What is happening behind the scenes in the gold market is quite unbelievable as paper players scramble to stay alive.

February 9 (King World News) – From retired pawnbroker Gurjit L: The Showroom is Empty: Why I’m Watching the Back Door at Asahi [The Vault Behind COMEX]

The “Vault Plumbing”: A Primer for the Street

Before we talk about the scramble, you have to understand how the “House” is built. Gold on the COMEX isn’t just a digital number; it’s backed by real metal sitting in fortresses like Asahi [The Vault Behind COMEX], JPMorgan, and Brink’s. Inside these vaults, gold is sorted into two buckets:

- Eligible [Private Storage]: Private gold held for safekeeping. It meets exchange standards, but it is not for sale. It belongs to someone else.

- Registered [The Showroom Floor]: Gold with a digital warrant attached. This is the only metal officially available for delivery to settle a trade.

The “Shadow” Move: Normally, when prices rise, banks move metal from Eligible to Registered to sell it. But right now, we are seeing the opposite. They are moving gold from Registered back to Eligible. They are taking metal off the “Showroom Floor” and hiding it in “Private Storage” to settle debts behind closed doors through EFPs [Exchange for Physical]—private, off-book swaps that allow them to pay off big players without letting the public see how little metal is actually left.

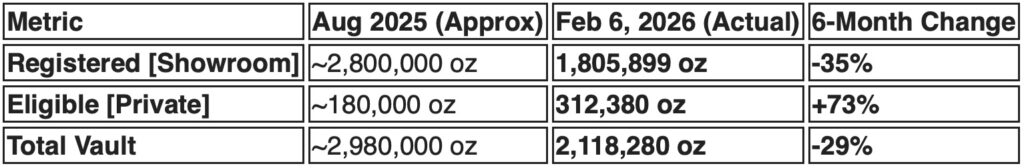

The Audit: Asahi’s 6-Month “Evacuation”

The numbers from Asahi [The Vault Behind COMEX] tell a story of a quiet drain that has recently turned into a full-blown scramble.

The “Shadow” Flip Acceleration: On February 6 alone, Asahi recorded a massive -91,455 ounce adjustment. That gold didn’t leave the building; it was flipped from “Registered” to “Eligible.” We are now seeing blocks of 90,000+ oz in a single day—a velocity that suggests the “Zero Date” for available physical gold could hit as early as Summer 2026.

The Pawnbroker’s Logic: “In my shop, if a guy moves one watch to the back safe, he’s just organizing. If he clears an entire shelf in one afternoon, he’s expecting a raid. Asahi is clearing the shelves.”

The $100 Billion “Liquidity Shield” (The Doom Loop)

Bullion banks are currently trapped in a high-stakes Liquidity Swap. They are heavily “Short” and bleeding cash every day. To stay alive, they are leaning on the Fed’s Standing Repo Facility, which is now processing over $110 Billion in swaps every single day.

The banks “pawn” their Treasury bonds to the Fed for cash at 8:15 AM to cover their margin calls, then have to buy them back the next morning. This is a 24-hour cycle of desperation. They can’t let the gold leave the vault because it’s the only collateral keeping their creditors from calling their bluff.

Don’t let the headlines fool you. A parabolic move to $10,000 is a mathematical likelihood, but it won’t be a straight line. The banks will use the Fed’s unlimited printing press to engineer “Flushes.”

By dumping massive “Paper Gold” contracts while the Fed provides them with $110B+ in liquidity protection, they can force the price down violently to trigger panic selling. Their goal is simple: Close their own short positions at the bottom of a manufactured dip. Only after the shorts are cleared and the metal is safely in the “Back Room” will they let true price discovery begin. It will likely go down before it goes up.

A Final Note from the Pawnbroker’s Counter

As always, do your own research. This is just through my lens—the lens of a man who has spent decades watching how people behave when real wealth is on the line.

The next few years in gold may be some of the most amazing trading days of our lives. There will be days where you have to take a breath, take a pause, and look at the big picture. Keep the faith. Understand the plumbing. Know that you are doing this as a true wealth transfer is happening right before our eyes. We are right in the middle of the whole process, and I promise you this: it’s not going to be smooth. One little bit.

LISTEN: Gold, Silver, US Dollar, Oil, future inflation and more…

To continue listening to legend Rob Arnott discuss gold, silver, the US dollar, oil, future inflation and much more CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

To listen to Alasdair Macleod discuss the collapse in Open Interest in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

Global Banking Elite Orchestrate Shadow Bailout To Survive $5,600 Gold Peak CLICK HERE.

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Gold & Silver Open Interest Has Collapsed To Historic Low! CLICK HERE.

UPDATE: Here Is Where The Silver Market Stands After The Crash CLICK HERE.

SILVER: People Start Making Poor Decisions When Volatility Spikes CLICK HERE.

Central Banks Will Move Gold Price Much Higher CLICK HERE.

SILVER: Look At What Is At One Of The Most Undervalued Levels In History CLICK HERE.

Economic Collapse And The Implementation Of The Slave Monetary System CLICK HERE.

Friday’s Historic Takedown In Gold & Silver Caused Some Dealers To Close The Door On Precious Metals Buys CLICK HERE.

This Is The Biggest Breakout In History! CLICK HERE.

Major Gold & Silver Update After Friday’s Crash In The Silver Market CLICK HERE.

Making Sense Of Friday’s Utterly Rigged Nonsense In The Silver Market CLICK HERE.

What To Do After Friday’s Brutal $37 Plunge In Silver CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.