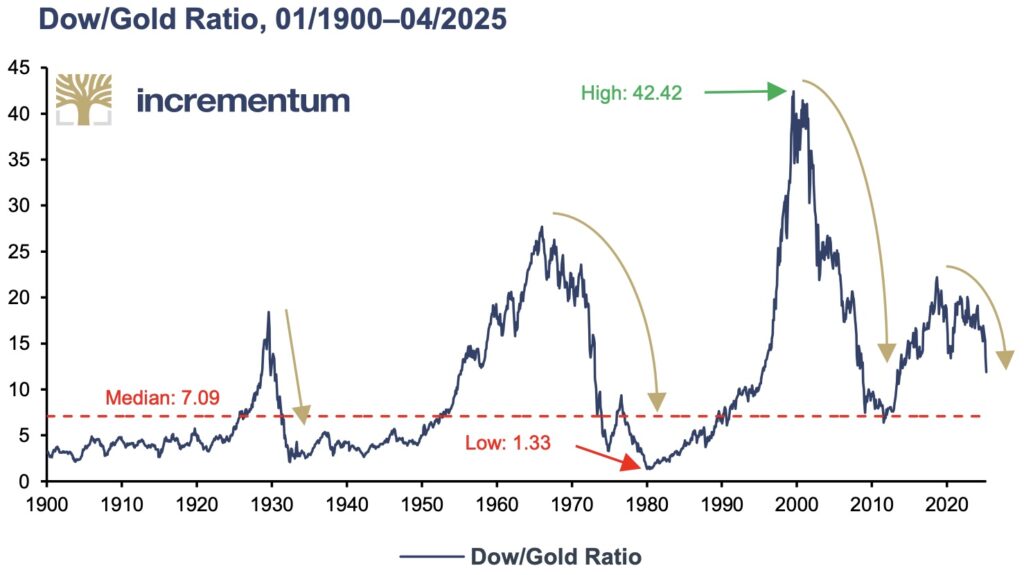

July 15 (King World News) – Ronald Stoeferle at Incrementum: The relative strength of gold against bonds – and now also against stocks – is likely to attract increased investor interest. Now that gold has recently gained strength against equities, it is worth examining the long-term trend of the Dow/gold ratio. In the past three major downward trends in this ratio in the 1930s, 1970s and 2000s, this development was always accompanied by a significant rise in the price of gold and stagnating US stock markets. The Dow/gold ratio currently stands at 11.91 and is therefore clearly above the historical median of 7.09, indicating that gold is still attractively valued compared to US equities.

KING WORLD NEWS NOTE: Gold Will Radically Outperform The Dow. Dow/Gold Ratio Collapsed To Roughly 1/1 In 1980

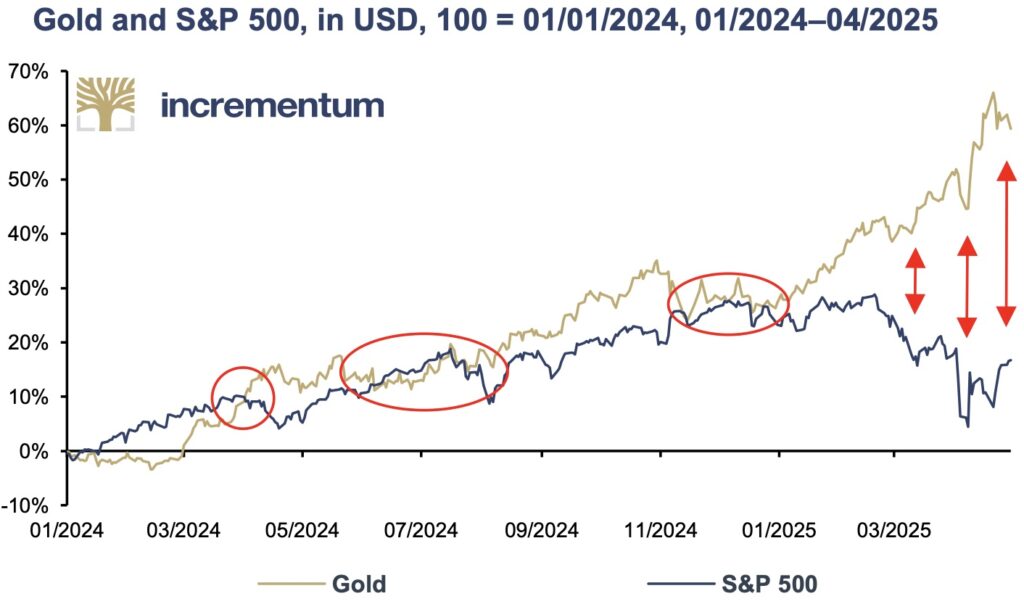

The growing gap between gold and the S&P 500 since the beginning of the year points to fundamental changes. Capital is increasingly flowing from US markets into the safe haven of gold, as well as into Europe and select emerging markets. If this trend is confirmed, it would be a clear signal of a sectoral and geographical rotation with far-reaching consequences for global investment strategies.

KING WORLD NEWS NOTE: Gold Outperforming S&P 500 In 2025, But Still Coiled To Massively Outperform Stocks In Coming Years

Michael Oliver Just Predicted Silver Will Hit $160-$240

To listen to Michael Oliver’s jaw-dropping predictions for the price of silver, gold, and the mining stocks in one of his greatest interviews ever CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss the massive upside breakout in the silver market and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.