It appears the paper gold markets are now heading for a liquidity crisis as the inventory of available physical gold continues to be vacuumed up by various central banks across the globe.

Record highs for gold, and silver soars

September 27 (King World News) – Alasdair Macleod: It has been an excellent week for gold and silver bulls. But is a correction now due, and if so, how deep and for how long? It looks like being severely limited.

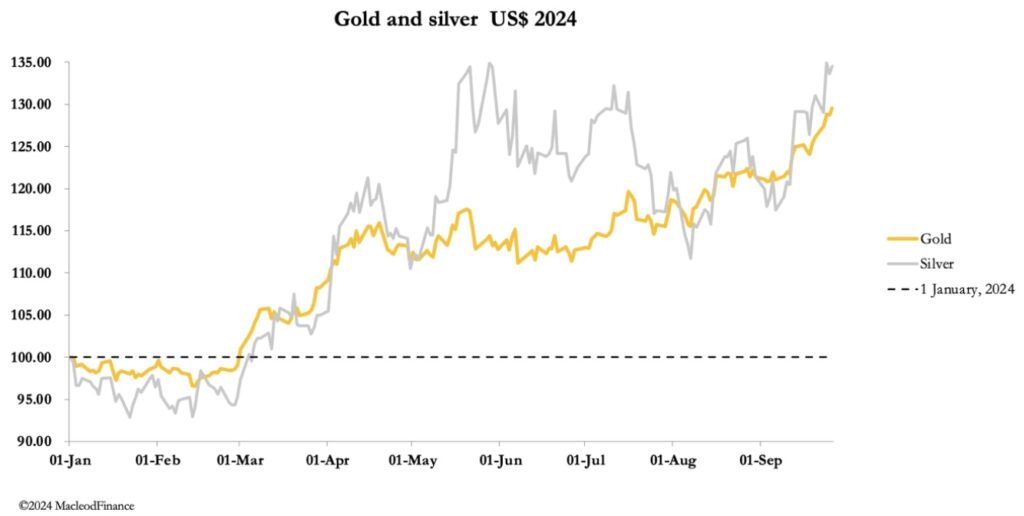

Gold continued to make new highs this week, today trading below yesterday’s best level of $2685 spot this morning in European trade at $2660, up $38 net from last Friday’s close. Silver had an excellent run from a low of $30.36 on Monday morning hitting a high of $32.70 yesterday (Thursday) before drifting back to $31.75 this morning. Since 1 January, that leaves gold up 29.5% and silver 34.6%. Comex volumes in both contracts were relatively high, consistent with bullish interest…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

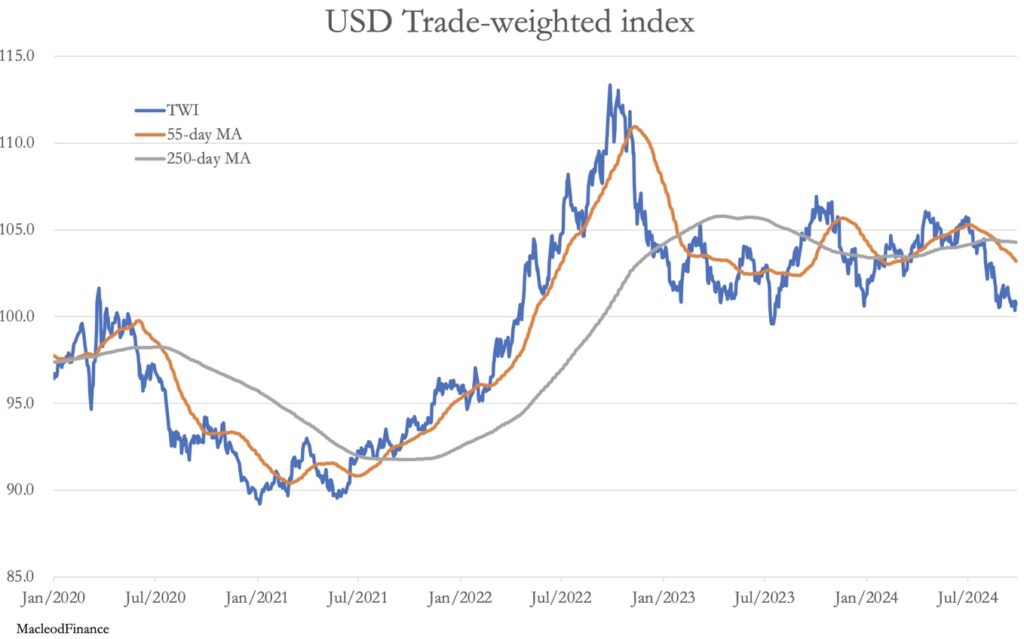

Gold is certainly overbought, judging by the net longs in the Managed Money category. With the increase in Open Interest since the last Commitment of Traders release (17 September) they are likely to be as high as 240,000 contracts, signalling caution on the bull tack is appropriate. But there is little doubt that the pair-trading hedge funds are turning bearish on the dollar with justification. The next chart of the trade-weighted index shows why:

Given the death cross on the moving averages, a clear break below 100 is in prospect with a rapid slide lower to follow. There is little doubt that this is the most important chart driving hedge fund sentiment. In these uncertain times, the dollar is less of a safe haven, gold more so. This suggests that any technical reaction in gold will be short-lived.

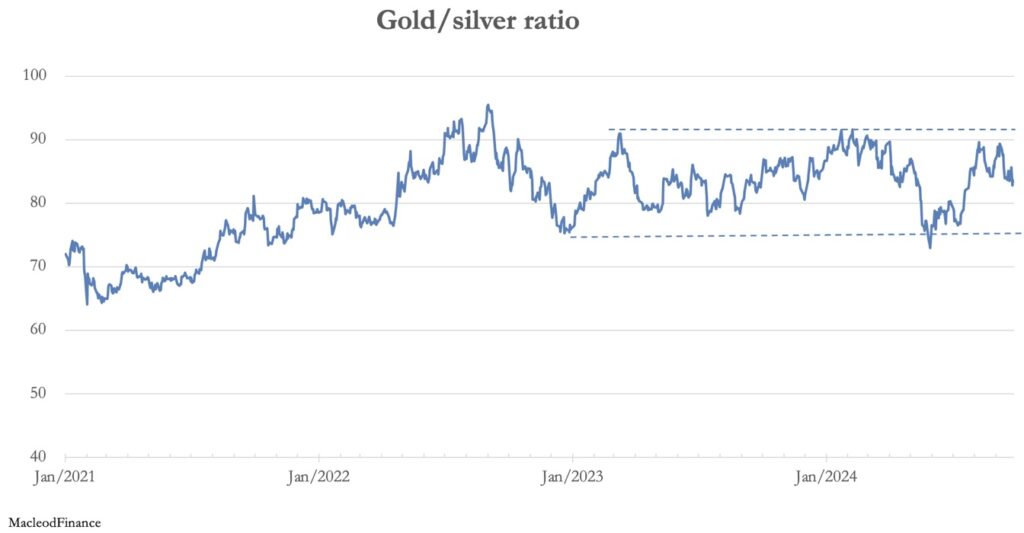

Gold is forging new highs, and the gold/silver ratio at 83 is far too high for an increasingly pro-gold sentiment. The next chart shows that it is still trapped in a band the lower parameter of which is about 75. Anti dollar sentiment propelling gold higher could easily drive the ratio through this lower level and beyond. What is the likelihood of this happening?

The technical chart for silver is extremely bullish and is next:

When silver tested $32.5+ yesterday, it was the highest since December 2012. It is far from being overbought and is being driven higher by poor liquidity. The 4-year consolidation supporting this rise could easily see it now running up towards all-time highs of $50.

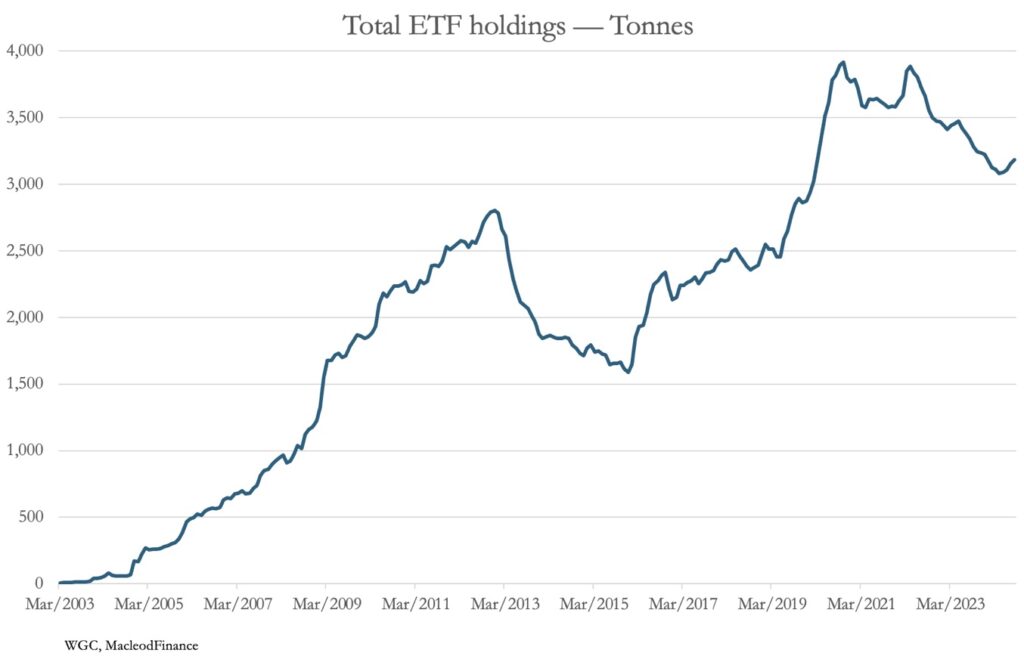

Continuing demand for gold should do the trick, and this is up next:

It looks runaway unstoppable, confirming that extremely powerful underlying forces are driving this gold/dollar relationship. Interestingly, this is confirmed by continuing withdrawals (stand for deliveries) on Comex almost every trading session totalling 11,407,700 ounces (354.8 tonnes) this year so far. And does not include an unknown quantity of exchange-for-physicals out of a total turnover of 811,414 contracts (representing a volume of 2,523.8 tonnes equivalent) which have ended up as deliveries out of London into central banks and Asian markets.

Paper Gold Markets Heading For A Liquidity Crisis

To me, unless something radical changes, these paper gold markets are heading for a liquidity crisis. And to top it all, there are emerging signs of a great public reawakening in physical ETFs, which after nearly four years of net selling are turning into net buyers:

There are other signs of awakening public interest in gold. My podcasts appear to be drawing larger audiences regularly as well. The atmosphere is just beginning to feel bullish. Given the lack of physical liquidity in London and New York, a revival of ETF interest can only be accommodated at far higher prices. And what that would do for silver can only be guessed, which according to the Silver Institute has been in supply deficit for the last four years.

In conclusion, while a short-term technical correction to remedy overbought conditions cannot be ruled out, its depth and durability looks like being severely limited.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.