On the heels of last week’s chaotic trading in markets, the biggest bubble is about to pop and it will be devastating to the economy. It would also explain a lot of the layoffs we have already seen.

May 8 (King World News) – Otavio Costa: This analysis should be in everyone’s mind.

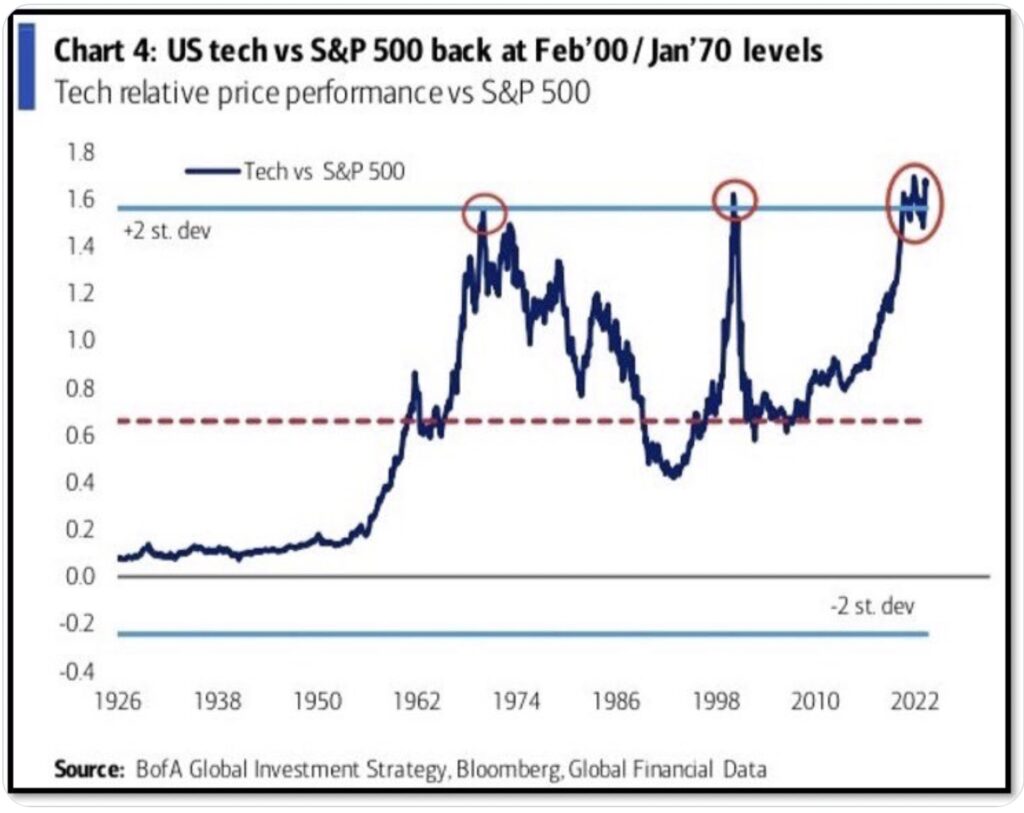

The tech sector’s outperformance compared to the broader market has never been more extreme.

As shown in the chart below, the ratio between tech stocks and the S&P 500 is now over 2 standard deviations above the historical mean.

Tech Stocks vs S&P Back To Highest Levels In History!

Only Comparable To 1970 & 2000 Stock Market Bubbles!

During other times when this indicator also reached such high levels, the tech sector significantly underperformed in the following decade.

It’s unlikely that this time will be any different.

When discount rates experience a structural increase, valuations become more important, particularly when fundamental growth becomes stagnant.

The Bulls Are Faltering

Art Cashin, Head of Floor Operations at UBS: So far, the bulls have been unable to expand their gains from Friday’s roaring rally. It has not turned into a full reversal as of yet, but, I think, that is primarily because of the regional banks and the fact that they are not subject to another round of selling.

The technicals hint that if we push down through 4120 the next target will be the round number 4100 and, of course, if they do remount a rally, resistance up at 4155 to 4165.

We are seeing the VIX begin to dip down a bit and yields are ticking up slightly.

So, nothing has moved enough to be any kind of tripwire, but we have a whole day ahead of us.

Watch that 4120 level and see if that leads to any add on selling should it break.

The ancillary markets are interesting. Bitcoin pulling back somewhat here. We have not had much of a renewed flight to safe havens.

We will see if they increase the volume and if they increase volatility.

Let’s see if the Senior Loan Officers Survey this afternoon becomes a market mover.

For now, it is watchful waiting.

Stay safe.

Arthur

Buffett & Munger

Peter Boockvar: It was another master class watching hours of Buffett and Munger and a priceless education as always. The notable macro extrapolation was Buffett saying “The majority of our businesses will report lower earnings this year than last year.” We are in an earnings recession.

We know insurance is a business mainstay for Berkshire, particularly with Geico and its auto presence along with other divisions and their P&C focus. Progressive last week, and this has more to do with inflation, said in their earnings call that “We plan to take aggressive rate increases where needed to across all lines through the balance of 2023 to ensure we’re pricing to deliver our target profit margins.”…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

Sponsored

Sponsored

As the cost of everything they insure has gone up dramatically over the last few years, we should not be surprised. The CEO said the question they’ve been asked and then answered it, “you said that you are confident that the biggest rate increases were behind you, what changed? The answer is fairly basic, we started seeing data come in over the last few months that was not in line with what we were anticipating, which caused us to increase reserves and react with rate increases.”

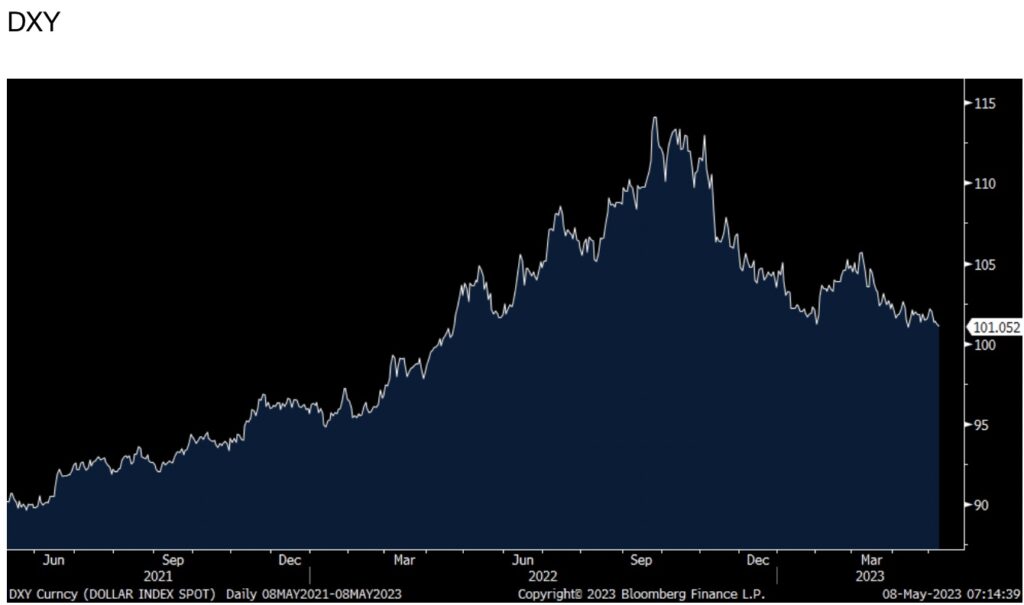

The euro/yen heavy US dollar index is within pennies of breaking to a one year low. I’ll argue again that the US dollar rally was solely about the Fed and their tightening aggressiveness, nothing more. It began in June 2021 when Powell at his presser said they were finally thinking about tapering QE and ended in October 2022 just as they were ending their 75 bps rate hike pace. Now that they are about done raising rates, though still conducting QT, the other flaws of the US dollar could be revealed like our enlarged twin deficits and debt ceiling nonsense. Got gold?

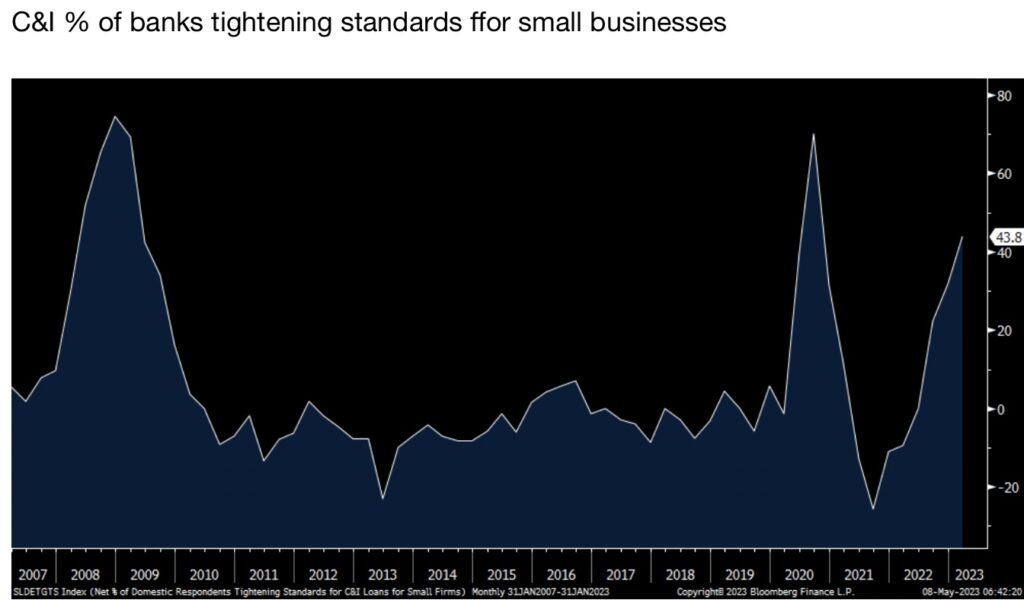

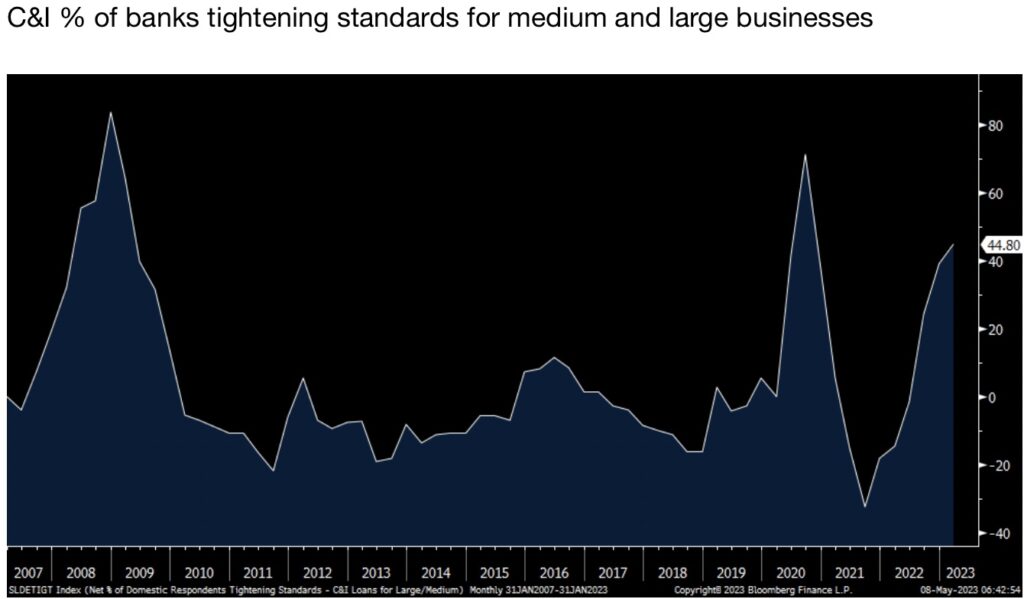

At 2pm we’ll see the new Senior Loan Officer Survey and we just have to assume it will reflect even tighter conditions on the lending side and likely a greater reduction in the demand for credit as well. With respect to C&I loans, the January survey already reflected the tightest standards since 2009 not including Covid.

For the week ended April 26th, there is no change in the amount of C&I loans outstanding and remains down about $60b since the 2nd half of March. There was a lift in real estate construction and land development loans outstanding by $2.9b and a large $14b rise in loans outstanding for real estate loans (I wish we could get more granular data on that). There was also a jump of $6b for a 2nd month in the amount of credit card debt outstanding and we wonder if that is because consumers are stretching to make do.

PacWest did the right thing in cutting its dividend in order to retain more cash, firm up its balance sheet and try to calm things down now that we have an implicit deposit guarantee, I think.

Manheim on Friday said its wholesale used vehicle car index for April fell 3% m/o/m and is down 4.4% y/o/y. The April drop comes after an 8.6% gain in Q1. They said “April’s decrease was impacted by the seasonal adjustment. The non-adjusted price change in April increased by .1% compared to March, moving the unadjusted average price down 5.6% y/o/y. While there was no chance that used car prices were able to sustain its shocking rise over the past few years and was inevitably going to reverse, they are still up 48% from its February 2020 level as 3 yrs of the stunted sale of new cars has us now with less used cars coming to market…

ALERT:

Powerhouse merger caught Rio Tinto’s attention and created a huge opportunity in the junior gold & silver space CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Looking overseas, Taiwan said its April exports fell 13.3% y/o/y, better than the expected drop of 19.4%. It is though the 8th straight month of y/o/y declines. Shipments to China and Hong Kong were down by 22% but that wasn’t as bad as the nearly 29% fall in March. Exports to the US fell 10.3% y/o/y. Product wise, the exports of electronic products were down by 8.6% y/o/y vs a drop of 14.6% in March. Imports were lower by 20.2%, a bit better than forecasted. The TAIEX was higher by .5% Chinese stocks rallied too with the H share index up by 1.5% and the Shanghai comp up by 1.8%.

Investor confidence in the Eurozone weakened in May as measured by the Sentix index. The index fell to -13.1 from -8.7 and that is the lowest since January. The May survey results were titled “Significant spring tiredness” and in it was said “There is not much left of the laborious economic recovery of 2023.” The index stood at +7.6 in January 2020.

***To listen to James Turk discuss why the bank crisis is set to accelerate and how it will impact major markets including gold and silver CLICK HERE OR ON THE IMAGE BELOW.

***To listen to Alasdair Macleod discuss the accelerating bank crisis and how this will impact the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.