With the Dow plunging and the Nasdaq down almost 100 today, below is a key piece which highlights the incredibly dangerous developments now taking place around the world, and covers everything from breaking news to done strikes and currency wars.

By Art Cashin Director of Floor Operations at UBS

January 27 (King World News) – Stocks didn’t get strangled Monday. Instead, they were run over by a speeding salt spreader, as states, cities and organizations hunkered down for a classic blizzard. Mother Nature, trickster that she is, moved the storm further offshore than models had projected. That led to snowfall less than one-third of the worst estimates.

Nonetheless, as I write this in the pre-dawn hours in lower Manhattan, Wall Street is a ghost-town. No traffic. No papers. No coffee and almost no people. New York lives through its subways. It may be hours to get them back up and running.

Markets Shrug Off Greece For A Pre-Storm Navel Gaze – The stock market swung in its narrowest range for any session this year. In the morning, they thought about oil, but seemed to become distracted, perhaps, by the severe storm warnings, in the afternoon.

In the U.S., stocks opened down and spent the first 20 minutes of trading going lower as crude sold off and looked like it might have one of those freefall sessions.

Shortly after 10:00, the oil price headed back toward neutral and stocks followed suit. Around 10:30, I sent out this brief synopsis:

Early weakness takes S&P down below the 50 DMA (circa 2047). It rebounds to that level as WTI seems to stabilize.

For the balance of the morning, stocks drifted up, achieving a mild move into plus territory around noon. I sent this follow-up:

Oil ticks up slightly, allowing equities to get back near neutral and maybe better. Run rate at noon projects to an NYSE final volume of 690/770 million shares.

Trading desks may thin after 2:00 but believe skeleton crews have rooms in the city.

(Some late day shuffling raised the NYSE volume to 805 million shares.)

Afternoon saw a bit of a separation between stocks and oil. In fact, as previously noted, there seemed to be a separation between stocks and everything else. It may have had something to do with the growing intensity of the storm warnings.

All scheduled athletic events were canceled. All Broadway shows were canceled. Officials talked of shutting subways and roads. Traders who had not secured a room in Manhattan began leaving early for what looked to be an arduous journey home.

A market on close buy program with over $300 million to buy on balance allowed the bulls to slip into the close with moderate ease. Then, off to imbibe some anti-freeze and prepare for the storm.

Earnings Season And The Dollar – As we kick into the heavy release of earnings season, the early results have been less than stellar. One cause (excuse) cited by many of the underperformers is the strength of the dollar.

If that continues, and I believe it will, it will probably stay the hand of the Fed, or at least postpone it, possibly into next year.

Drone Strikes In The Currency Wars – There was very sharp whipsaw trading in the Swiss Franc overnight. Some contend that the Swiss National Bank may have tried a quick surgical intervention. Whatever the cause, the unusual hyper-volatility in foreign exchange markets is sending a distinct chill that has nothing to do with a blizzard.

Maybe It Was A Tape Delay – While markets seemed to have shrugged off Greece’s election yesterday, they seem to have renewed focus today. Here’s a bit from my friend Peter Boockvar over at the Lindsey Group:

Markets swept Greece under the rug yesterday but Greece is again sticking their head out. Greek bonds and stocks are again getting hammered. The Athens stock market is down almost 5% with National Bank of Greece, Piraeus Bank and Eurobank Ergasias all down more than 10%. The 3 yr note yield is higher by another 214 bps to 14.2% after yesterday’s 197 bps spike. The upcoming discussions between the new Syriza leadership and the Troika will not be a kumbaya moment.

As Greece wants to stay in the euro and needs money for upcoming maturities (3.4b euros to the IMF in February and March to start), the only outcome is a net present value haircut to their debt, not a nominal one. With Greece then paying a lower interest rate and longer maturity than the other countries bailed out (which they already are even before another adjustment), I’d not be happy as a citizen in one of those other countries.

The Troika will also likely ease the austerity/budget deadlines with which Greece was supposed to comply with. German finance minister said “there are rules, there are agreements. New elections change nothing.” Alexis Tsipras said “there will neither be a catastrophic clash nor will kowtowing continue. We are fully aware that the Greek people haven’t given us carte blanche.”

Consensus – Hyper-volatility in Swiss franc and renewed concerns on Greek banks have markets rather edgy. High dollar dings earnings in some of the bluest of blue chips have futures taking a pounding. Also, vague rumors of a possible massive layoff from a big blue chip circulate. All may be a topic as FOMC convenes. Stick with the drill – stay wary, alert and very, very nimble.

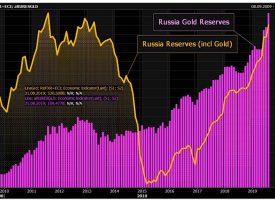

***ALSO JUST RELEASED: Richard Russell Big Picture For Gold – Collapse In Russia, Commodities And A World Flooded With Liquidity CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the blog page is permitted and encouraged.

The audio interviews with John Mauldin, Egon von Greyerz, Dr. Paul Craig Roberts, Gerald Celente, Lord Christopher Monckton, Michael Pento, Bill Fleckenstein, David Stockman, Dr. Philippa Malmgren, Stephen Leeb, Andrew Maguire, John Embry, Rick Rule, Rick Santell and Marc Faber are available now. Other recent KWN interviews include Jim Grant and Felix Zulauf — to listen CLICK HERE.