After a significant move higher in the US dollar, there is no question that newly elected President Trump’s moves will heavily impact gold and the US dollar.

November 17 (King World News) – Matthew Piepenburg, partner at Matterhorn Asset Management: Below we look at the direction of gold in the context of announced Trump policies, the USD debate and comical debt markets.

A Revolution Coming?

Needless to say, Donald Trump recently won the US election, and as RFK Jr. said of this “impolitic” figure, a “revolution” is coming.

Depending on one’s politics, such a “revolution” is either music to one’s ears or the potential for “fascism American style.”

Good grief…

Nothing written here or elsewhere will change the polarized opinions of those who have long ago picked their right or left camp (or pejorative), so there will be neither gloating nor hand-wringing here.

A Weaker Dollar?

What we do know is that change is certainly coming, and despite the DXY’s impressive climb of relative strength (which does matter), we should expect to see a USD that trends weaker rather than stronger in the next four years.

Why?

Well, for one thing, both Trump and Harris have been saying so throughout their campaigns.

And despite Powell’s aborted “higher-for-longer” (i.e., pro-DXY) campaign of 2022-2023, even Janet Yellen and Jake Sullivan have been operating openly and covertly toward a weaker USD.

I, too, have argued and foreseen the same, not because it’s fashionable as a gold executive to be anti-fiat, but because a weaker dollar is the only Realpolitik way out of the United States’ sovereign debt trap.

Throughout history and without exception, whenever a debt-corned nation is forced to choose between its currency and bond market, the currency has always been sacrificed.

Always.

In other words, the US needs a weaker dollar…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Alternative View

Contrary views, most notably those of the highly credible Dollar Milkshake Theory, effectively argue that there is too much USD-demand (“straw-sucking”) in the Euro Dollar, SWIFT and global derivative markets to prevent a rising DXY.

And despite the growing evidence of rising de-dollarization, the valid defenders of a rising DXY soberly argue that given the massive systemic nature and dollar-based leverage in these global markets, any equally massive de-leveraging attendant to such de-dollarization (akin to a global “bank run”) would not only be too destabilizing to the dollar-based system, but would, ironically, only send the USD higher.

Fair enough.

But that is why the BRICS+ nations, including Saudi Arabia and the UAE, whose currencies are pegged to the dollar, want to make this “bank run” slow and steady rather than all-of-a-sudden.

The BRICS+ and other sovereigns are not seeking to destroy or replace the USD, but they are seeking to reprice it.

The same, I maintain below, will be true of the Trump White House.

And Trump, not yet a tenant of that White House, is already getting very busy with his plans.

Falling Rates, Rising DXY?

That said, even as the Fed has been cutting rates like a corner barber shop, the DXY has been rising from October 100 to November 107.

What (the heck) gives?

Well, the short answer is that a recession, marked by desperately lower rates and lower growth, is coming.

This makes the “door charge” (or risk premium) for the USD more expensive in yes—those Milkshake Eurodollar markets overseas.

Today’s DXY climb, in fact, is eerily similar to 2001 when a new President (Bush) headed to DC. In the same year, Greenspan’s Fed cut rates with fury.

But in that same year, the DXY skyrocketed from 108 to 121 despite 6 consecutive rate cuts.

Think about that.

In short, the current DXY’s climb has less to do with the Fed’s increasingly impotent rate cuts or Trump’s election than it does with the Eurodollar’s rising cost (due to difficult offshore lending conditions) in a world that is seeing what no one in DC wants to admit, namely: Recession is coming.

India’s falling rupee and S. Korea’s falling won, both of which are facing higher Eurodollar risk premiums to play ball in the global markets, are simply the most obvious (and recent) canaries in the recessionary coal mine.

In essence, the US desire to weaken the Dollar is colliding with the Eurodollar’s rising cover charge for that same currency, which means we can’t ignore the “Milkshake Theory’s” rising DXY nor the Realpolitik of needing to debase the USD.

It’s worth noting/reminding, however, that a relatively stronger DXY doesn’t mean an inherently stronger purchasing power for the USD—it just means the dollar is the best horse in the global glue factory, which is nice for Americans spending dollars in say, Argentina or Turkey, but not much help to Americans buying milk and eggs in, say, America…

Trump’s Objectives

The fact that Elon Musk and Vivek Ramaswamy (at the new Department of Government Efficiency or “DOGE”) have been tasked with trimming $2T of wasteful spending out of the DC budget (swamp?) by 2026 is just a small promise of the aforementioned “revolution” to come.

Such a goal, if achievable, should not be partisan but applauded, but we shall see.

Trump also seeks to restore jobs and industries that were relocated to China circa 2001 when the US C-suites of American “capitalism” quietly chose to sacrifice/swap millions of US jobs for cheaper foreign labour.

This was done in order to achieve higher margins (and share-price-driven executive salaries) in a subtle move to have the American Dream Re-Made in China at the expense of American labor.

Thus, Trump’s admirable re-shoring objective should be fairly beyond a left vs. right debate, but simply a necessary (but expensive/inflationary) plan.

Equally reasonable–on its face at least–are Trump’s promises to expand US oil production, reduce regulatory red tape and take a bite out of US deficits.

But given that Trump’s “face” is behind such objectives, at least half the country will mock the message along with the messenger, regardless of the substance.

That’s politics. That’s America today.

And Trump, love him or hate him, has other plans, all of which impact the dollar (and hence gold) discussion herein.

The Fed’s Latest Threat?

Even the infamous Fed, of which I have never been a big fan, is coming into the cross-hairs of his camp.

There is now talk of making the independent Fed less “independent” (i.e., even more political).

This is an interesting headline, but the real question/issue for me is not the Fed’s alleged independence but its blatant unconstitutionality—despite its coerced “legitimization” in 1913.

It matters far less to me, for example, whether it’s the FOMC or Trump’s White House who acquires more or less say in fixing the supply and price of American dollars.

This is because I am of the outdated opinion that the only force worthy of making such determinations is the bond market itself.

Just say’n…

But given the Fed’s immense power and systemic range, I am not sure how anyone can unwind that now embedded serpent…

The Fed’s Trapped Endgame

But even if actual supply and demand realities were to one day replace political fantasies (i.e., MMT) at the Eccles Building (don’t hold your breath), one has to face the hard math that less and less of the world wants US debt.

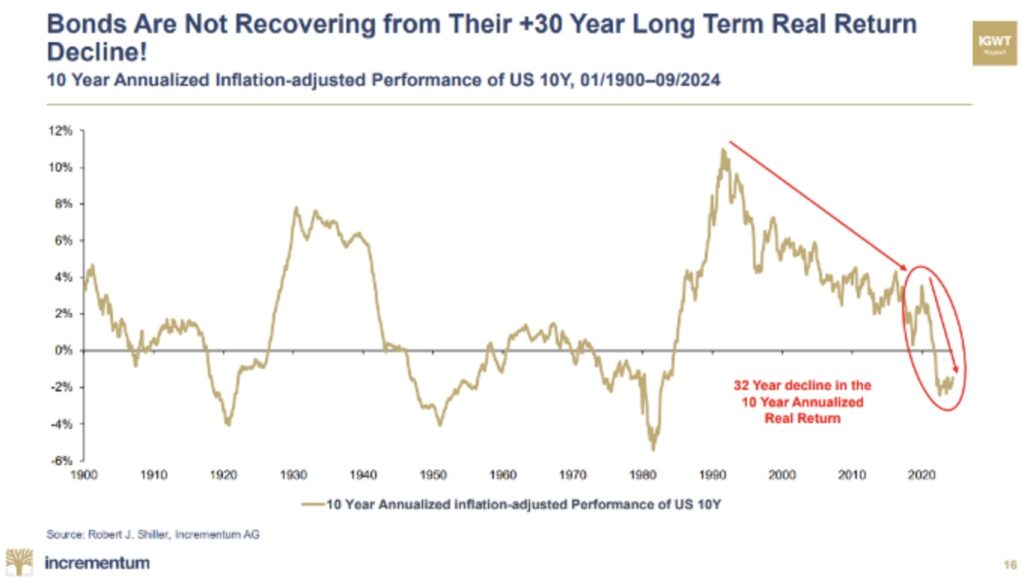

And given the real returns on US IOU’s, can we really blame them?

Despite the longest stretch of yield curve inversion in decades, the Fed has not been able to net-sell a 10-Year IOU since 2010.

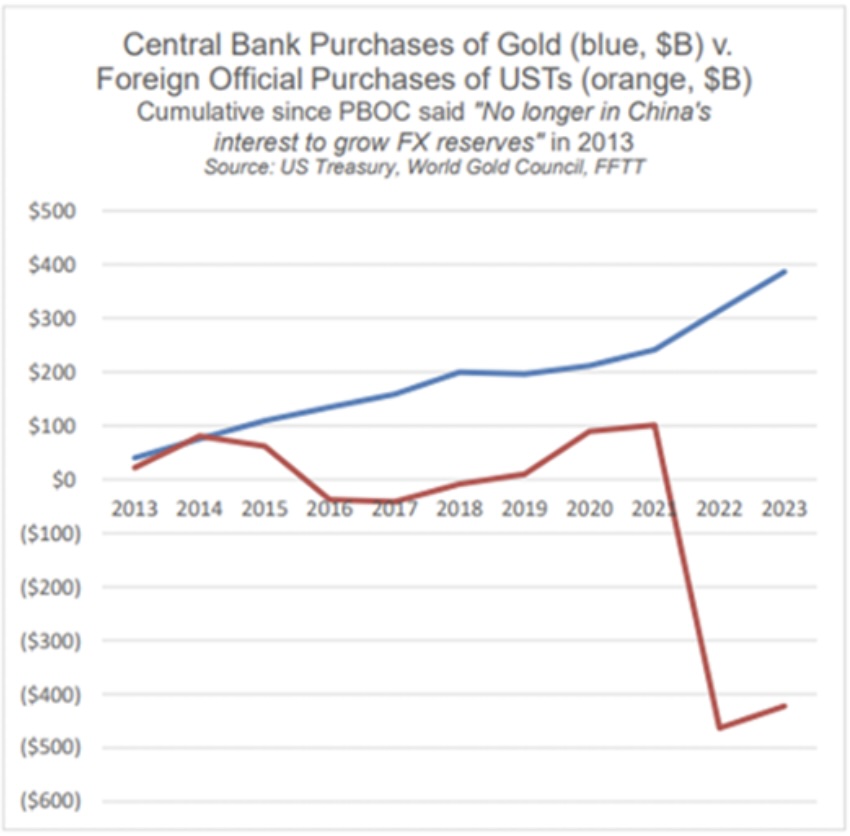

Instead, central banks clearly prefer real gold over US paper:

More simply, if we ever truly and actually tried to rid ourselves of that Fed snake, the immediate result would be a naturally tanking UST market and a yield (and hence rate) spike to the heavens, which would rival Musk’s SpaceX.

In short, if actual supply and demand (i.e., capitalism) were allowed to speak naturally, this would naturally murder the narrative of American Exceptionalism in less than 60 seconds.

This is because America’s debt-based “exceptionalism” is supported entirely by fake liquidity from a fake (i.e., not so-so “federal”) Federal Reserve.

In sum, and as currently Fed-centralized, the US sovereign debt market (and the dollar attached to it) is objectively and mathematically trapped with no way out other than inflating its way out.

And that, folks, is the endgame.

The Dollar’s Endgame. Gold’s Rise.

This, of course, partially explains gold’s 2024 rise, which, though never in a straight line, is heading secularly north for a reason.

As Peter Schiff rightfully stated with refreshing simplicity. We are not seeing a gold bull market, but simply a fiat bear market.

The additional facts speak for themselves, namely that the BIS, along with a rising and de-dollarizing BRICS+ membership and the slow but steady dilution of the petrodollar are all flashing neon signposts of a world openly favoring gold over the US 10Y (and hence USD) as a strategic Tier-1 reserve (and energy asset).

All of these factors make gold’s longer-term direction geopolitically clear.

Trump’s Immediate Options

Regardless of Trump’s “reassessment” of the Fed’s independence, I share Luke Gromen’s take on the obvious yet hardly ideal options available to sustain the debt beneath America’s wings.

Those options are as follows:

- Weaken the USD to provide more balance sheet “accommodation” for the long-end of the yield curve to “stimulate” higher growth, inflation, markets and hence tax receipts. (The math behind such a plan is simple, for the weaker the DXY, the lower the deficit, which is an open Trump objective.)

- Re-Capitalize (i.e., “re-leverage”) Fannie & Freddie Mac to purchase those otherwise unloved and still toxic MBS “assets” from the Fed’s Chernobyl-like balance sheet.

- Officially modify the regulatory rules to favor “supplementary leverage ratio” exemptions which would allow the TBTF banks to effectively do their own version of hidden QE off the Fed’s balance sheet (and DC headlines).

The Golden Bazooka Option?

There is, of course, another Bazooka option, one which Gromen and others are slowly raising and which we, of course, cannot ignore.

That is, Trump could have the US Treasury Dept instruct the Fed to officially (and overnight) revalue Uncle Sam’s gold supply (whatever that figure truly is?).

Based upon official US gold data, every $4,000/oz revaluation in US gold would mean an additional $1T in new liquidity for the Treasury General Account, making it that much easier to pay down larger chunks of Uncle Sam’s $35.8T public bar tab.

Be Careful What You Ask For?

Such a move, tempting on its face, is hardly without dramatic ramifications for the dollar’s world reserve status and a staggering global reshuffling of economic power and influence.

After all, under such a revaluation option, the nation who holds the most gold wins, and it’s still unclear to many just who owns what and the most…

Toward this end, the national gold holdings reported by World Gold Council are likely not even close to accurate, so any US gold “revaluation” may give more power to the East than West?

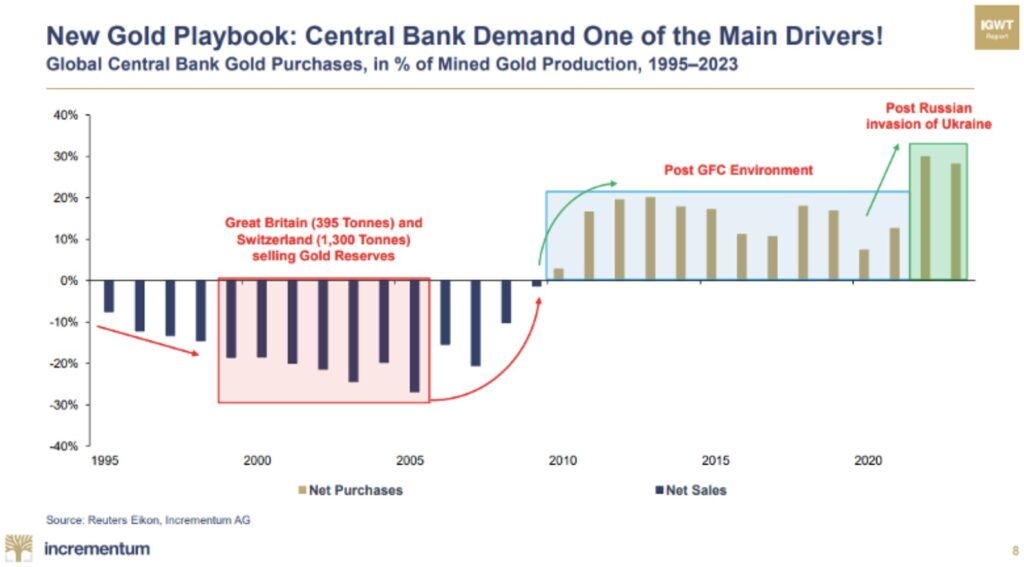

The net-stacking of physical gold by eastern central banks, for example, suggests that such a revaluation possibility has been tactically and strategically on their minds, despite being almost completely off the headlines of a corporate owned Western media.

Looking Forward

Whether such goals and promises (or even gold revaluations) come to fruition is a matter of time, math and politics, the latter of which is the least reliable.

For now, at least, the markets and the USD, along with its oil correlation, appear to be stable to rising while both the USD and oil fall hard relative to gold.

As to math, we can also agree, regardless of political bias, that re-shoring US industry and jobs while simultaneously raising tariffs against big names like China will be expensive and, hence, inflationary (notwithstanding a deflationary recession or stock market mean-reversion).

We also know that Trump will only have one term to “revolutionize” the swamp, and given the fact that mid-term elections in the House are less than 2 years out, he will want and need to act fast.

Rock Now Beats Paper

No one, of course, can say with certainty what Trump can or will do and what or how the world, forever in flux, will react.

Will the DXY rise on Eurodollar “sucking-sound” demand or fall on un-loved “no-demand” for USTs?

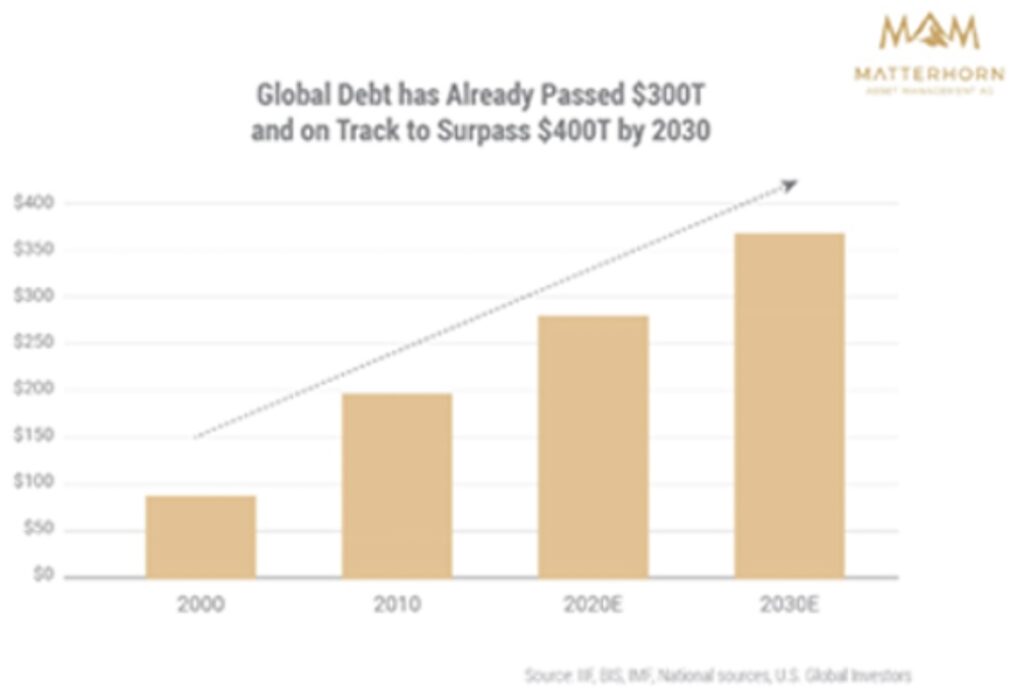

What we do know with certainty, however, is that the world is marching toward over $340T in global debt, with GDP numbers at less than 1/3 that figure.

Such simple math is an open indicator of some kind of reckoning, which will almost certainly be a reckoning for the paper currencies previously engaged to “support” this unsustainable and chaotic debt cycle/fantasy.

Gold, of course, loves chaos and shines brightest when paper money is most embarrassed and unloved.

The obvious yet still largely ignored moves (begun over a decade ago) by more and more central banks to stack gold and dump USTs at record levels are evidence enough for those who are more comfortable and patient with the lessons of math and history than they are with the term “gold bugs” …

Gold is not a debate or “bug” designation. It’s simply history in motion as, in today’s debt-defined “new abnormal,” rock beats paper. This will link you directly to more fantastic articles from Matthew Piepenburg and Egon von Greyerz CLICK HERE.

To listen to Gerald Celente discuss his the radical 2025 that lies ahead as well as his predictions for gold, global markets, war, and what surprises to expect in 2025 CLICK HERE OR ON THE IMAGE BELOW.

ALSO RELEASED!

To listen to the man who helps oversee $170 billion discuss how investors around the world can prepare themselves for the turbulence in global markets that lies ahead CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.