Expect a rate cut today from the Federal Reserve, plus this just tumbled to the lowest reading since 2015!

Rate Cut And More

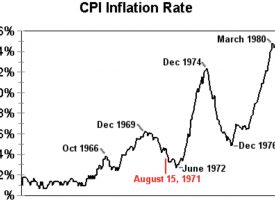

October 30 (King World News) – Peter Boockvar: So outside of getting a rate cut and a likely expressed pause from here, the other thing that needs to be addressed is what the Fed is doing to contain overnight lending rates and Powell will try to tell us why they are not now monetizing the US T-bill market. With regards to today’s cut and what comes next, we’ll be left with a fed funds rate of 1.5-1.75% and I’ll argue that once it starts to shift below this, the Fed is fighting a deeper slowdown and no longer is trying to preserve the expansion. Also keep in mind that the rate after 2pm will compare with a 2.4% core CPI rate and tomorrow’s core PCE deflator is expected to be up 1.7% y/o/y. Expect another dissent from Esther George and Eric Rosengren and likely more emphatically behind closed doors today…

BONUS INTERVIEW:

To listen to Doug Casey’s just-released KWN interview discussing his prediction of financial and economic chaos and a panic into gold CLICK HERE OR BELOW:

Positive market sentiment continued to build according to Investors Intelligence as mood follows price. Bulls rose to 54.2 from 52.8. In October it got as high as 55.3 in the beginning of the month and bottomed at 47.6 a week later. North of 55 starts to get into the extreme with above 60 being notable so we are just below. Bears were 17.8, little changed with 17.9 last week. Those expecting a Correction fell to just 28, down for the 8th week in the past 9 and II said “Correction readings below 30% are a concern, as they point to heavily invested stances by the editors.”

Fear & Greed Index

Also with respect to sentiment, the CNN Fear/Greed index clocked in above 70 yesterday at 71. That’s in the ‘Greed’ category and as seen is approaching the ‘Extreme Greed’ quartile, https://money.cnn.com/data/fear-and-greed/. It was 59 one week ago and 52 one month ago. When things started to hit the fan one year ago it was as low as 7. In terms of market timing, this mood meter is less effective in the short term relative to II, AAII and others.

Ahead of the value added tax increase on October 1st, Japanese consumers scrambled to get what they could in September without it. Retail sales rose 7.1% m/o/m, double the estimate of up 3.5%. Household appliances and cars led the way and expect a hangover in October but not as bad as the one after the last VAT hike a few years ago.

Coincident with the rise in US Treasury yields, the average 30 yr mortgage rate ticked up another 3 bps to 4.05%, the highest since late July but had no impact on mortgage apps on the week. Purchase apps rose 2.3% w/o/w after 3 weeks of declines. Versus last year they are up a still good 10%. Refi’s fell .5% after a 17% drop in the week prior but because rates are still down about 100 bps y/o/y, refi’s are up by 134% y/o/y.

EUROPE: Lowest Since 2015

Shifting to Europe, its economic confidence index in October shifted lower again to 100.8 from 101.7. The estimate was 101.1 and that’s the lowest since January 2015 (see below).

Lowest Economic Confidence Reading Since January 2015!

Manufacturing led the way but services softened further too as did consumer confidence and retail confidence. Construction was the only bright spot and helped by rock bottom rates. Bottom line, while we now have to wait for a Brexit vote in December, hopefully we are close to a Brexit resolution and that would help confidence for the region. We’ll soon see on the US/China thing. The euro is little changed but will likely be more influenced by what the Fed will do today. Sovereign bond yields are down a touch and equity bourses are mixed.

***KWN has now released Michael Oliver’s remarkable KWN audio interview and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2019 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged