Trump has surged in polls as the public is euphoric about the stock market.

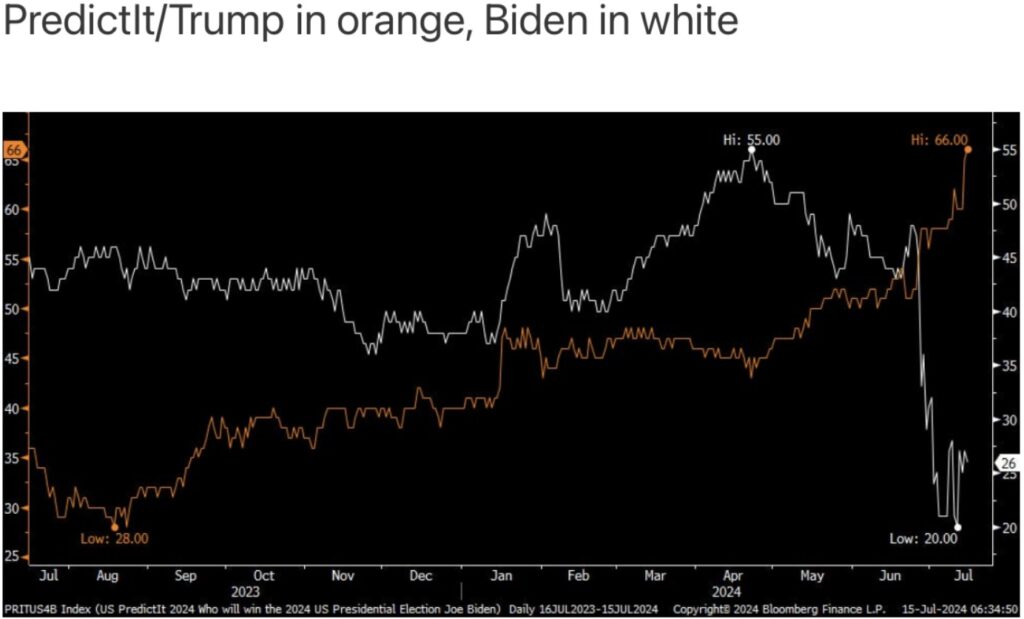

July 15 (King World News) – Peter Boockvar: PredictIt has a Trump win now up to 66% from 60% on Friday in light of the tragic events Saturday. It was at 55% right before the debate. Biden is down to 26%, down 1 pt and compares with 45% before the debate. My friend Eric Rosen, who pens the widely read Rosen Report on Substack twice per week, highlighted yesterday that Reagan got a 22 pt lift to his poll numbers after he was shot.

Everyone is passing around their favorite Trump trades but I think we’ve seen over the past century that stock market moves are more random than what a president can dictate. Yes, a change in the corporate tax rate was a big deal in terms of corporate earnings but that won’t change much in the next four years. Personal tax rates certainly matter but at best we’ll get a continuation of the current rates. The regulatory state can ease but with the Chevron ruling, judges and Congress now will be more influential on that.

Healthcare payments are mostly driven by government so who is president might matter here as well as for defense spending. As for overall government spending, whether Congress is split or not in terms of parties of course will hugely matter but either way, government spending is out of control and will continue to be so regardless of who is president. I do believe though that whoever runs the FTC will have a big influence on the pace of M&A since it’s been basically stunted over the past 3 1/2 years.

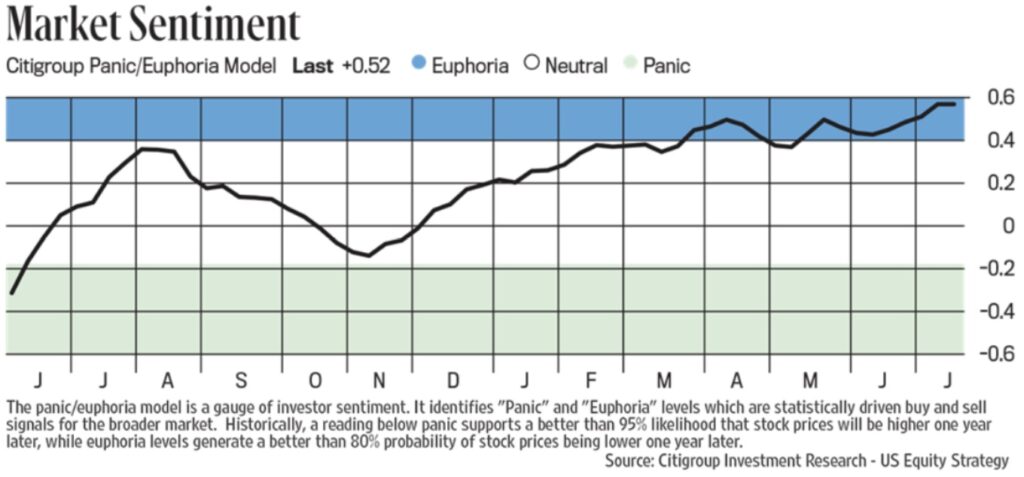

Panic & Euphoria

Moving on. As measured by the Citi Panic/Euphoria index, the Euphoria is getting more euphoric as their index hit .52, up from .46 in the week before and you have to go back to 2021 to see a higher read. Again, take note because of the statistically significant implications, according to Citi, of a read this high.

Public Euphoric About Stock Market

The World ACD gave us air cargo data on Friday in light of the squeeze higher in container shipping rates. The average spot rate for a cargo flight from Asia Pacific to the US on a per kilo basis is up by 68% y/o/y. The global rate of $2.57 per kilo is higher by 14% y/o/y. Again, as said with container prices now, someone has to eat this and we’ll see who in the coming months/quarters based on what can be passed on to one’s customers.

Yen Troubles In Japan

When a major developed country’s currency trades at nearly a 40 yr low against the US dollar, it is not just a talking point for Wall Street. It has real world implications for that country. We keep talking about Japan and the yen and the damage a weak currency has on their standard of living as the cost of imports rises sharply and wage growth is still not keeping up with inflation. I’ll add another problem for Japan that the NY Times business section pointed out over the weekend. “Plunging Yen Takes Toll on Military.” The article said “The government has slashed orders for aircraft, and officials warn that further cuts may be imminent. Japan buys much of its military equipment from American companies, in transactions done in dollars. The government’s purchasing power has been drastically eroded by the yen’s diminishing value.”

Tobias Harris has a Substack on Japan and is an expert on the dynamics there. He wrote on Friday, “Dissatisfaction with the yen is present throughout the economy. Kobayashi Ken, the head of the Japanese Chamber of Commerce and Industry, which represents small and medium sized enterprises, earlier this month called on the government and BoJ to adopt FX policies that take the struggles of SMEs into consideration. Meanwhile, Niinami Takeshi, chairman of the business federation Keizai Doyukai, somewhat unusually called on Friday for a rate hike to provide relief from the weak yen.”

Also, “The rising cost of imported goods has led to a mood of despair on Japan’s opinion pages, as editorial writers and experts lament Japan’s relative ‘impoverishment’ and decline.”

Bottom line, expect a rate hike and a large cut to QE at the end of the month from the BoJ. The yen is down a touch today after the sharp rally last Thursday and Friday.

Luxury Slowdown

Burberry stock is down sharply today both in part due to “a backdrop of slowing luxury demand” the company said and likely execution issues too where the CEO is leaving. Other luxury makers are down in European markets.

Cries In China For Stimulus

China reported a slower than expected GDP growth rate for Q2 of 4.7% vs the estimate of 5.1%. Softness in retail sales was a main factor. As home prices continue to drop, the wealth impact is notable with so much consumer money tied up in their homes. I hear more cries for stimulus and easing but time is the only healthy cure at this point for the residential real estate downturn.

***To listen to Alasdair Macleod discuss how to make a fortune in this gold bull market CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.