This will be wildly bullish for gold.

August 26 (King World News) – Ronnie Stoeferle at Incrementum: The Fed’s higher-for-longer October mantra belied their expectation that policy lags would take a few more quarters to drive a stake through inflation’s heart. However, such rapid 1%-plus declines across the yield curve suggest markets are spooked by something more consequential than CPI or payrolls.

At the risk of talking our own book, we truly believe the legacy imbalances of the modern era of unconventional central banking are finally coming home to roost. Exacerbated by the gross excesses of post-Covid fiscal stimulus and monetary expansion, the U.S. financial system is saddled with untenable amounts of malinvestment and unproductive debt. Even the most optimistic bulls recognize that excessive debt must eventually be rationalized…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

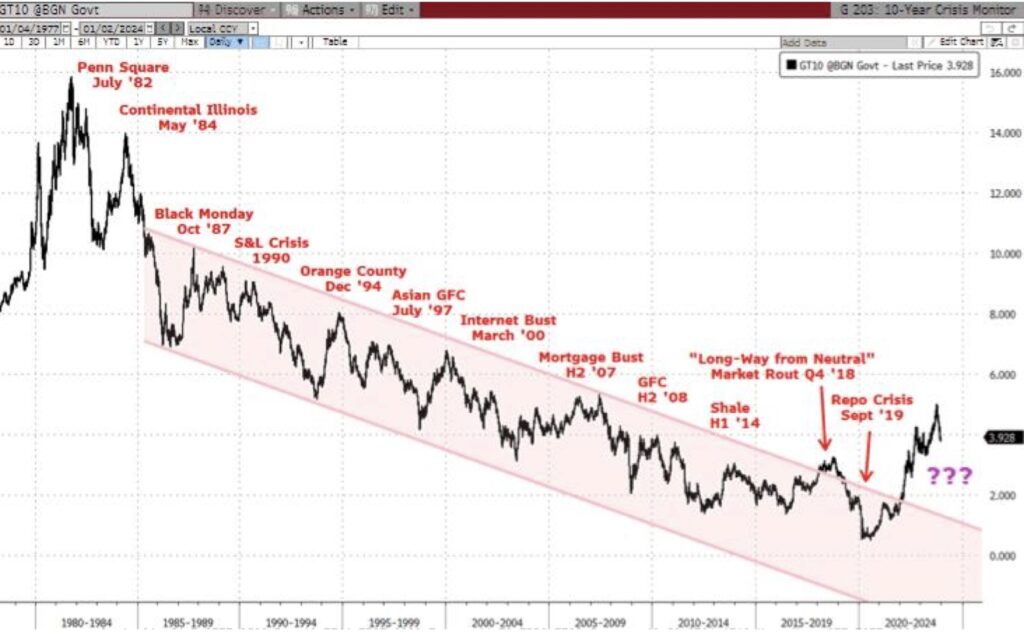

In retrospect, the $10 trillion tidal wave of post-Covid liquidity was sufficiently large to suspend one of the most ironclad economic relationships of the past 40 years. Since the buildup of U.S. debt began in the 1980’s, not only have long rates been in steady decline, but on every occasion 10-year yields have backed up meaningfully, a financial crisis has ensued. As shown below, the downtrend of 10-year Treasury yields has formed a remarkably consistent channel since 1985. Prior to the Covid liquidity cycle, each time the 10-year yield approached the top of this channel some sort of financial meltdown was triggered.

Each Time The 10-Year Yield Approached The Top Of This Channel Some Sort Of Financial Meltdown Was Triggered!

U.S. 10-Year Treasury Yield (1977-2023)

Since the Fed began its aggressive tightening in March 2022, 10-year yields have broken decisively above their 40-year downtrend. Truth be told, we are shocked long rates have been able to rise this high without causing more visible damage to the financial system, but we have learned this is the type of systemic indemnity $10 trillion can buy!

As impressive as the resilience of the U.S. economy has been, it is only a matter of time before the stimulus buffer is exhausted and reality sets in. Our extensive study of debt dynamics and monetary policy leave us firmly convinced that today’s over-levered U.S. financial system cannot withstand normalized rate structures without clearing trillions-of-dollars of malinvestment and nonproductive capital. That is our story and we’re sticking with it. Our only questions are when and how quickly rate structures revert to their prior downtrend. On both the long and short end, we expect rates to decline further and much faster than current consensus.

King World News note: No matter what the Fed attempts to do going forward, the 40-Year bond bull market is over and a bear market is underway. This means that after the rate cut cycle is over we should expect rates to continue to even higher levels. This will be crippling to the US economy and finally force the government to make significant spending cutbacks. Regardless, this 1970s-style stagflation will be wildly bullish for gold, silver and the high-quality mining and exploration shares.

To listen to Alasdair Macleod discuss what may cause the silver market to explode higher as well as what’s in store for gold and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.