Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, told King World News that parabolic gold and silver moves are about to shock people around the world.

Today James Turk told King World News that the massive silver short position may get squeezed on a spike in the price of silver.

Today gold futures surged above $2,400 as the price of silver advances toward $32.

What a remarkable read on the 4th of July!

Here is a look at an IMF warning, gold, silver and the global push toward…

Today James Turk shared a very unique look at the silver market.

Here is the setup ahead of the next Fed Meeting.

The US is facing a major problem, plus a look at gold.

Look at what is happening in the gold and silver markets.

Today one of the greats in the business warned the West is manipulating gold like crazy because they are desperate.

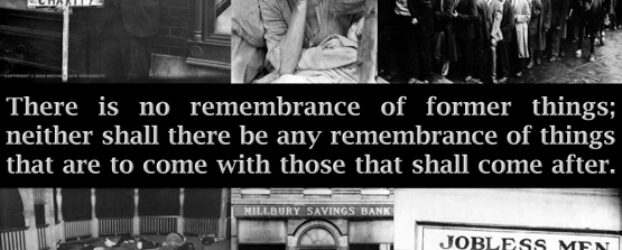

With people still riding the high of parabolic tech stocks, almost nobody realizes the coming collapse will be far worse than 2008.

Here is an update on the war in the gold and silver markets.

This just collapsed to the lowest level in history, plus look at what is skyrocketing!

Central banks expect to keep buying gold in large quantities.

Things are moving very quickly now as the world faces hyper-debt and another Great Depression.

Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, shared with King World News his thoughts on what is really happening with the gold market right now.

Below are three must see charts for gold, silver and commodities bull markets.

Look at what China is doing in the gold market.

Silver is preparing to blastoff, but here is the really big surprise.

The younger generations in Europe and the United States are giving up hope. Take a look…