This breakdown is a very big deal as central banks try desperately not to spook the major markets.

This Breakdown Is A Very Big Deal

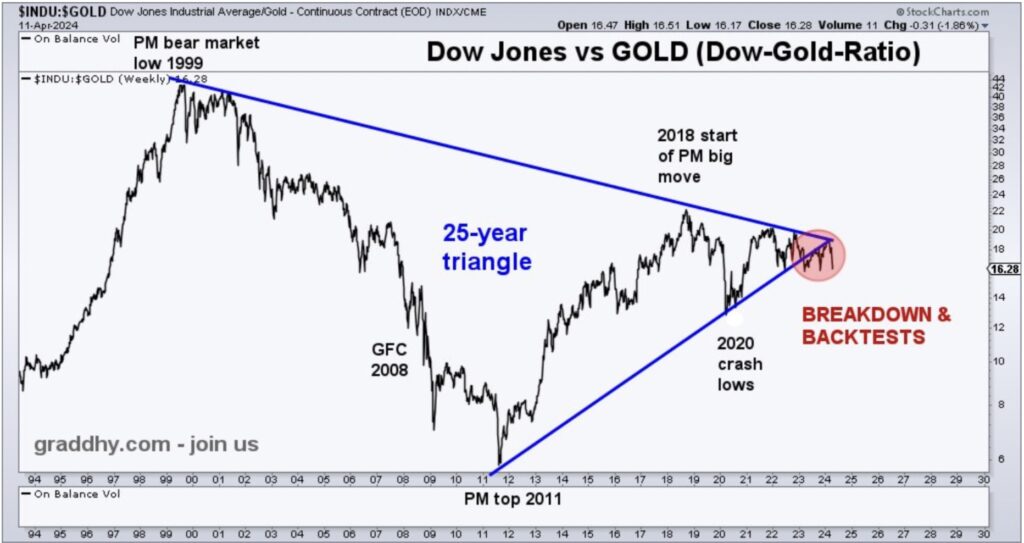

April 17 (King World News) – Graddhy out of Sweden: The Dow-to-Gold ratio has now backtested for the second time, after breaking down below its 25-year triangle. And the chart is now very close to making an expected lower low, which will confirm the historical trend change.

Dow/Gold Ratio Breaking Down:

Expect Significantly Higher Gold Prices And Lower Dow Jones

So gold is now set to outperform the general stock market. And, the stock market is now at the same time extremely stretched in its 4 year cycle, just like it was back in 2020 before the crash. Meaning it once again has very little time left in the 4 year cycle for its 4 year cycle decline to take place.

Very important chart for the next macro trend.

So it begins…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Big Breakout For Silver

Graddhy out of Sweden: The big breakout level for SILVER using the yearly time frame is $31-$32, and not $38/$50 like on lower time frames. The blue tightening arrow pattern means a breakout is coming, and it is.

Massive Breakout On Silver Is On The Way:

Expect Silver Breakout Above $31-$32

A 45 year very bullish pattern – let that sink in. Lifetime opportunity!

Trying Desperately Not To Spook Markets

Peter Boockvar: When a central banker speaks, they know to choose their words very carefully because how sensitive markets are to every single word. When a speech is prepared, those words can be especially crafted. With the topic yesterday being focused on Canada, Fed Chair Powell could have chosen to say nothing about US monetary policy. Instead he said this from written notes, “The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence…If higher inflation does persist, we can maintain the current level of restriction for as long as needed.”

We saw the 2 yr yield touch 5% in immediate response but did back off. Message though has been sent, by him and his colleagues that June is likely off the table. In the fed funds futures market, rate cut odds at that meeting are down to just 16%. As for July, they stand at 32%. A rate cut in fact is not fully priced in until November with September odds at 80%. Again though, this will all change with incoming data but it is how the market is priced today.

I agree he should not have greater confidence. When he celebrated New Year’s Eve, the 2 yr inflation breakeven was at 2%. He was looking good going into 2024. Today it stands at 2.93% with the CRB index up 12.5% year to date. Now, he doesn’t have to conduct policy just on commodity prices but it does complicate their decision making and influences their confidence on achieving 2% SUSTAINABLY.

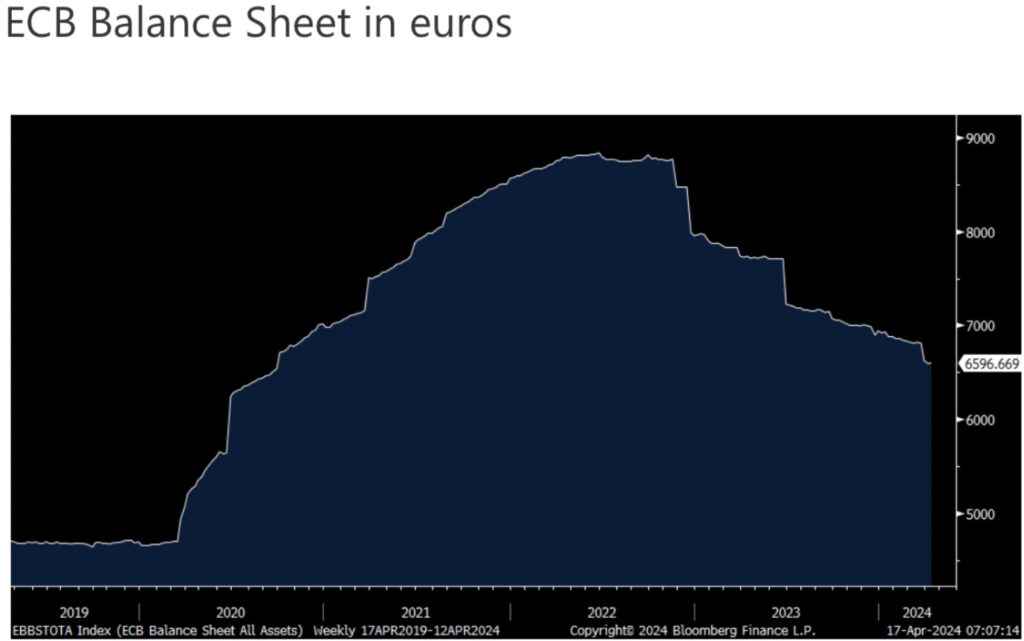

We also heard from ECB president Christine Lagarde yesterday in a long form interview on CNBC with Sara Eisen. Lagarde acknowledged the rise in energy and other commodity prices. She acknowledged the euro weakness, especially in light of the weak yen, and how that can influence inflation. Irrespective of these factors, she and her colleagues seem pretty set on cutting rates in June with the swaps market pricing in a total of 3 this year.

Interesting too is with the ECB balance sheet. In February 2020 it stood at 4.67 Trillion euros and almost doubled in size by June 2022 at 8.84 Trillion euros. Part of this huge expansion was the ECB’s Targeted LTRO program where they lent banks money at cheap rates. As a lot of that has been paid back and why the ECB balance sheet is down to ‘just’ 6.60 Trillion euros, Lagarde said yesterday that they plan to keep on shrinking it even as they cut interest rates.

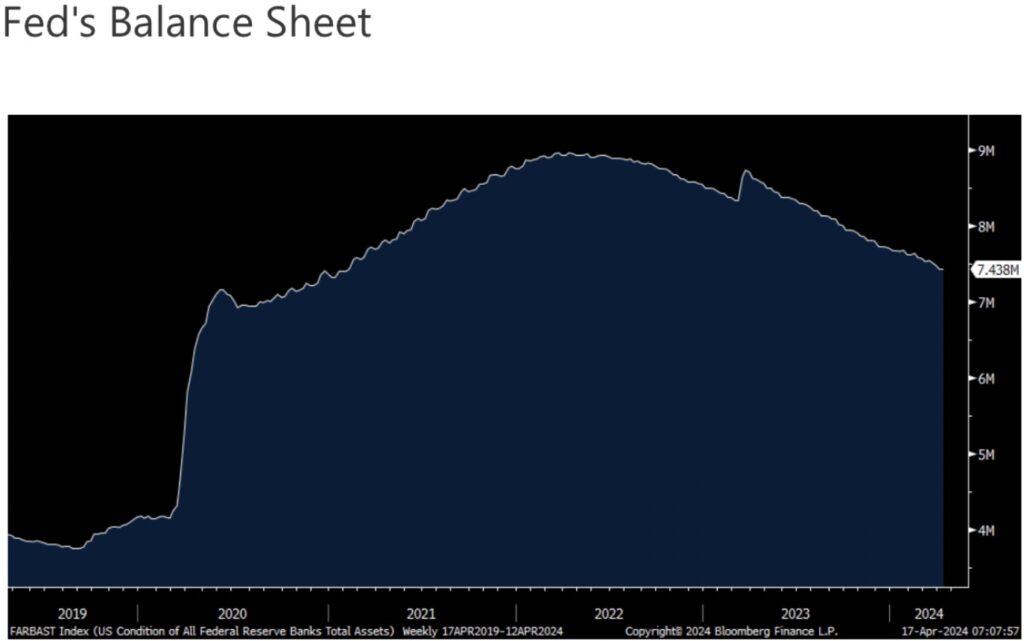

The Fed’s balance sheet, where likely in May they’ll announce the slowdown in monthly QT but possibly extent it out time wise, it still remains well above its February 2020 level of $4.15 Trillion with it currently at $7.44 Trillion, down about $1.5 Trillion from its peak.

From LVMH on the US consumer, “The American consumer is a bit negative, but not that negative…The aspirational customer has to adapt to the new normal…It’s just going to take time.” The ‘new normal’ the CFO was referring to was higher prices for its goods.

Billionaire Pierre Lassonde Predicts $19,000 Gold!

To listen to billionaire Pierre Lassonde discuss the wild trading in the gold market, what his predictions are for gold, the mining stocks, and much more CLICK HERE OR ON THE IMAGE BELOW.

Jim Sinclair’s Prediction Coming True

To listen to this timely audio interview with Alasdair Macleod discussing Jim Sinclair’s prediction coming true and the wild trading in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.