The next commodity boom cycle is underway.

Critical Materials Breakout Into A New Bullish Phase

August 25 (King World News) – Paul Wong, Market Strategist at Sprott: Critical Materials on the Move.

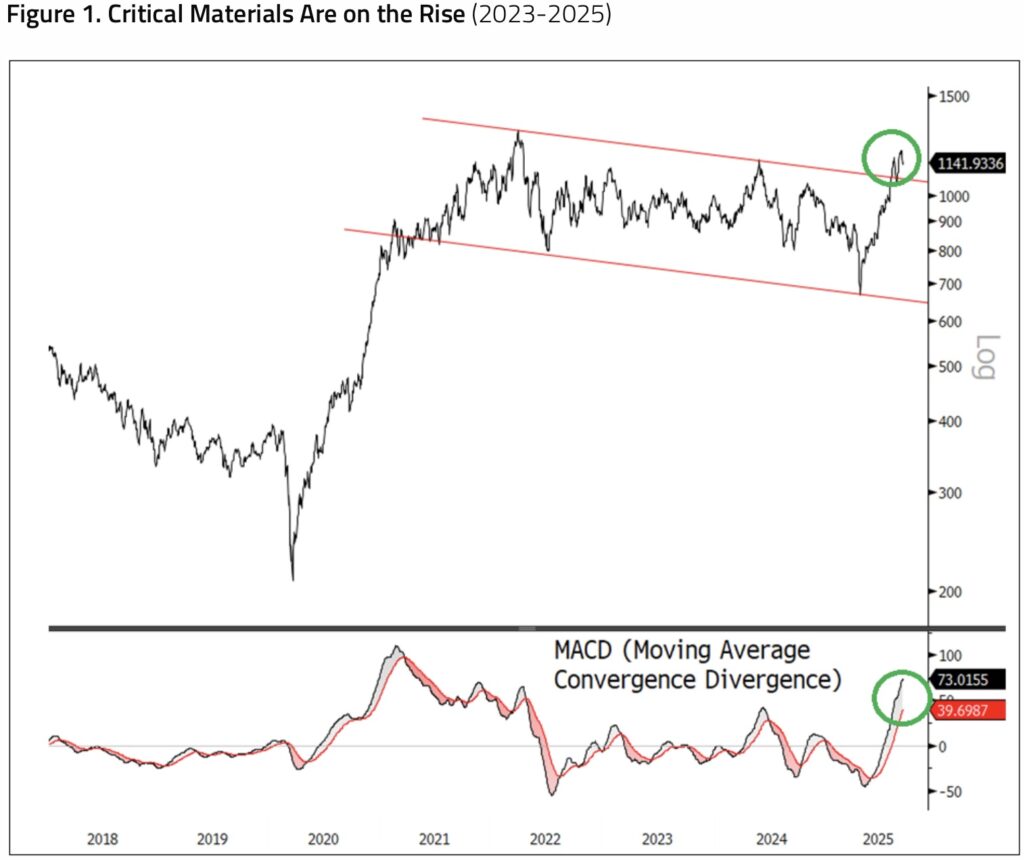

From the 2020 lows to the early 2022 peak, the Nasdaq Sprott Critical Materials IndexTM (NSETMTM) underwent a three-year-long consolidation trading range, until recently breaking out. Typically, breakouts from these very extended bullish consolidation flag-type patterns tend to spike higher.

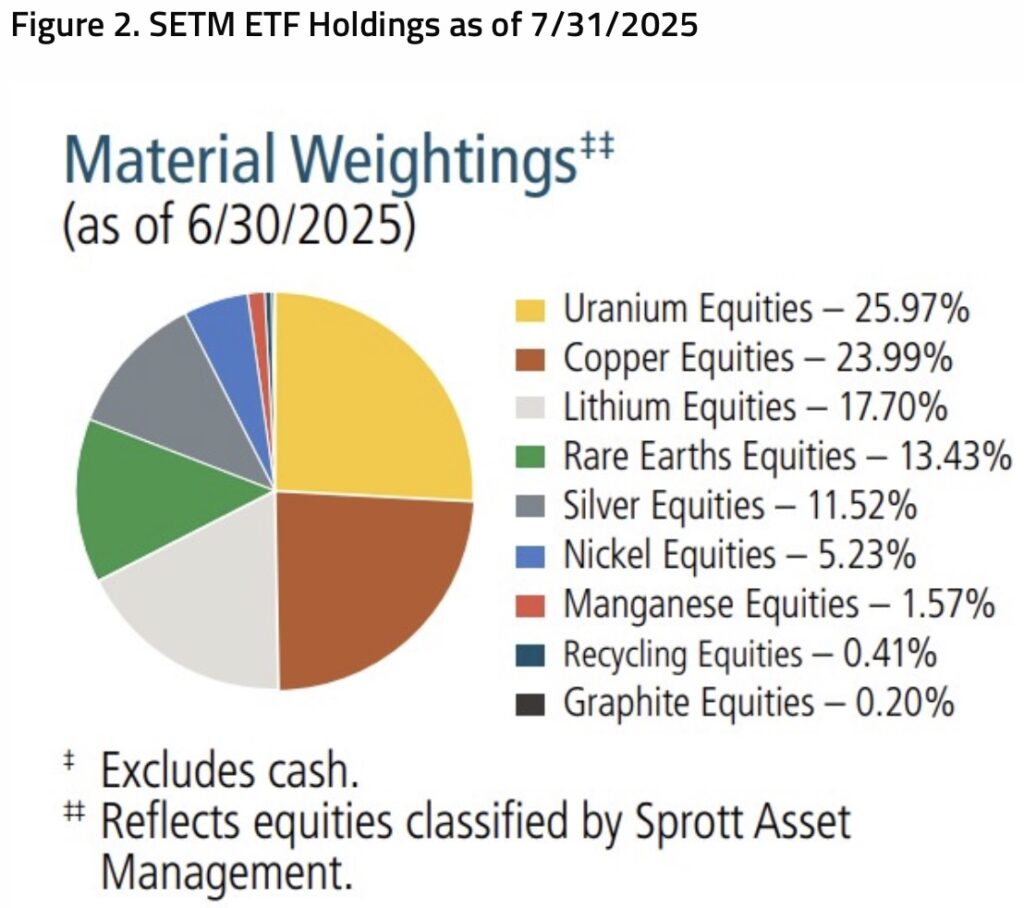

In the short term, markets are likely approaching the seasonal September weak period with elevated positioning and a steepening skew. There is a popular long/short momentum index, MSZZMOMO or “MOMO”, which may be a helpful gauge of extended or toppy price action, when markets may be overbought and potentially due for a pullback. Some SETM positions would likely be considered MOMO stocks, and they may be signaling short-term caution despite long-term bullish fundamentals.

The (Still) Developing Long-Term Macro View of Critical Minerals

During the extreme Liberation Day tariffs in April, when the U.S. slapped 145% tariffs on China, and then quickly introduced a 90-day pause (and now another 90-day pause), the significance of rare earth minerals rapidly came to the forefront. With China controlling up to ~90% of the supply of certain rare earth minerals and magnets, some U.S. industrial and defense manufacturing sectors were at risk of halted production because of strategic mineral shortages. The possible risk of key U.S. military defense components shutting down was (and still is) enough to alter the Trump Administration’s main efforts to reorder the global trading system.

Anecdotal news headlines reported that Ford would have stopped manufacturing its F-150 electric vehicle (EV) by September, and F-35 fighter jet production would have stalled by September. During the recent Israel-Iran war, the U.S. used up a quarter of its inventory of interceptor missiles in a single week. The message is clear: rare earth and critical minerals are no longer niche metals. In our view, they have the potential to become the epicenter of the next commodity supercycle.

In the early 2000s, iron ore, metallurgical coal and crude oil were the physical commodity foundations of China’s economic rise. Though we may still be in the nascent days of an emergent mid-2020s commodity cycle, critical minerals and rare earths, driven by national security concerns, have taken the lead thus far. The tariff wars have likely just started. Expect more chaos and evolution.

Definition of Critical Minerals

While there is no clear accepted definition, a mineral may be considered “critical” if it is both essential to a country’s strategic interests and vulnerable to supply disruptions. Strategic importance can span defense (rare earths), infrastructure (copper and minerals for steel alloys), and high-growth sectors like semiconductors. Supply risks arise from geopolitical tensions, resource nationalism, market manipulation, or the mineral’s nature (e.g., small market size or by-product extraction).

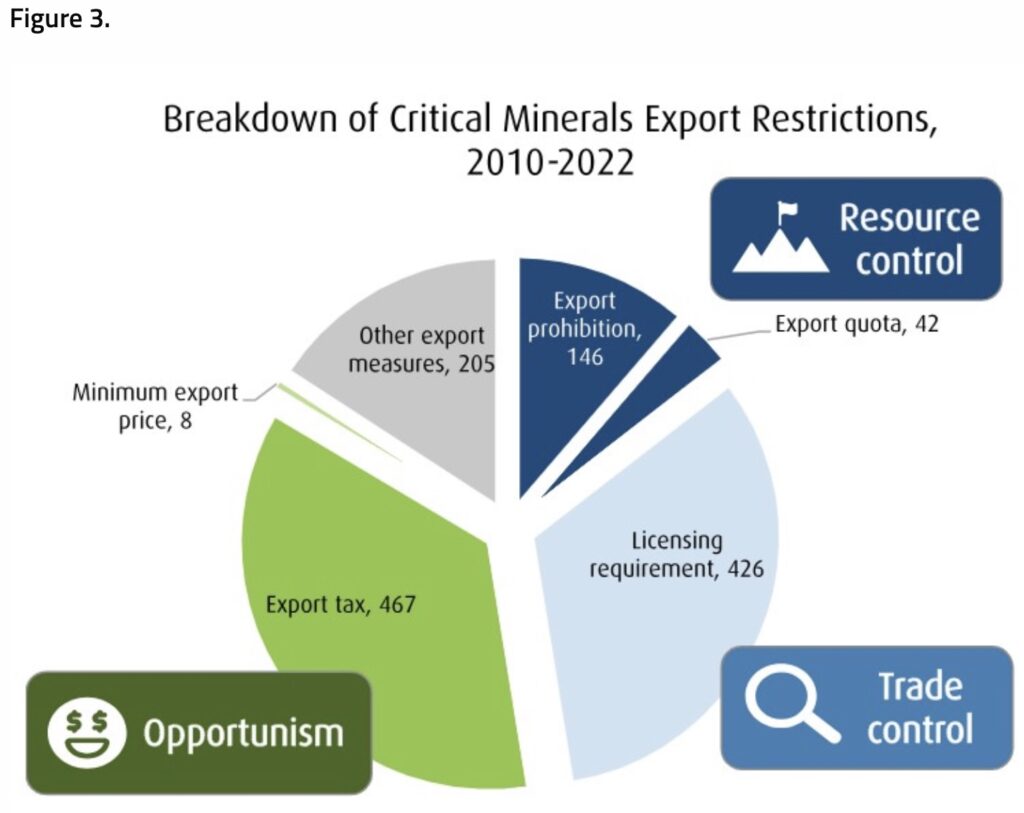

Strategic Commodities Are Being Redefined

China’s effective use of rare earths as strategic leverage indicates critical minerals are no longer niche. Once considered basic or specialty materials, many of these minerals (e.g., copper and rare earths) are now central to national security, energy policy, and industrial strategy. According to the Organization for Economic Co-operation and Development (OECD), despite making up ~3% of global trade, critical minerals represent ~30% of all export restrictions introduced worldwide since 2010. This high and growing level of restriction is indicative of critical minerals’ growing strategic value and is set to increase.

Implication: Expect increased government intervention, including subsidies, stockpiling and strategic partnerships, which can distort traditional supply-demand dynamics and alter global supply chain inventory systems.

Supply Chains Are Under Pressure

High concentration of supply in geopolitically sensitive regions (e.g., China, Democratic Republic of the Congo and Indonesia) makes many critical minerals vulnerable to disruption.

Implication: Companies and countries will prioritize supply chain diversification, leading to:

- Higher capital expenditures in politically stable jurisdictions or full domestic reshoring.

- Growth in domestic mining, refining and recycling industries.

- Increased strategic stockpiling and long-term offtake agreements.

- Minerals like cobalt, molybdenum, and rhenium are particularly vulnerable due to their limited primary production and concentrated geographic sources.

Trade Restrictions Are Reshaping Global Flows

Export controls on critical minerals have surged since 2009, with ~5,500 new restrictions introduced globally between 2010 and 2022. Controls include outright bans (mostly on waste/scrap), licensing requirements, and export taxes. Refined mineral bans are rare, but ore and concentrate bans (e.g., Indonesia) are common to encourage domestic processing.

Implication: The global market is becoming more deglobalized, fragmented and regionalized, which could:

- Create price bifurcations between regions.

- Increase regulatory risk premiums for producers and traders.

National Security, Defense and the Energy Transition Are Driving Demand

With deglobalization weakening economic ties and the U.S. retreating from past military commitments, global defense spending has been rising sharply as geopolitical tensions intensify and strategic alliances recalibrate across regions. While global military spending estimates vary, 2024 saw global spending around $2.7 trillion, with forecasts of $6.38 trillion by 2035 (an 8% CAGR).

Advanced military hardware (e.g., fighter jets, stealth systems) and clean energy infrastructure (e.g., wind turbines, EVs) require a wide array of specialty metals. According to the IEA, renewables have a significantly higher mineral intensity than traditional energy sources.9 At the same time, export bans on waste and scrap are encouraging domestic recycling industries.

Implication: The secondary supply market will become scarcer, increasing input costs and these sectors could be long-term structural demand drivers, potentially supporting:

- Sustained price strength for key inputs like lithium, copper, rare earths and other critical minerals.

- Innovation in materials science to reduce dependency or improve efficiency.

The military application chart does not include drones, which are quickly emerging as the new frontier of warfare. Drones require rare earths for motors, communications, optics, navigation and targeting systems. Battery materials like lithium, cobalt, nickel and graphite are required to run drone power systems. Future drone development points toward AI-driven autonomous drones, which will require a further increase in advanced semiconductor use and all accompanying systems.

China’s Dominance Is a Strategic Vulnerability

China controls a significant share of global production and processing capacity for many critical minerals, including materials like gold and potash, reflecting China’s broader economic and geopolitical strategy of de-dollarization. The U.S., EU, and China may all have different and evolving goals, but each country’s priorities emphasize securing critical minerals in ever greater amounts and urgency.

Implication: Western economies will accelerate onshoring, friendshoring and resource diplomacy and invest in alternative supply chains and domestic capabilities. While Western economies may face higher costs in the short term as they transition away from Chinese dependence, over 20 countries have formalized their lists of critical minerals, with significant overlap in defense-related and energy transition materials.

The Next Commodity Cycle

The convergence of national security imperatives, energy transition policies and evolving trade dynamics is fundamentally redefining the role of critical minerals. The breakout in the Nasdaq Sprott Critical Materials Index™ is an early signal of this shift, reflecting technical strength and deep structural drivers. While near-term caution is warranted amid momentum-driven froth and seasonal weakness, the long-term trajectory remains clear: rare earths, battery metals and strategic minerals are likely set to define the next commodity cycle. As shown in Figure 5, we expect a significant increase in the demand for critical materials over the coming decades as global energy needs accelerate. This evolving landscape presents risks and potential opportunities for investors as critical materials transition from niche to indispensable.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.