Here is a look at today’s epic tech bubble chart of the day! Plus a look at real estate and shipping costs.

Epic Bubbles

February 15 (King World News) – Peter Boockvar: Another parabola has been spotted and it certainly is super. These chart patterns always end the same way but it can certainly go higher before it cracks. The analogy here is the one who sprints as fast as they can at the beginning of a marathon will always flame out. The one that takes a more measured pace typically finishes the race. The stock by the way is now trading at $920 pre market today.

THE TECH BUBBLES ARE EPIC:

Super Micro Computer (SMCI) Now Trading At $1,004 Up Another $123 Today

Stock market sentiment is back to being extreme as seen in the Investors Intelligence report yesterday as the Bull/Bear spread got back above 40. Bears rose to 58.8 vs 54.3 even as Bears rose to 17.7 from 17.1. Those expecting a Correction fell to the just 23.5 from 28.6. The Bull level is the highest since the summer of 2021. The AAII is less giddy as it captured the selloff on Tuesday. Bulls fell by 6.8 pts to 42.2 while Bears rose by 4.2 pts to 26.8, still though a wide spread. The CNN Fear/Greed index remains in the ‘Extreme Greed’ category at 76 and I mentioned a few days ago that the Citi Panic/Euphoria index is nearing Euphoria…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Bottom Line

Bottom line, just as we tell our kids to be aware of their surroundings, it’s important for investors to do the same.

Austan Goolsbee’s dovish side is coming out as yesterday he rationalized and stretched for reasons to eventually cut rates. He basically said we don’t have to pay attention to CPI because they only look at PCE. I’ll say for the millionth time that PCE always runs below CPI because its biggest weight is healthcare that is mostly measured by artificially suppressed Medicare and Medicaid reimbursement rates. So the 1% plus monthly gains in health insurance seen in CPI won’t show up here for example.

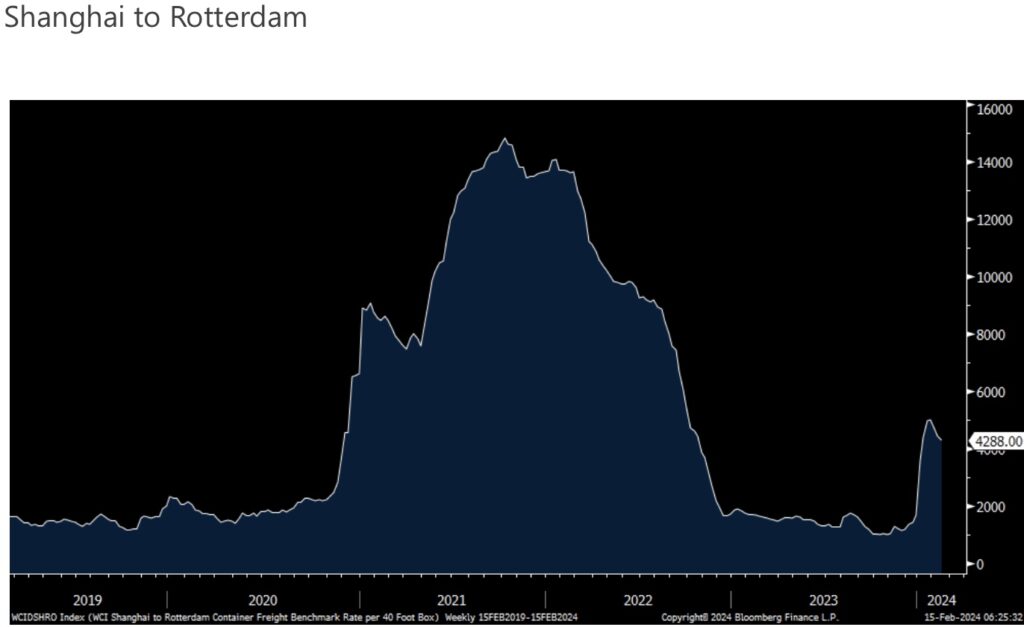

Shipping Costs Shanghai To Rotterdam

The World Container Index Shanghai to Rotterdam price of a 40 foot container cooled for a 3rd week, falling by $138 to $4,288, though still up from $1,667 in the last week of 2023. It was at $1,851 in the same week in 2019.

The Shanghai to LA route was little changed, down by $17 to $4,754 vs $2,100 in late December and vs $1,496 in mid February 2019.

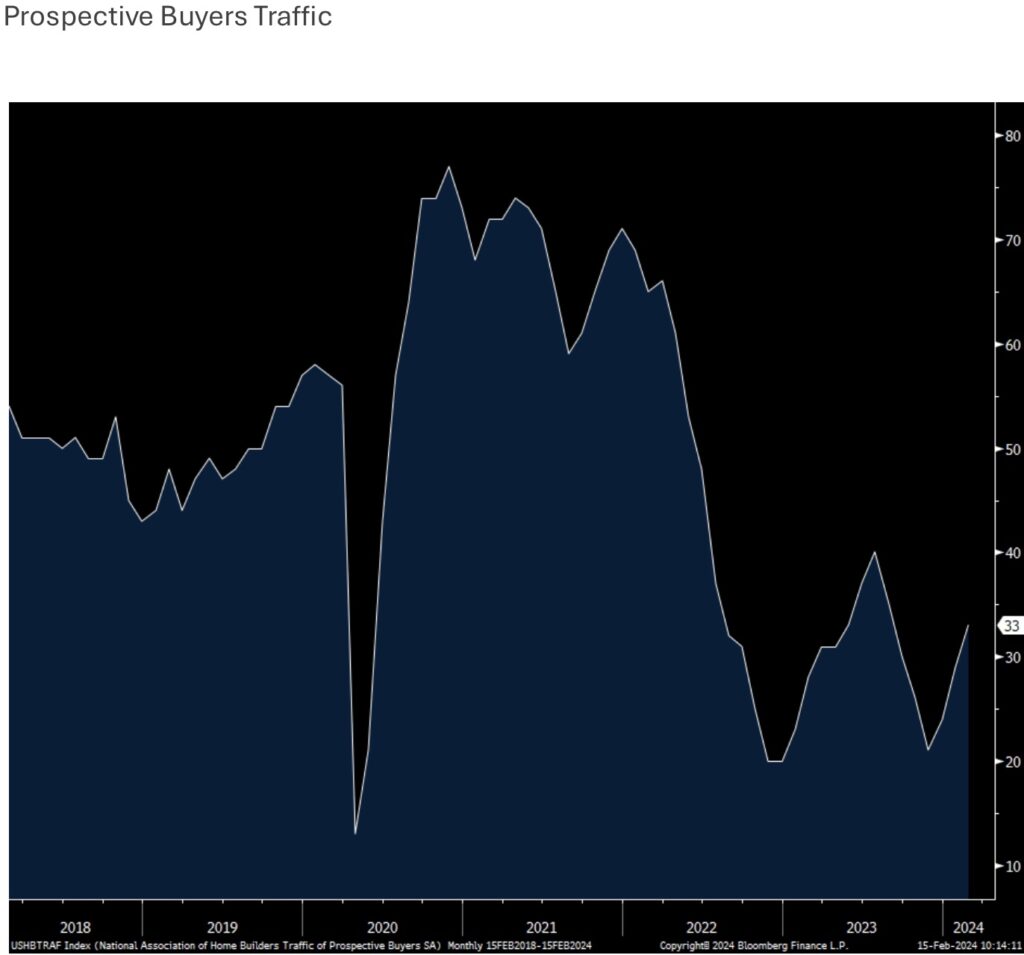

Real Estate

The February NAHB home builder survey rose 4 pts m/o/m to 48 and that was 2 pts above the estimate.

Home Builders Survey Remains Below 50

The present situation got back above 50 at 52 from 48. The future is where the optimism really reigns as it was up 3 pts to 60. Keeping the headline though below 50 was the 33 print on Prospective Buyers Traffic, though up 4 pts m/o/m but remains well below 50.

Prospective Buyer Traffic Remains Collapsed

So, builders are more positive but they need more people to visit their offerings.

Serious Affordability Challenges

The optimism lies in the hope the Fed cuts rates this year and that mortgage rates will fall in response. I think if the Fed notably cuts short term interest rates, long rates would actually rise, providing little relief for a 30 yr mortgage rate but I could very well be wrong. Either way, the average 30 yr mortgage rate is up 40 bps in February alone to 7.29% according to Bankrate, highlighting the still big affordability challenge for first time buyers when you add on the continuous rise in home prices.

Homebuilders did trim back on their discounting in response to the drop in mortgage rates (prior to this recent rise). According to the NAHB, “In February, 25% of builders reported cutting home prices, down from 31% in January and 36% in the last two months of 2023. However, the average price reduction in February held steady at 6% for the 8th straight month. Meanwhile, the use of sales incentives is also diminishing. The share of builders offering some form of incentive dropped to 58% in February, down from 62% in January and the lowest share since last August.” We’ll see how they respond now with the jump in mortgage rates over the past 2 weeks as we know discounting was a main lever main builders pulled in order to sell homes.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.