Here is a look at Trump trades on the move, chance of a lifetime plus a stunning look at gold.

Trump Trades On The Move

July 17 (King World News) – Peter Boockvar: We’re realizing again that the Trump Trade goes both ways and markets are responding to the Bloomberg interview. Tariffs of 60% might not be enough and 100% could be the rate we heard. Biden though doesn’t disagree as we’ve seen his administration slap that on some more Chinese products and I’ll call out both sides for their obsession with tariffs and the overall damage it does.

People forget that the 2018 tariffs put the US manufacturing sector into a recession and we’ve been in another one for the past two years. Another tariff battle is a bad thing. Another economic fight with the 2nd largest economy is a bad thing. There is also a story this morning that the Biden administration will further limit the sale of chip related products to China. The daily bashing of China will continue until the election, at least, it seems.

Also, the euro/yen heavy DXY is trading at the lowest level since March 20th as we were reminded that Trump doesn’t like a strong dollar either. “We have a big currency problem he said.” The yen in particular is having a good day. The Ministry of Finance in Japan is getting a free ride today on someone else’s verbal FX intervention.

As for Taiwan, Taiwan Semi is down almost 4% pre market and who is going to make Nvidia’s chips if China takes advantage of the Trump comments?

As for Jay Powell, he’s now apparently welcome to stay on until his term ends to deal with the inflationary implications of all these tariffs and a weak dollar (though usually ones currency would rise with tariffs imposed on others).

Positively, a 15% corporate tax rate would make Corporate America and doing business in the US even more competitive. Just see how many companies have gone to Ireland to do business.

Politics and policy is certainly a lot about trade offs for sure.

Fed Governor John Williams is seemingly telling us that we won’t be getting a surprise July rate cut. He said yesterday (posted today) in a WSJ interview that while they are gaining more confidence on the disinflationary trend, “I would like to see more data to gain further confidence inflation is moving sustainably to our 2% goal.” ‘Sustainably’ again the key word.

I’ve been trying to square what I’ve seen from a variety of retailers over the past few months with the big upside seen yesterday with the non auto retail sales (impacted by the CDK software problem). My buddy David Rosenberg helped by saying “A very generous seasonal factor was at play. The raw NSA data actually showed retail sales plunging 5.6% m/o/m in June, the worst drubbing in a decade and tied for the steepest plunge since the series began in 1992!”

The British pound is now above $1.30 for the first time in a year, helped by the Trump comments but also a CPI print that came in higher than expected that is seeing Gilt yields jumping too. While headline CPI was up just 2% y/o/y, the core rate was much higher at 3.5% because of a 5.7% service price increase, all one tenth above expectations. The BoE won’t likely be cutting rates in August. The positive though was softer than expected PPI figures for both input and output charges.

Chance Of A Lifetime

Graddhy out of Sweden: Chart now as think it has turned inside the massive blue triangle for the last time. Oil sector lead the commodities baby bull move up from the bear low in 2020. This chart says it is now time for precious metals to shine.

Time For HUI Gold Mining Index To Shine vs Oil Stocks

The move in precious metals miners have only just begun.

The charts are now set up to climb the right side of huge rounded bottoms. Most will not get into a bull market mindset until too late though. So, be one of the few that catches the whole move, the move of a lifetime.

Gold

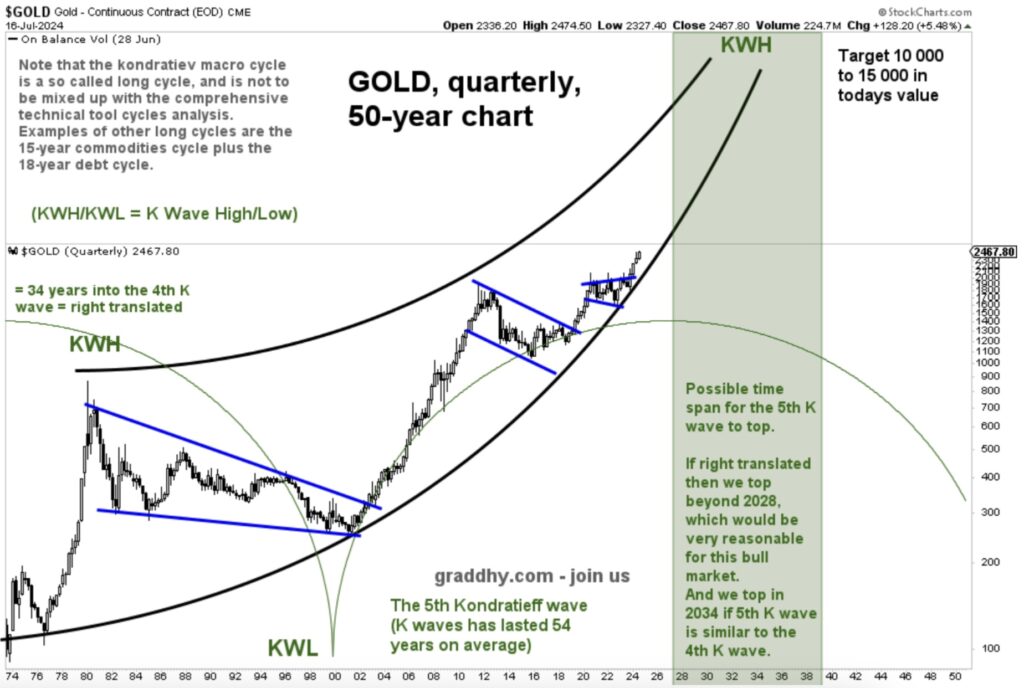

Graddhy out of Sweden: This gold roadmap back in 2019 is still showing the way. Got another blue mega breakout 6 months ago. Bull market price objective $10 000 – $15 000, but could briefly go much higher at end of the bull.

Gold Price Target = $10,000-$15,000

New all-time highs yesterday after a sideways consolidation.

Opportunity of a lifetime.

***To listen to Alasdair Macleod discuss how to make a fortune in this gold bull market CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.