Today top trends forecaster Gerald Celente spoke with King World News about the action in gold and silver and what KWN readers around the world should expect next.

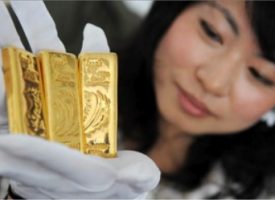

(King World News) Gerald Celente: “$10.7 trillion of negative yields — that is what is driving the gold market, along with the turmoil in the currency markets. The British pound just plunged over 20 percent in a matter of days. So these are the catalysts for the bid in the gold market…

Continue reading the Gerald Celente interview below…

Advertisement

To hear which company investors & institutions around the globe are flocking to

that has one of the best gold & silver purchase & storage platforms

in the world click on the logo:

Gerald Celente continues: “But when you add in the fact that people are becoming increasingly terrified of holding money in banks in Italy and Germany, in particular Deutsche Bank, this is simply turbocharging physical gold and silver demand. Eric, the Stoxx Europe 600 Bank Index has collapsed 35 percent this year. 20 of the largest global banks have lost a staggering half a trillion dollars of value in just the first six months of this year.

With the margin increases and the fact that we have Friday’s Jobs release in the United States tomorrow morning, KWN readers around the world should be aware that jobs release will definitely move the gold and silver markets and it could be either to the upside or downside.

Buckle Up And Look At What China Is Doing

But regardless of the short-term noise in the gold and silver markets, people need to buckle up and hold on because this is going to be a long and bumpy ride on the upside for many years to come in the gold and silver markets.

For what it’s worth, China is one of the only governments on the planet looking out for their citizens because they know what is coming and they keep urging their citizens to buy gold to protect themselves from the currency devaluations. China just devalued the yuan once again and they want their citizens protected from the monetary madness.

The Last Great Opportunity To Buy Gold

In closing, I also believe that the next sharp pullback will be the last opportunity to buy at these prices, and when gold moves beyond $1,400 an ounce it will spike to $2000. The next pullback will ready the gold market for the longer and stronger surge that will be violent on the upside.”

***The extraordinary KWN Stephen Leeb audio interview has now been released and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***One of Bill Fleckenstein’s greatest audio interviews ever has now been released and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***Also Just Released: Top Citi Analyst Issues Major Update On The Silver Market Click Here.

© 2016 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.