We are seeing serious inflation in just the past 50 days, take a look…

Serious Inflation In The Past 50 Days

March 20 (King World News) – Peter Boockvar: So the previous FOMC meeting was on January 31st and the collection of both economic and market data since does not make Powell’s job any easier for him. The unemployment rate has gone from 3.7% to 3.9%, the highest in two years. Initial claims remain low though continuing claims remain elevated. Retail sales have flat lined since November. Maybe manufacturing is showing signs of bottoming out due to the need for some inventory restock. Small business confidence remains depressed. Existing home sales remain punk but the new build of single family homes is still pretty good.

The CRB index has risen by 5.5% with crude oil up 9% and the average gallon of gasoline according to AAA higher by 11.5% at the highest since late October. The CRB food index is up by 5.2% since late January. Two yr inflation expectations in the TIPS market have risen by almost 50 bps and by 17 bps for the 5 yr. Super core CPI, after rising by .3% in December, a stat they saw at the last meeting, was up by .9% in January and .5% in February m/o/m and higher by 4.3% y/o/y vs 3.9% in December. I could go on but clearly no easy job here for the Fed and if anything on the inflation side, Powell should be less confident with the direction of inflation since that meeting, not more so.

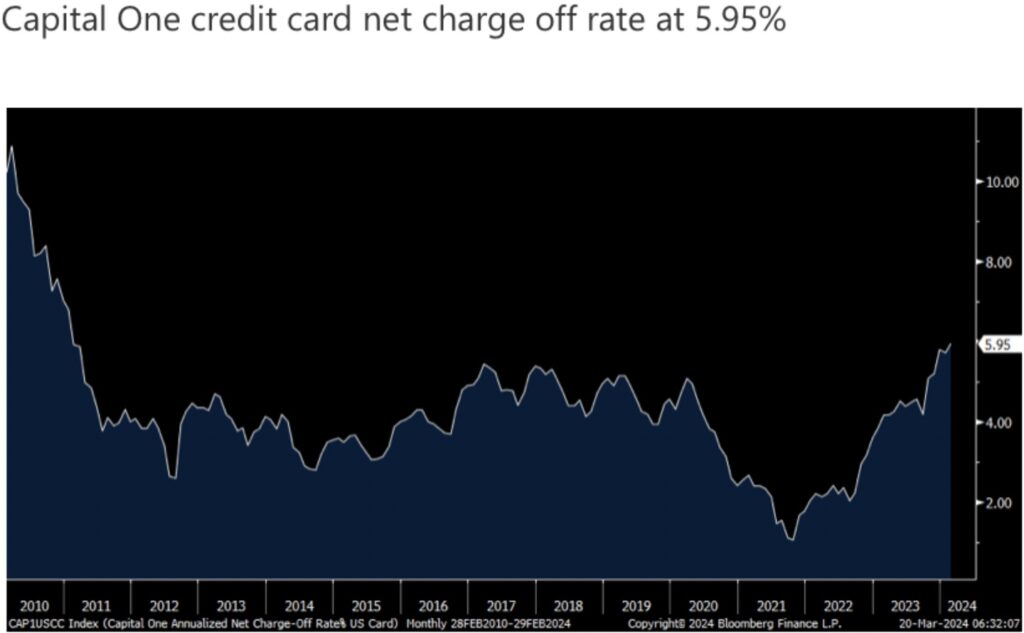

Many People Not Paying Credit Card Bills

I mentioned on Monday the net charge off and delinquency monthly numbers we saw on Friday from Capital One and Synchrony, among others but didn’t include a chart for a visual. Here is one capturing Capital One’s credit card net charge off rate thru February, the highest in 13 years:

1990s Stock Market Bubble In Full Swing

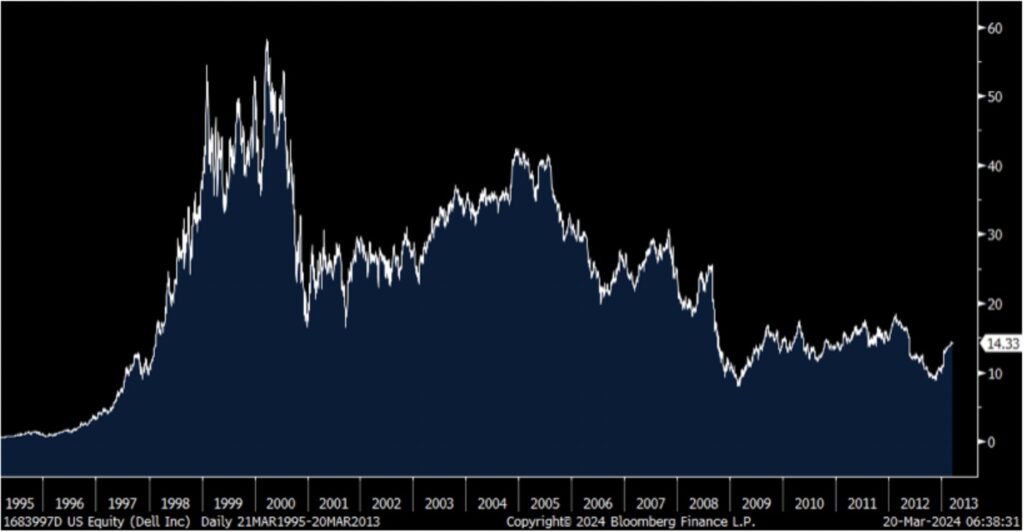

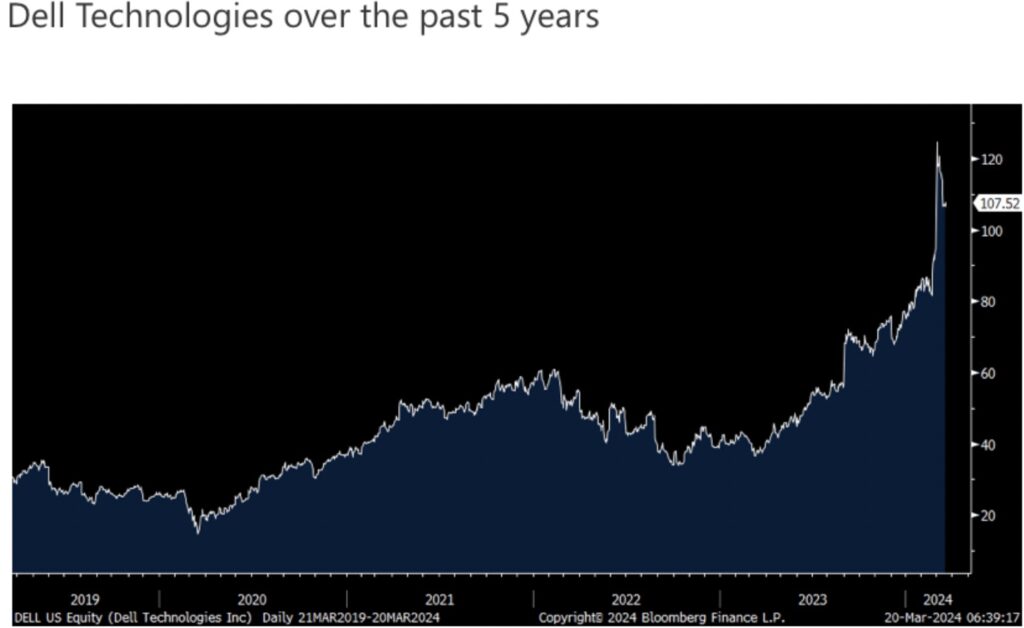

As we debate the comparisons between the stock market behavior in tech stocks in the late 1990’s vs what we’re seeing now, if there is someone who remembers the stock market action back then it was Michael Dell as his stock skyrocketed with many others only to come crashing down and remaining in the desert for a decade plus as it pulled forward so much earnings optimism. So what did Michael Dell do over the past few weeks as his stock went parabolic again because they talked about its growing AI server business? He sold almost $500mm worth of stock, totaling about 4mm shares over multiple days. He didn’t forget.

Here is a chart of Dell Computer (what it was called then) from 1995 to when it was taken private in 2013:

Dell Computer Taken Private At $14.33 In 2013

Dell Taken Later Public Now Trading $107.52

Meanwhile Inflation In The UK

The UK said its February CPI was higher by 3.4% headline and by 4.5% core, both down from January and one tenth less than expected. Services CPI though remained high as it rose 6.1% y/o/y, one tenth above expectations, though down from 6.5% in the month before. Wholesale input prices fell but as expected when including revisions while output prices were up more than forecasted. The market response to the data was mixed as the 10 yr inflation breakeven is unchanged at 3.63%, hovering around the highest since late November but the 10 yr gilt yield is down by 5 bps. Andrew Bailey’s job at the BoE is no easier either.

Christine Lagarde spoke today and while she still seems to want to cut rates in June, “even after the first rate cut, we cannot pre-commit to a particular rate path.”

When hearing Powell in front of Congress, then from Bailey and Lagarde, they are itching to cut rates but the reality of still high inflation relative to target and fears that the moderation in the pace of inflation won’t stick has them still nervous to move it seems, especially in any aggressive way.

China Still Dumping US Treasuries

Finally, China resumed its selling of US Treasuries in January, down by $18.6b while Japan increased their holdings by $14.9b. Total foreign holdings of US Treasuries, including bills, fell by $32.4b to $8.024 Trillion after large increases in November and December. While this is at a new high, the percentage of total marketable debt continues to shrink. Ten years ago, foreign holdings of US marketable debt stood at 48%. As of January this year it has shrunk to 30%.

Alasdair Macleod’s latest audio interview discussing the short squeeze in the silver market has just been released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.