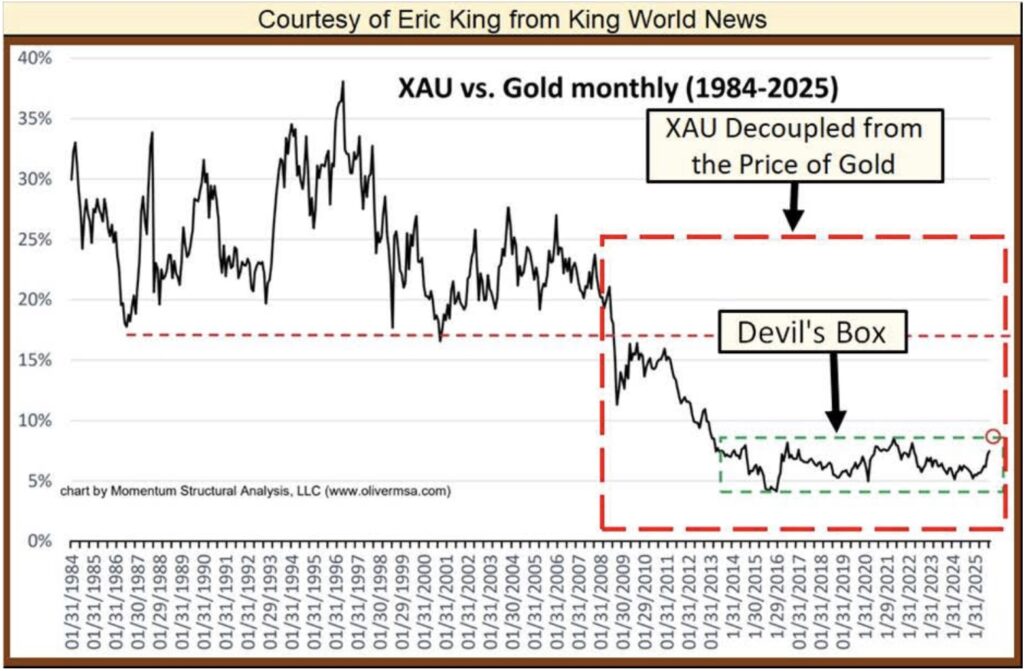

The bull market in mining hasn’t even begun as the XAU vs Gold remains trapped in the Devil’s Box, but this will send gold and silver mining stocks screaming higher if it unfolds.

KING WORLD NEWS NOTE: Soundcloud was having technical difficulties but KWN was finally able to release Michael Oliver’s historic audio interview (link below)!

On The Brink

December 17 (King World News) – Peter Schiff: The U.S. economy is teetering on the brink of the biggest economic crisis of our lifetimes. Gold and silver prices skyrocketing to new highs will ultimately pull the rug out from under the U.S. dollar and Treasuries, sending consumer prices, bond yields, and unemployment soaring.

This Will Send Mining Stocks Screaming Higher If It Unfolds

Gerald Celente: Next year, the world will be inundated by an oversupply of oil amid a sluggish global economy, creating a “super glut” of oil, according to Saad Rahim, chief economist for Trafigura, one the world’s leading commodities traders.

The price of Brent crude oil, which benchmarks global oil prices, has fallen 16 percent already this year, marking its worst year since the COVID War in 2020. Brent traded at TK at 5 p.m. U.S. EST on 15 December.

Now rich new oilfields are scheduled to begin producing in Brazil and Guyana in 2026.

“Whether it’s a glut or a super glut, it’s hard to get away from that,” Rahim said in a statement announcing Trafigura’s annual results.

China’s demand has been blunted, he said, in part due to the major shift among its consumers to all-electric and hybrid electric passenger vehicles. The country also has used this year’s low prices to stockpile millions of barrels of oil. That will pare back its purchases in 2026.

China said in 2024 that its demand for oil has peaked and would decline from then on…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Donald Trump has urged U.S. producers to “drill, baby, drill.” The price of West Texas Intermediate crude, the pricing standard for U.S. domestic oil, has struggled and often failed to stay above $60 for the past three months. It was priced at TK at 5 p.m. U.S. EST on 15 December.

In October, Ben Luckock, Trafigura’s chief oil trader, forecasted that Brent’s price would fall further before climbing back. “I suspect we’ll go into the $50s at some point across Christmas and the new year,” he said.

TREND FORECAST:

This is old news for Trends Journal subscribers. With Brent crude down some 22 percent this year, the worst decline in seven years, we had noted that the reason for the sell-off is because there is much more supply than demand, and despite cutting back supply, OPEC+ has been increasing it. Indeed, Saudi Arabia is adding oil into the market to generate revenue needed to pay for crown price Mohammed bin Salman’s ambitious plans to reconfigure the country’s economy as a center for artificial intelligence and other advanced tech, clean energy, and the financial industry.

In the past, analysts have said Saudi Arabia can profit even if oil is priced below $40 a barrel.

Barring surprises, such as Israel and/or the U.S. attacking Iran or the Ukraine War heating up, oil prices are unlikely to strengthen appreciably in 2026.

Why Would This Send Mining Stocks Exploding Out Of The Devil’s Box?

King World News note: 20-28% of expenses for mining stocks is related to the price of oil as their primary energy input. If the price of oil continues to weaken as gold prices remain firm or continue to surge, the miners, which are already seeing all-time record levels of profit, free cash flow, and dividends, would see their fortunes increase even further.

As the XAU breaks out of the Devil’s Box which is above the 8.1% level, you will see a 130% surge as the XAU vs Gold rises to the 17.5% level (SMALLER DOTTED LINE SHOW ACROSS THE CHART). XAU vs Gold will then rise another 60% from that level just to get back to the decades long median of 26%.

Historic Breakouts Will Send Gold & Silver Prices To Levels That Will Shock The World!

Michael Oliver discusses exactly what investors need to be doing with gold, silver, mining stocks and so much more and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED!

This Sums Up The Situation In The Silver Market Beautifully CLICK HERE.

ECONOMY IMPLODING: More Than A Million Layoffs In America CLICK HERE.

This Is All That Needs To Be Said About The Recent Gold & Silver Trading Action CLICK HERE.

This Is Why The Price Of Silver Is Poised To Skyrocket CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.