Today one of the greats in the business said mining stocks are seeing more and more blue skies, and that could be a very good sign of what is to come.

May 21 (King World News) – Jason Goepfert at SentimenTrader: Gold bugs finally follow through.

Key points:

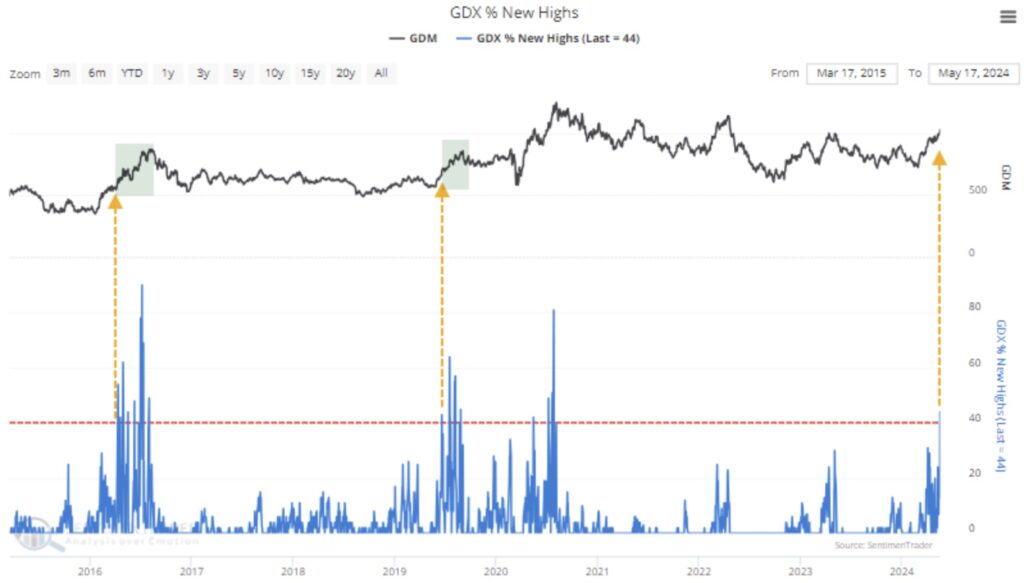

- More than 40% of gold mining stocks have reached 52-week highs

- Few of the stocks are now in corrections or bear markets, a stark change from a few months ago

- Similar cycles in this sector over the past 30 years had a good record of further gains over the next few months

Miners see more and more blue skies

A little over a month ago, we examined the surge in gold mining stocks. About a third of them had reached 52-week highs, a concerted push with an inauspicious record in this sector. If buyers continued to show interest, it would tell us quite a bit about their longer-term prospects.

And interest they have shown. Miners dipped for a couple of weeks after that, but buyers saw that as an opportunity, which is rare for this particular sector. As a result, more than 40% of mining stocks hit a 52-week high last week. This was the first reading over 40% in over a year, and the last couple of instances marked the nascent stages of impressive rallies.

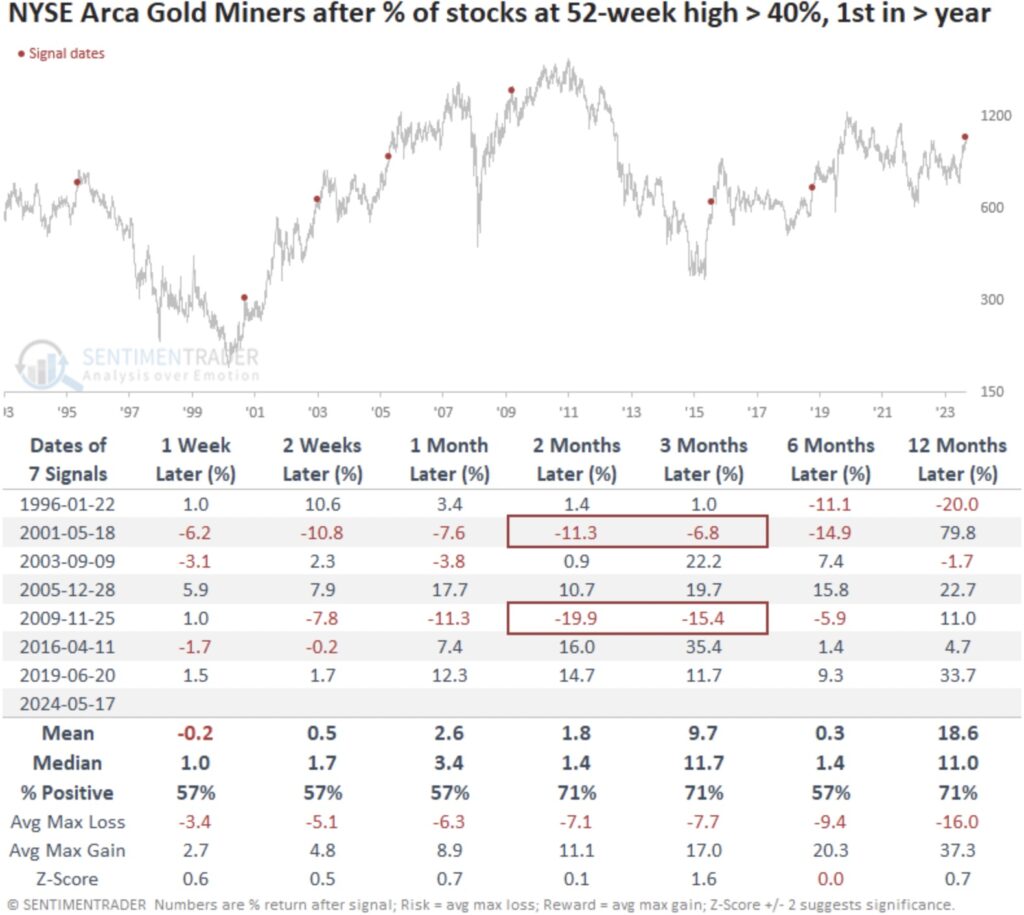

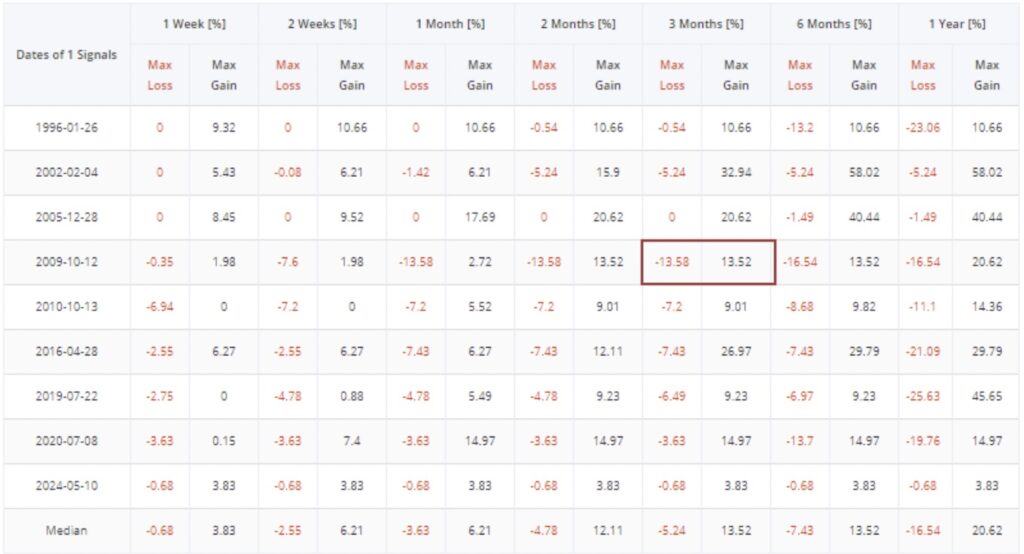

Over the past 30 years, the first time more than 40% of gold miners reached a 52-week high at the same time mostly preceded further gains in the NYSE Arca Gold Miners Index, though there were a couple of large failures with double-digit losses either two or three months later.

Fewer corrections and bear markets

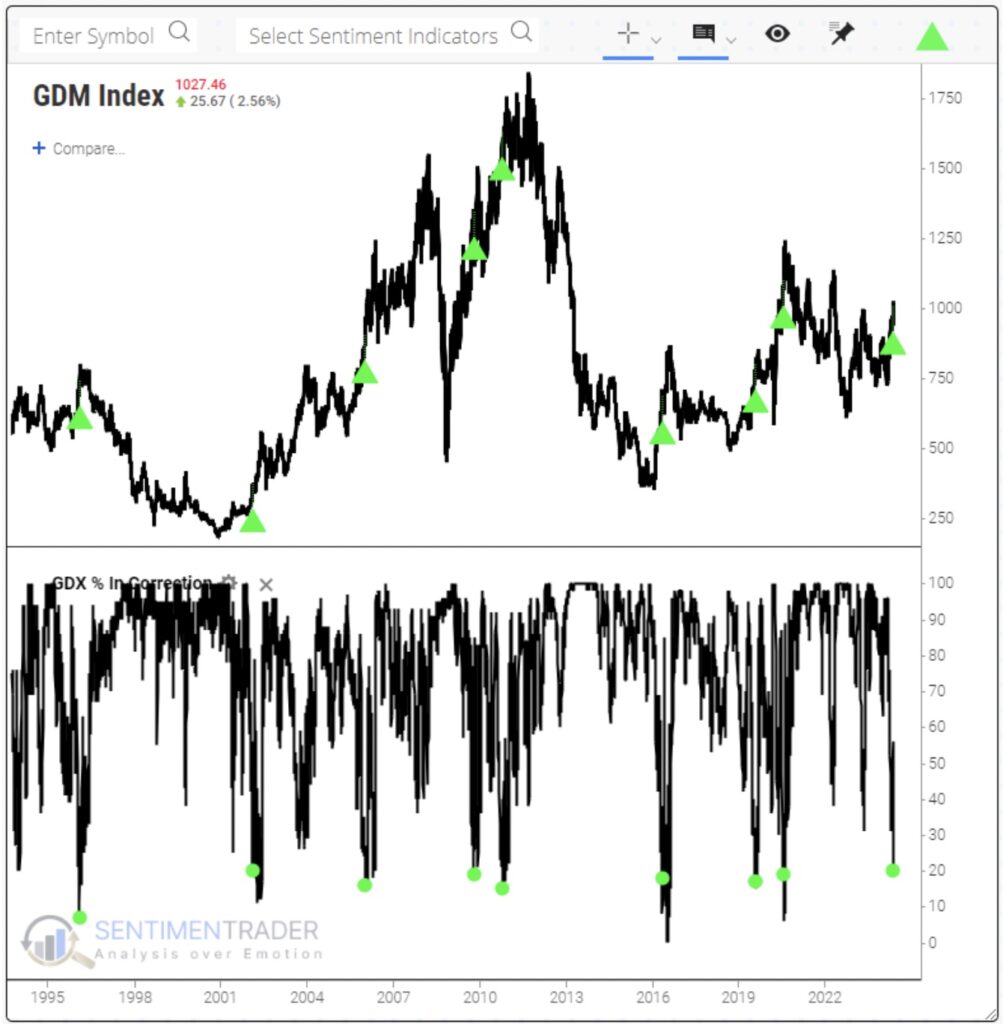

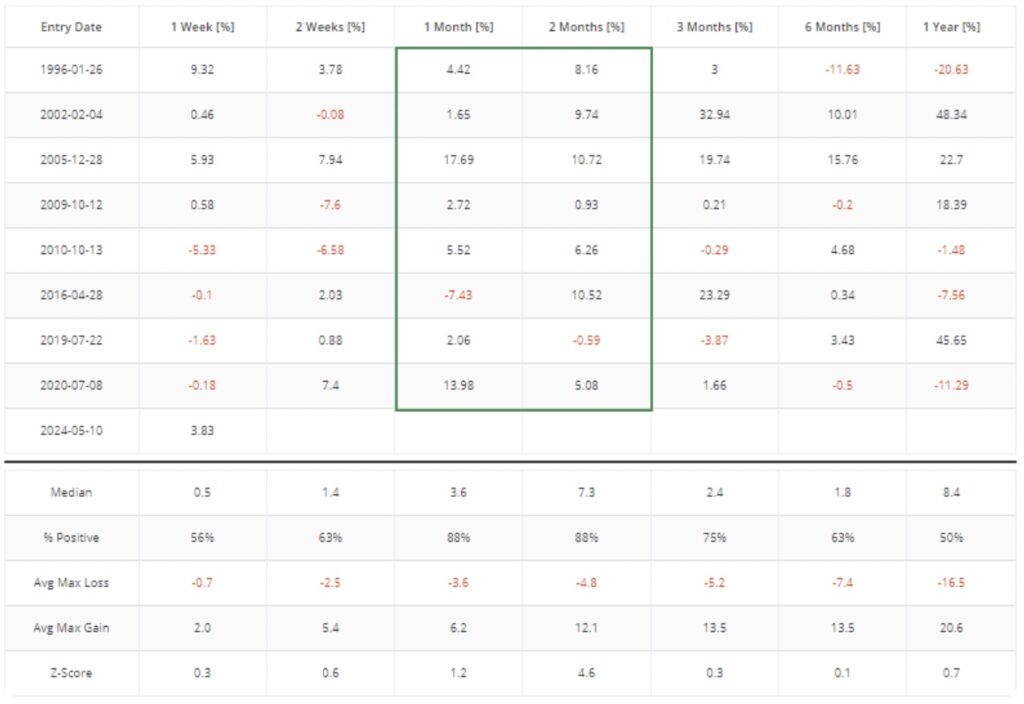

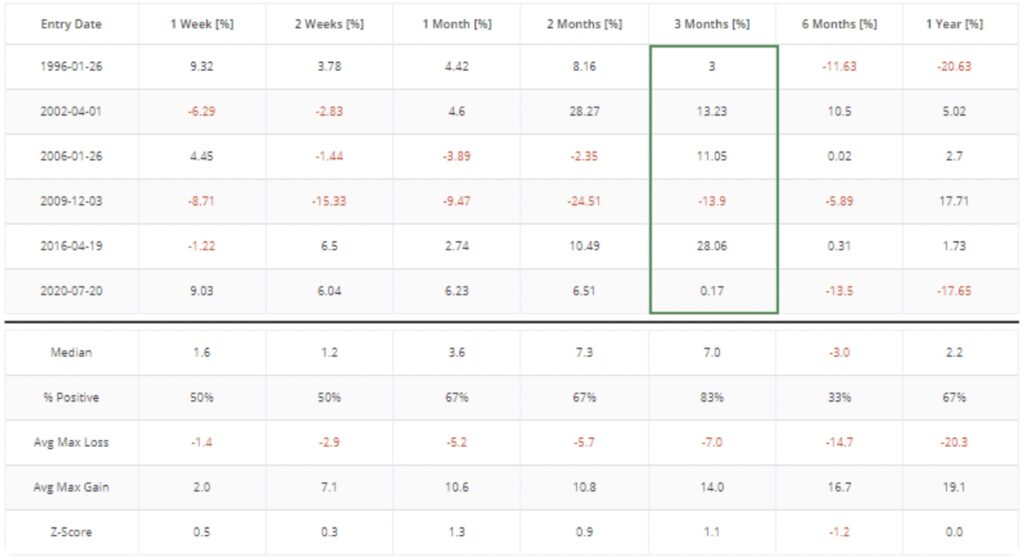

As a result of the rally and more stocks reaching new highs, it’s logical to assume that fewer stocks are in corrections, which they are. After more than 90% of miners were in corrections (more than 10% from their last 52-week high) and then 20% or fewer of them were, the NYSE Arca Gold Miners index showed a gain either two or three months later every time.

Even more impressive about these cycles is the favorable risk/reward ratio, which is hard to find with gold mining stocks, especially after showing positive momentum. The table of maximum gains and losses across time frames shows that only one signal (barely) witnessed a larger interim loss than gain over the next three months.

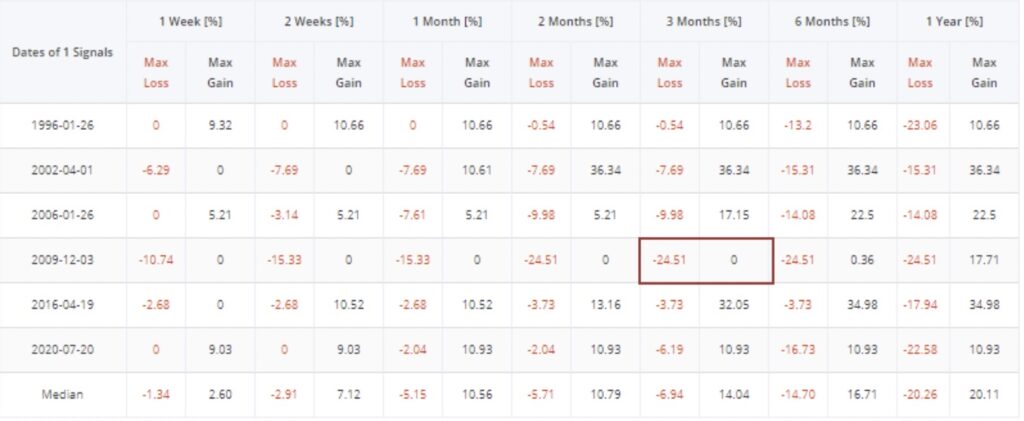

Not only are fewer of them in corrections, but even fewer are in bear markets (more than 20% off their 52-week high). This figure has cycled from above 80% to fewer than 8% for only the 7th time in 30 years. As we saw above, the next three months were mostly positive, with only one failure.

Similar to the previous study, the risk/reward heavily favored longs. Only the failed 2009 signal witnessed a horrible ratio. All the others strongly favored bulls over bears during the next three months.

What the research tells us…

Gold mining companies have a long and inglorious history of treating shareholder interests as secondary or tertiary interests. A few years ago, they made a lot of noise about changing their behavior and becoming better stewards of the capital entrusted to them. Investors have logically been highly skeptical of these statements, though they have mostly followed their promises.

Investors seem to be coming around to better corporate behavior, and record highs in some metals don’t hurt. Mining stocks have performed exceedingly well in response. It’s always hard to trust them, given their long history of rug-pulls once investors start to believe the bull case again. But when they cycle as they have over the past couple of months, their record over the past 30 years has been quite good and skews the case further toward the bulls. To subscribe to the internationally acclaimed work that Jason Goepfert and his team produce at SentimenTrader CLICK HERE.

Billionaire Lassonde Says Gold Headed Thousands Of Dollars Higher

To listen to billionaire Pierre Lassonde discuss what he is buying right now as well as the wild trading he expects to see in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss this week’s explosive upside action in gold, silver and mining shares and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.