Prepare for liftoff, plus a look at bulls vs bears and more inflation.

The Great Rotation

July 18 (King World News) – Graddhy out of Sweden: This very big picture ratio chart now shows silver breaking out plus backtesting vs SPX.

Silver Coiling To Blastoff vs S&P 500

A historical, global asset class rotation is in the making, away from overvalued paper assets towards undervalued hard assets. And, it is now about to accelerate.

Prepare For Liftoff

Graddhy out of Sweden: The move in precious metals miners have only just begun. The charts are now set up to climb the right side of huge rounded bottoms. Most will not get into a bull market mindset until too late though. Do not miss the move of a lifetime.

Gold Mining Stocks Set To Skyrocket

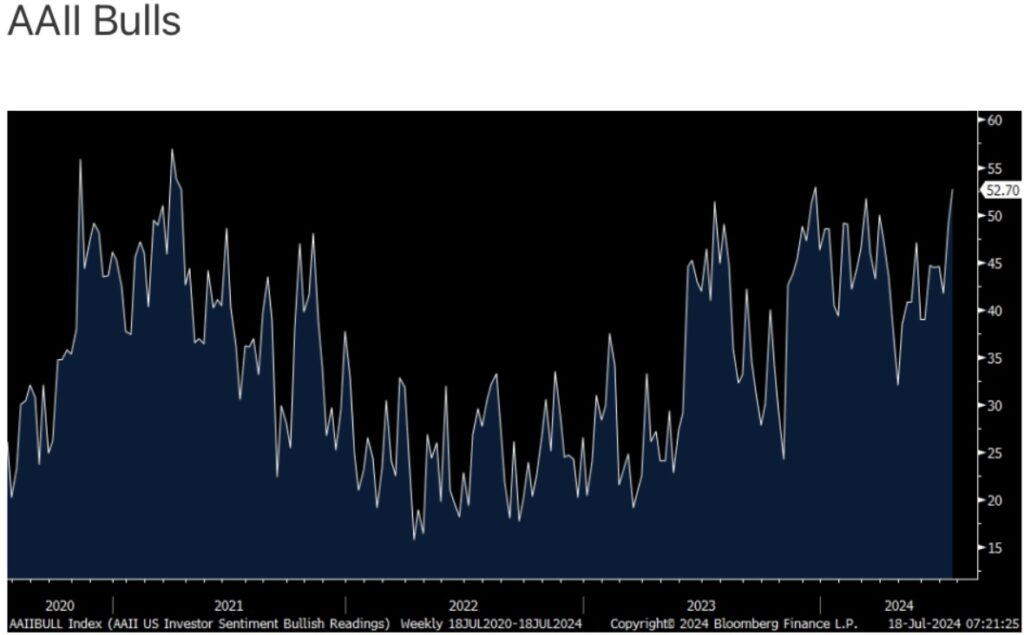

Bulls vs Bears

Peter Boockvar: Measured before yesterday’s selloff, the level of bullishness continues to get even more extreme. In the Investors Intelligence survey, the Bull/Bear spread rose to 46.9, the most since 2021 with Bulls up at 63.6 vs 62.7 last week.

Bears slipped to 16.7 from 17.9. In today’s AAII survey, Bulls rose another 3.5 pts to 52.7, the most since December and just .3 pts from a level last seen in April 2021. Bears did tick up too, with the balance going to the Neutral side, to 23.4 from 21.7 in the week prior.

Bottom line, combine the above with the continued rise in Euphoria as measured by the Citi index and we are ripe for more than just a one day correction in order to shake out this giddiness. It could be perfect timing too with big tech earnings over the next few weeks.

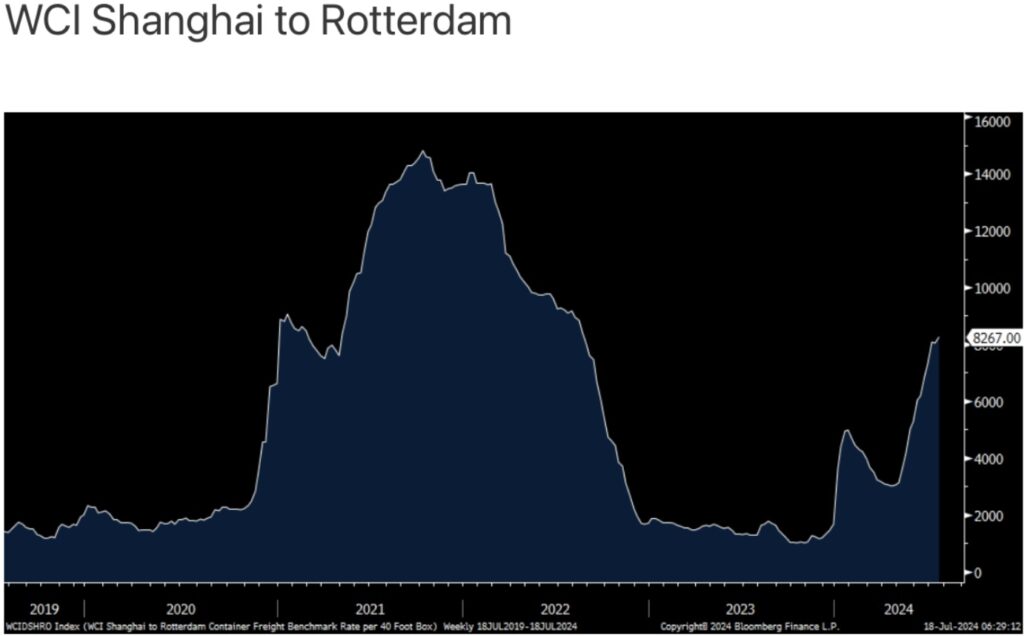

More “Transitory” Inflation

After taking a rest last week, shipping costs continue to rise as measured by the World Container Index on particular journeys. The Shanghai to Rotterdam trip now costs $8,267 for a 40 ft container vs $1,667 at the beginning of the year and vs around $2,000 in February 2020.

More “Transitory” Inflation On The Way:

Shanghai To Rotterdam Shipping Costs Have Skyrocketed

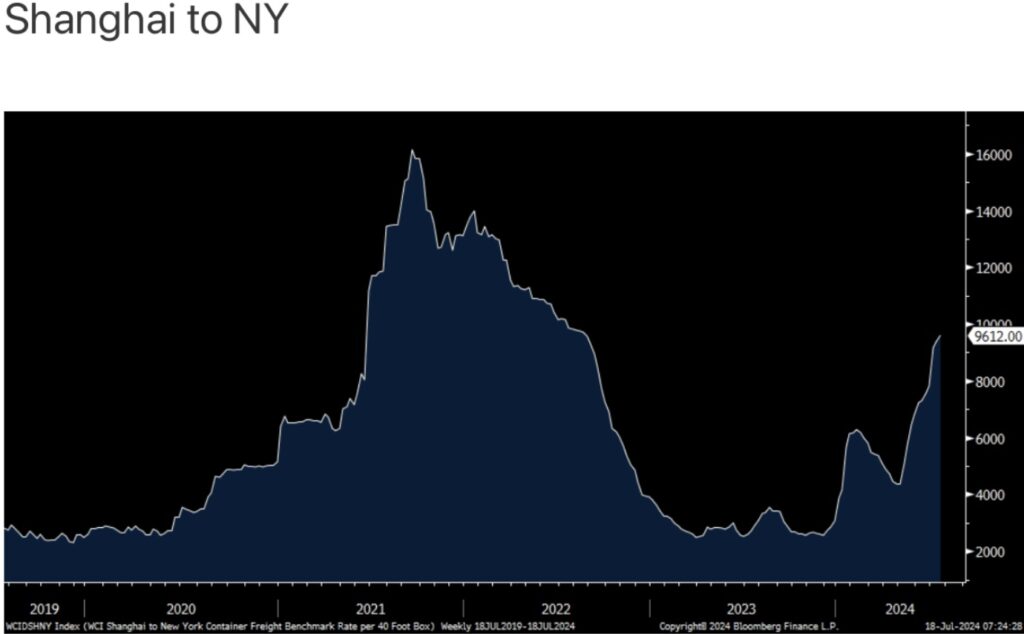

While still well below the nearly $15,000 seen in October 2021, it’s the most expensive in two years. I’ll stretch this view out and mention the Shanghai to NY trip as prices here rose $225 w/o/w to $9,612, tripling this year. It was about $2,800 in February 2020 and peaked at $16,138 in September 2021.

More “Transitory” Inflation On The Way:

Shanghai To New York Shipping Costs Have Skyrocketed

Somebody Is Going To Have To Pay

Bottom line, I’ll say again, someone is going to have to eat these sharp gains, especially ahead of the holiday shipping season. We are seeing evidence that companies are front loading their shipments so as not to get caught short ahead of the holidays which in turn could be helping to lift shipping prices overall.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.