Apparently Yellen is terrified of spooking the US Treasury market as crude oil moves gather steam. Take a look…

Terrified Of Spooking The US Treasury Market

January 30 (King World News) – Peter Boockvar: Yes, the Treasury’s quarterly refunding announcement is now market moving news because of the enormous debts and deficits being accumulated. While they keep on growing, the Treasury’s news just now that they plan to borrow $760b in Q1 vs the estimate last fall of $815b has the Treasury market rallying and stocks following.

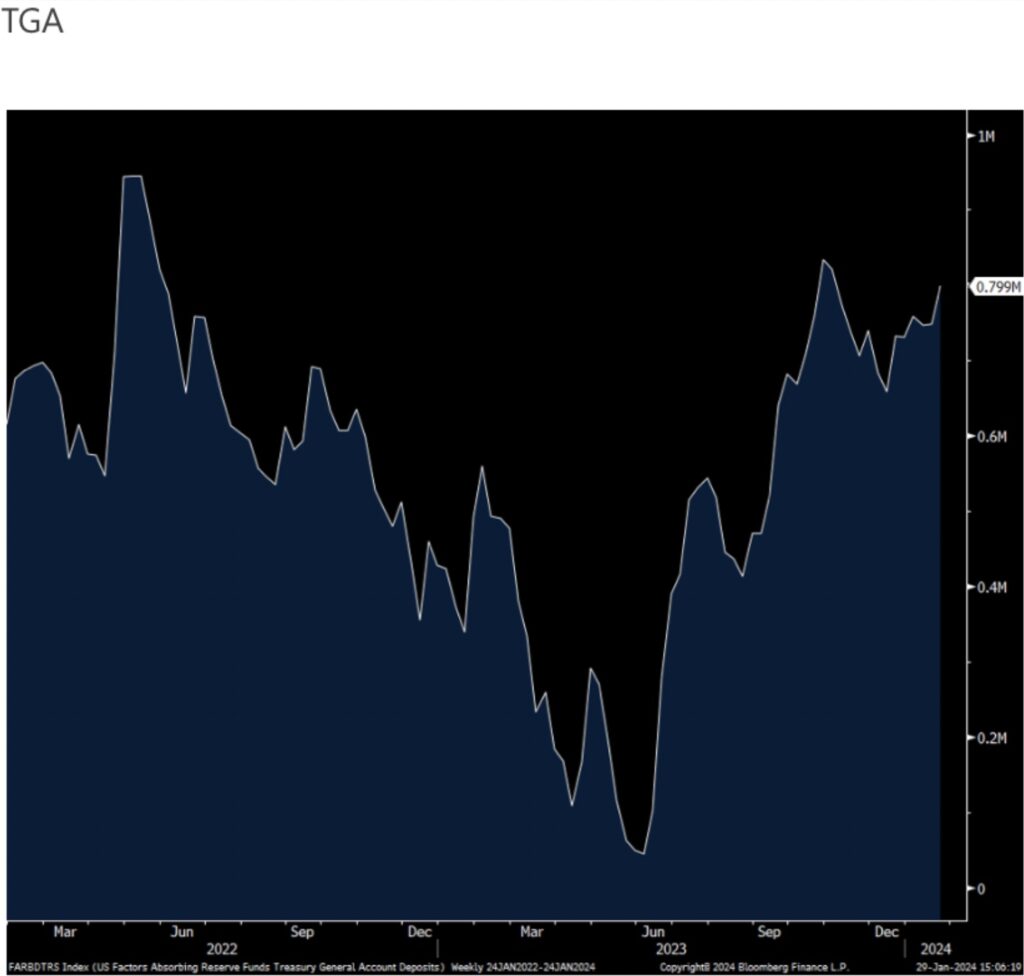

I’m guessing part of the reason for the lesser estimate is that the Treasury General Account is near its recent highs and Yellen will tap this rather than via more borrowing. There is also political maneuvering on the part of Janet Yellen in wanting not to spook the Treasury market.

Yellen Is Terrified Of Spooking The US Treasury Market…Will Take Money Directly Out Of The US Treasury

We’ll hear in coming days the complexion of the issuance in terms of maturities and I’m sure again Yellen will tilt to the short end.

The 10 yr yield was 4.09% right before the news and now stands at 4.07%. The 2 yr yield is in by 1 bp from where it was right before…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Oil Moves Are Gathering Steam

Naveen Nair at Citi: Oil: Brent futures (CO2) have closed weekly above the key 81.25-81.75 resistance (200d MA, 55w MA, August 23rd low), and are testing resistance at 84.61.

Why it matters: This opens a 4.4% move higher towards the 86.69-87.37 handle (61.8% Fibo, Jan, April, August 2023 highs). Interim resistance is at 84.61 (Nov 2023 high).

THIS WILL CREATE MORE INFLATION:

Oil Chart Looks Very Bullish

The break is especially significant, since it has followed multiple tests of the 200w MA support.

Technical indicators:

- Weekly lose above 200d and 55w MA resistance, which had held in December 2023. This represents a break of the narrow band we had discussed earlier.

- Comes after multiple tests of the 200w MA support level.

- No strong resistance till the 86.69-87.37 level (61.8% Fibo, Jan, April, August 2023 highs).

Keep Stacking Physical

King World News note: At the end of the day, all of this inflation that will feed through to other areas as the price of oil surges higher will be very bullish for gold and silver. Continue stacking, and remember that silver is particularly cheap at these levels with the Gold/Silver ratio near 90/1!

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.