With gold and silver continuing to consolidate, take a look at what is happening behind the scenes.

Within hours KWN will be releasing two audio interviews. Until then…

Gold & Silver Consolidation

May 24 (King World News) – Alasdair Macleod: This pullback in prices might provide the best opportunity to buy gold and silver before China’s continuing demand drives them far higher.

Gold and silver corrected sharply this week, with gold down $85 from last Friday’s close at $2342 in European trade this morning. And silver was off $1.30 at $30.56 over the same time period. While nominally these appear to be large numbers, in percentage terms and given their recent rises these corrections should be regarded as to be expected.

It is now widely accepted that both metals are being drained out of western vaults to satisfy demand in China. In particular, silver’s volatility indicates that there is an alarming lack of liquidity in western vaults, especially when one bears in mind that the large majority of vaulted gold and silver is custodial and therefore not available to market makers and bullion banks to cover their positions…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Many goldbugs suspect that earmarked reserves of both metals are being tapped into by bullion banks as part of their suppression schemes. Whether that is conspiracy or fact should not concern us. The problem for the paper establishment used to controlling forwards and futures values is that pricing is being taken away from them. For example, at one point this week, silver was trading in Shanghai at the equivalent of $36, a premium of $4 or 11% over spot. Clearly, Chinese and other banks are strongly incentivised to arbitrage these differentials by sourcing silver in London and Comex for delivery in Shanghai.

It is no exaggeration to claim that prices are no longer being set in the West’s paper markets. This is something that goldbugs have been praying for, but perhaps do not yet appreciate. So where does this leave the bullion bank establishment?

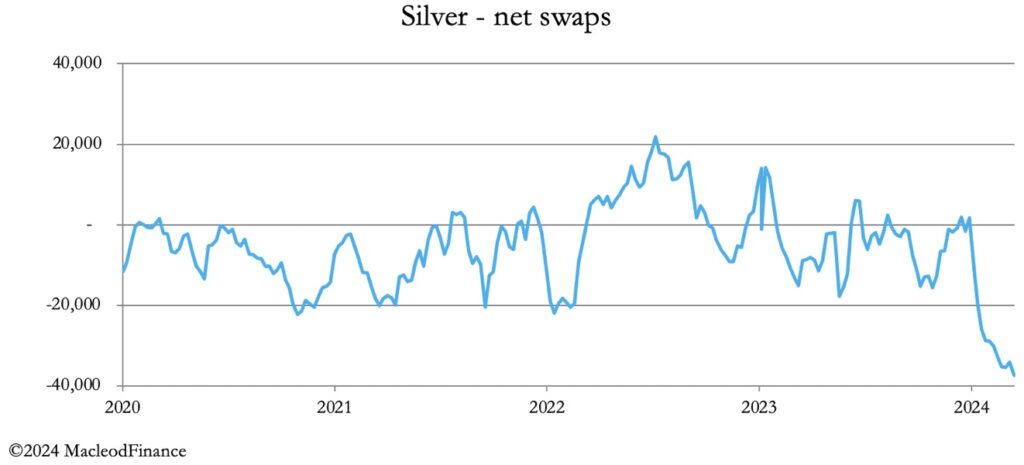

Comex Swaps’ short positions in silver have become alarming, as the next chart shows:

At net short 37,522 contracts, this represents 187,610,000 ounces, equivalent to over 20% of global mine output. It is also the largest net short position since April 2017 when silver was only $17.40 so the financial commitment (damage) at current prices is far greater. Furthermore, this year a further 78,975,000 silver ounces have stood for delivery, which didn’t happen in 2017.

As an illiquid market, the establishment’s silver position is worrying to say the least. Either of two events might tip it over the edge: if gold continues to rise in value, silver is bound to go with it at twice the rate; and if public demand for ETFs, coin, and bars begin to reflect bullishness the squeeze on the establishment will intensify.

Both these appear to be likely. The chart for gold in USD looks very bullish, and in this context the current correction is perfectly normal taking the price back to possibly test the 55-day moving average, currently at $2290:

The point about paper markets losing control over pricing is made clear by assessing the potential demand and behaviour of China’s household savers. Their annual savings run at about 46 trillion yuan ($6.3 trillion) which is the equivalent of 85,000 tonnes of gold. With property and the stock market out of fashion, most of this is going into bank deposits. Undoubtedly, it won’t take much for a gold-loving Chinese population to start bidding prices higher. In fact, it has already started. To listen to Alasdair Macleod discuss the silver shorts being trapped and what to expect from gold and silver in the coming weeks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.