As gold futures approach $3,200, look at who just turned bullish and what it may mean for the gold market.

April 10 (King World News) – This is a headline from CNBC today.

What is fascinating about the major banks recommending gold is that it could be a bad omen. Meaning, the criminal syndicate of banks that are agents for the West’s desperate price suppression scheme turn bullish on gold right at a top. Yes, that is one possibility. But another possibility is that the public eventually needs to enter the gold sector for a true bull market to be expressed. The only way that will happen is when the banks begin leading their clients into the gold space.

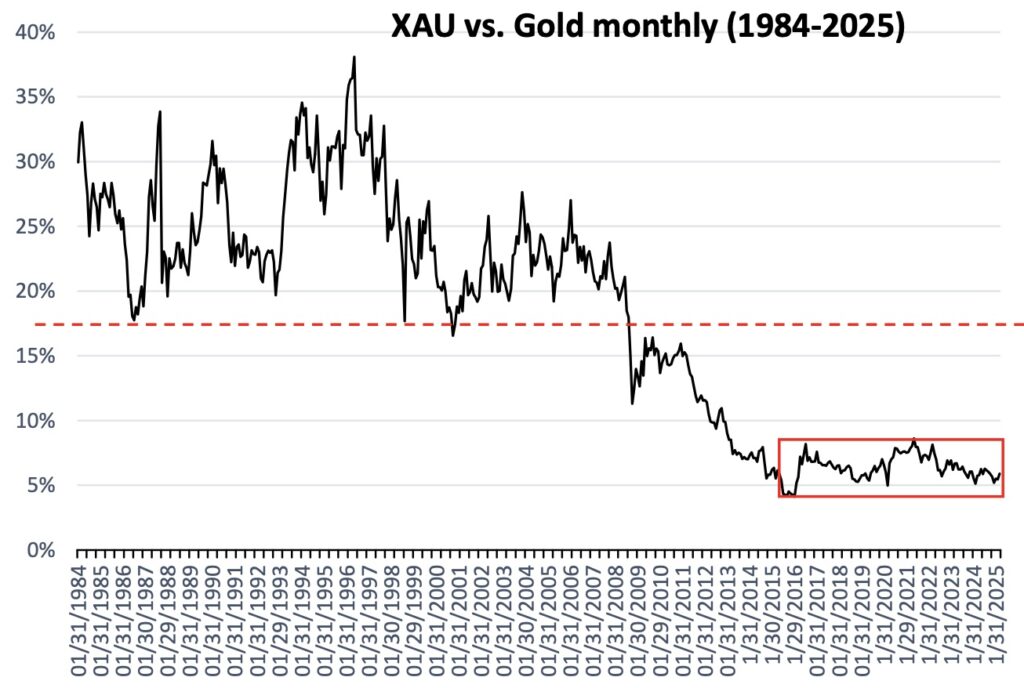

The truth is the mining stocks (HUI Gold Mining Index) is trading at 368, which is a jaw-dropping 262 points below the peak set in 2011 when the price of gold was trading at $1,920. And the price of gold is $1,270 higher today at $3,189 (gold futures). So the mining stocks as a whole remain radically undervalued.

And then there’s this…

KING WORLD NEWS NOTE: Just a reminder of how radically undervalued Mining Stocks vs Gold

The mining stocks would need to roughly quadruple in price just to get back to the mid-point of the historical ratio from 1980-2008. As you can see from the red highlighted box in the chart above that there is an opportunity for smart investors to buy the mining stocks while they represent great value.

To quote Spock from Star Trek:

And remember that fortunes will be made when we eventually enter the phase III upside mania of the gold bull market which is still in front of us. And don’t forget about silver since the Gold/Silver ratio is near an all-time high of 100/1. Meaning, silver is grotesquely undervalued and you should continue to accumulate it because silver is the cheapest hard asset on the planet.

Email From KWN Reader

Here is an email from one of the KWN global readers Charles P: I hope I’m not too late with this request, but it’s still early Thursday morning.

Please ask Eric to have Alasdair focus on the silver situation. Ok, you and I and Eric and Michael and Graddhy and James all know how the silver game is still being rigged by The Perps. But to the casual observer it looks like silver can’t get out of its own way, while gold is halfway to the moon. For those casual observers who are vaguely aware of the “silver outperforms” theme, they have to be wondering “What’s wrong with this picture?”. Frankly, after a wee bit too much Laphroaig, I ask myself the same question.

Ok, if anybody knows where “all the bodies are buried” there in London and The City, it’s Alasdair. Have Eric ask Alasdair roughly this question: “What clue can we look for that will tell us – unequivocally – that the silver logjam is about to break up, and break up for good?”

I, for one, won’t mind if Alasdair spends the whole 10 minutes or so talking about the silver situation.

Thanks, Bryan.

Keep up the good work!

RELEASED: Man Who Predicted Stock Market Crash

To listen to the man who predicted the stock market crash discuss what to expect next CLICK HERE OR ON THE IMAGE BELOW.

RELEASED!

To listen to Alasdair Macleod discuss the terrifying second stage of this crash CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.