With the price of gold below the key $1,300 level, Jeffrey Saut’s partner at Raymond James is still cautiously bullish on gold.

Dow Jones Industrial Average Went Parabolic

November 3 (King World News) – Here is a portion of what Jeff Saut’s partner Andrew Adams wrote: We place less emphasis on the Dow Jones Industrial Average than the S&P 500 for many reasons, but the recent parabolic action is worth noting. This type of almost straight up move is rare in a major index and often signals a blow off top over the short term. So far, though, the Dow has only paused instead of retreating and has now gained around 31% over the last year (see chart below).

U.S. Dollar Index Inverted Head-and-Shoulders

A few weeks ago, we called attention to a possible inverted head-and-shoulders pattern forming in the U.S. Dollar Index but warned the pattern would have to fully form before we got too optimistic on the dollar…

IMPORTANT:

To find out which company is the #1 junior mining takeover target in the world that the

biggest money on the planet is lining up to buy – CLICK HERE OR BELOW

Well, that inverted H&S did complete last week when it broke up above “neckline” resistance (green line), and now this level should help provide support. Overall, this may mean the September low represents at least a near-term bottom in the U.S Dollar Index (see chart below).

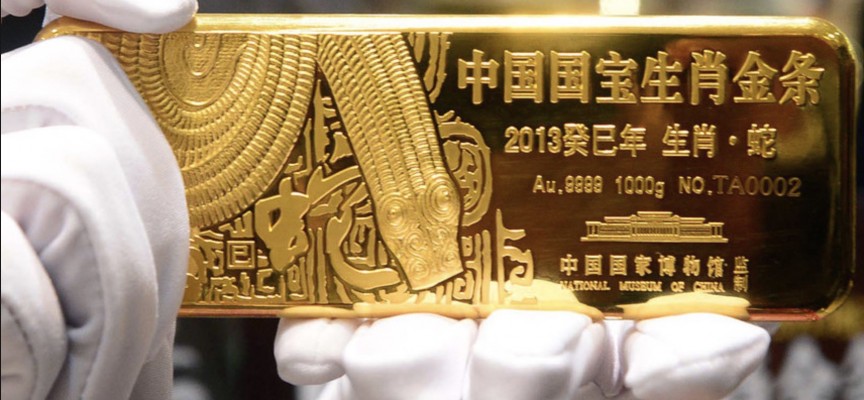

Gold Still Interesting But Hasn’t Popped

We have pointed out in the last few weeks that Gold is interesting at these levels after it broke above major resistance from a line connecting the highs of the last few years. The price pulled back to this line, which now acts as support, but it really hasn’t shot up like we were hoping. It is, therefore, still worth watching and possibly worth a trade, but be cautious if it drops back below that long green line (see chart below).

Gold Set For $200 Surge?

King World News note: KWN readers around the world need to remember that when Adams turned bullish on silver on December 14, 2016, the price of silver went on a tear, surging more than 15 percent in roughly 2 months. I wouldn’t be surprised to see Adams (although cautiously optimistic) be proven correct on his bullish call on gold in the coming months. For what it’s worth, a 15 percent surge in the price of gold would translate into a $200 advance for the “King of Metals.”

***ALSO JUST RELEASED: Multi-Billionaire Hugo Salinas Price – There Will Be Absolute, Total Breakdown In The World CLICK HERE.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.