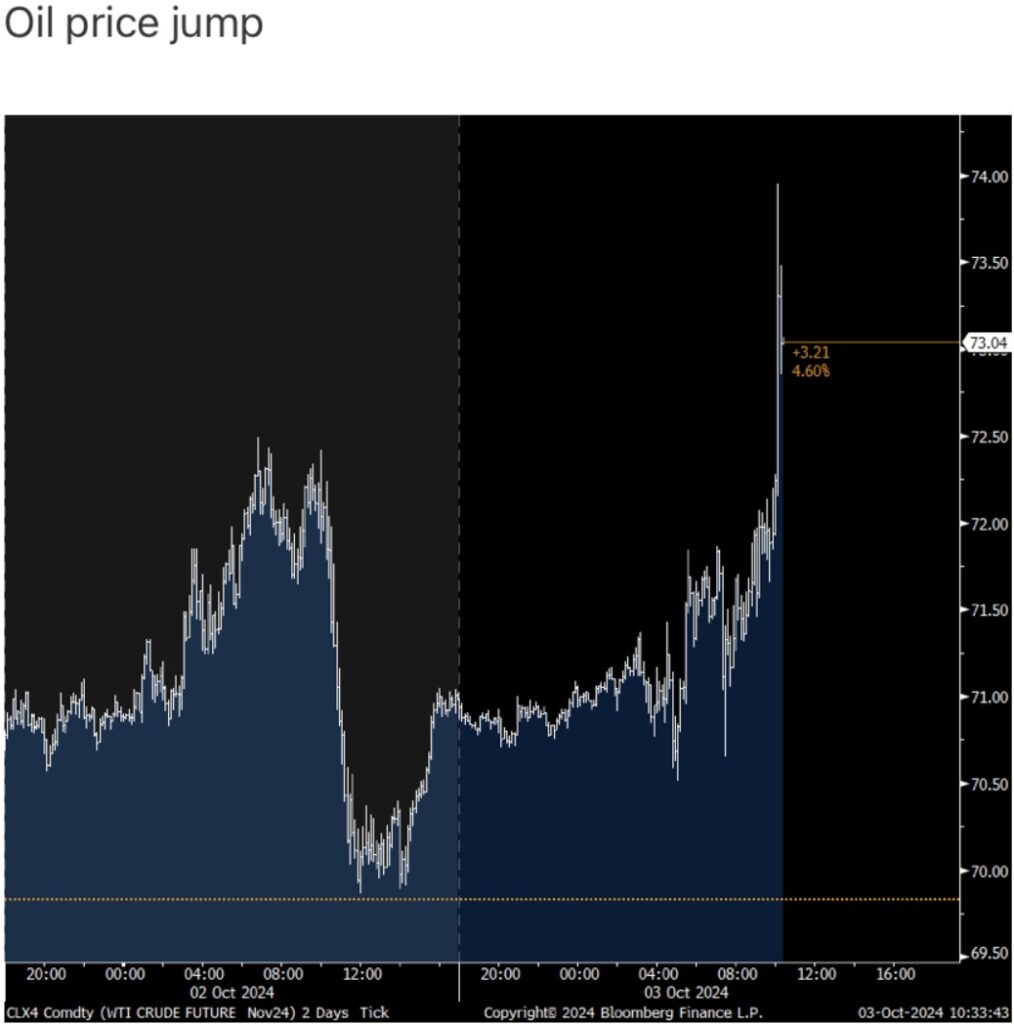

Today the price of crude oil futures surged 5.3% or $3.77 as the price of silver approaches a major upside breakout.

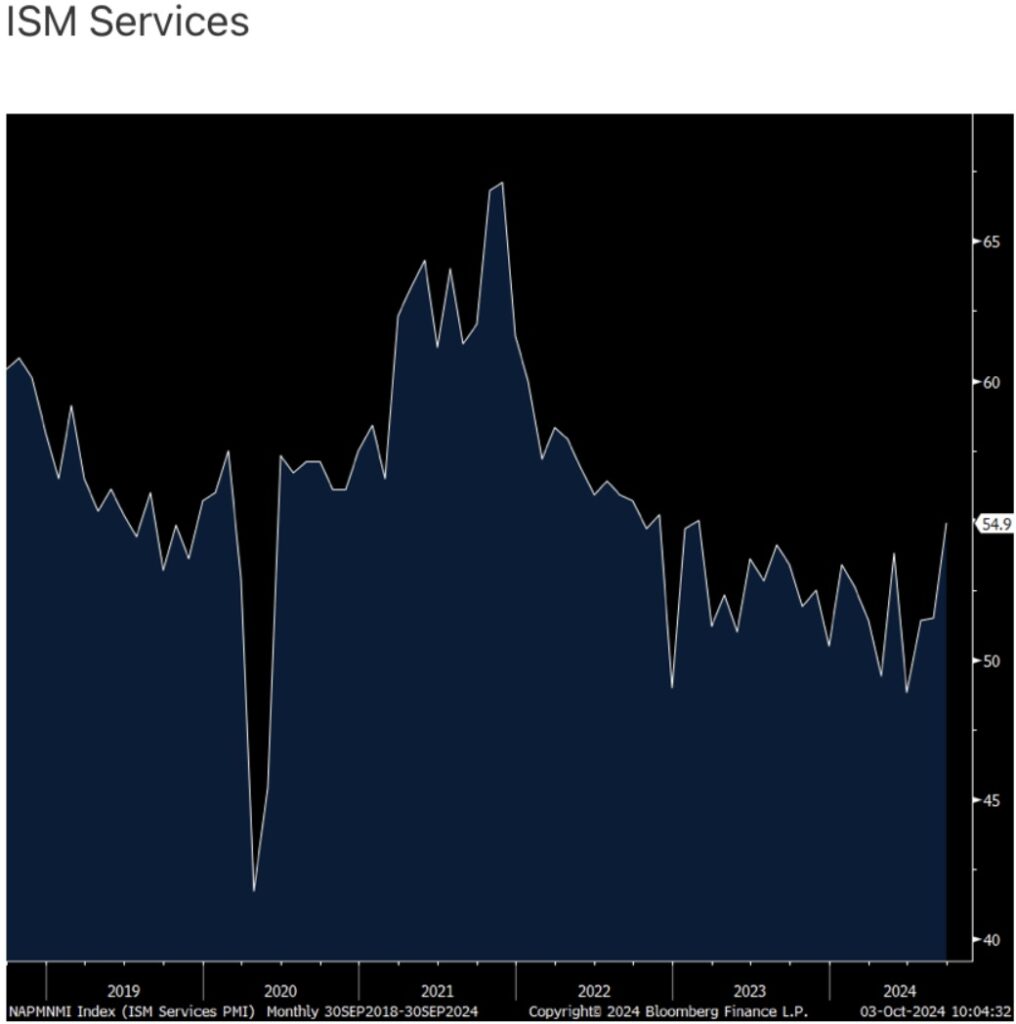

October 3 (King World News) – Peter Boockvar: The September ISM services PMI rose to 54.9 from 51.5 and that was well above the estimate of 51.7 and the highest since February (measuring direction of change, not degree).

The internals though were mixed. New orders did jump by 6.4 pts to 59.4 but backlogs remained below 50 at 48.3, though up 4.6 pts m/o/m after losing 7 pts in August. Inventories jumped to 58.1, up 5.2 pts.

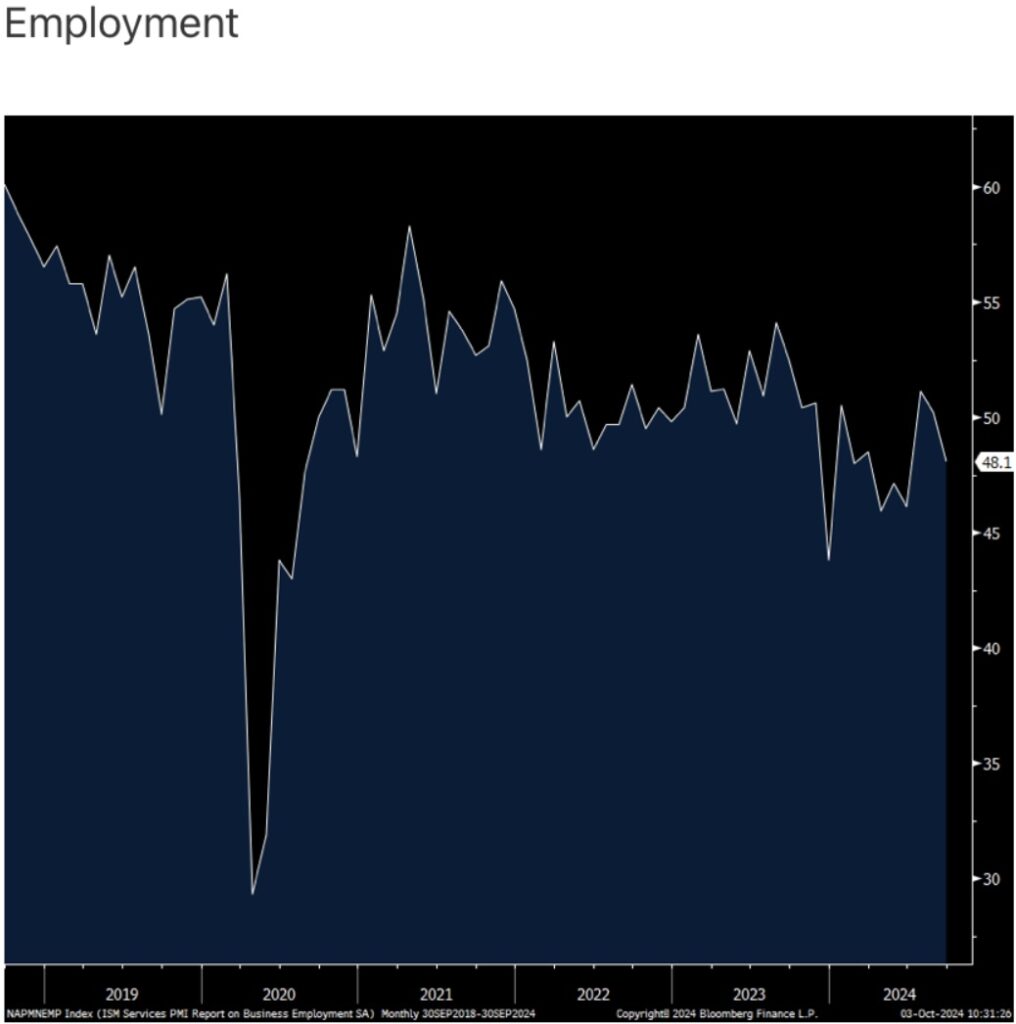

The employment component softened to 48.1 from 50.2, and thus back under the key 50 level ahead of tomorrow’s payroll figure.

Supplier deliveries rose back above 50 (implying slower deliveries) at 52.1.

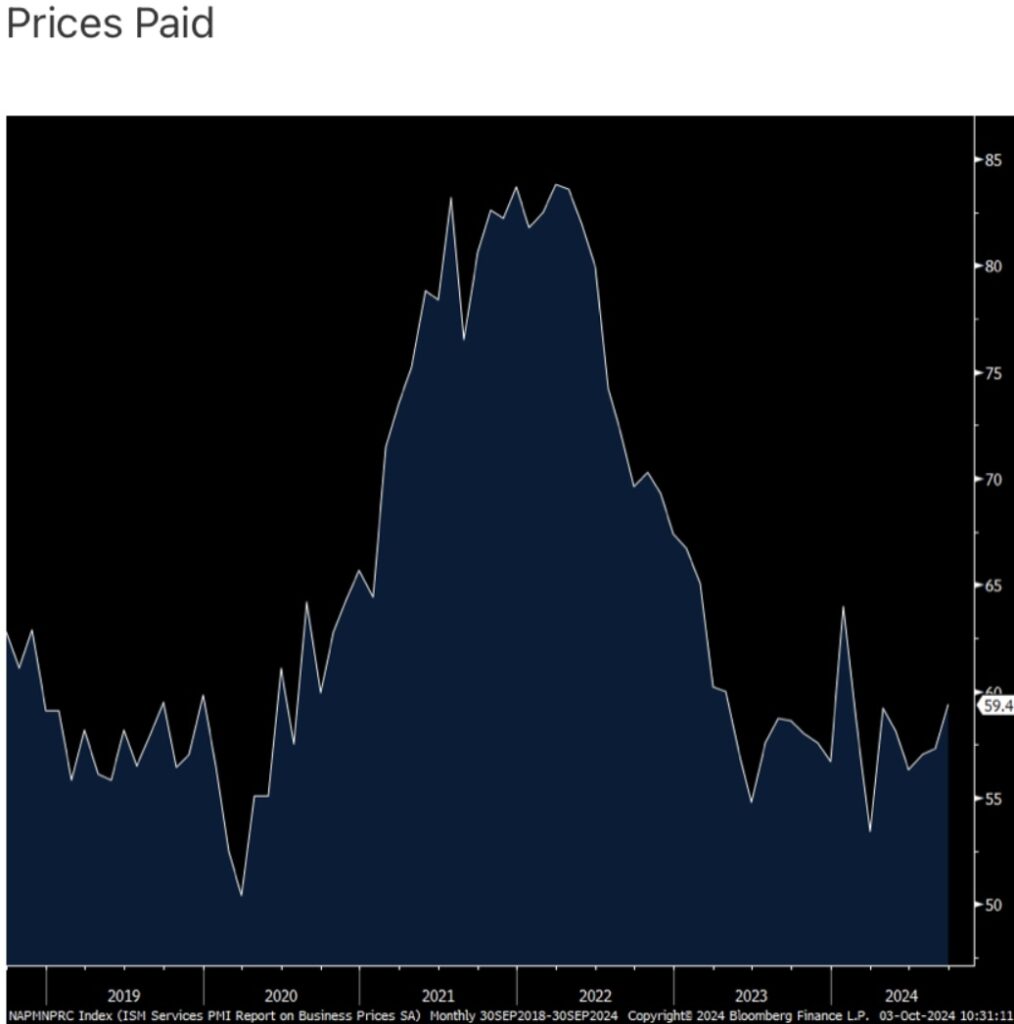

Prices paid was up 2.1 pts at 59.4, the highest since January.

With regards to industry breadth, 12 industries saw growth vs 10 in August. 5 said their business contracted vs 7 in the month before.

Bottom Line

The bottom line from ISM was this, “The stronger growth indicated by the index data was generally supported by panelists’ comments; however, concerns over political uncertainty are more prevalent than last month. Pricing of supplies remains an issue with supply chains continuing to stabilize; one respondent voiced concern over potential port labor issues. The interest-rate cut was welcomed; however, labor costs and availability continue to be a concern across most industries.”

My Bottom Line

My bottom line, stocks bounced in immediate response as maybe we’re back on to good economic news being good for stocks and vice versa rather than what each economic data point means for the Fed. BUT, they then sold off on the story that Biden is discussing with Israel about bombing Iranian oil facilities and oil is spiking as a result, higher by $3 per barrel for WTI. I’m sure he and Harris DO NOT want oil prices going higher ahead of the election.

Oil Prices Spike On Middle East War

As for the Fed, Treasuries sold off and yields continue higher. The 2 yr yield touched 3.70%, a 4 week high, before backing off to 3.68% and the 10 yr is now at 3.83% vs 3.65% the day before the September Fed meeting.

Quietly too, while still remaining low, inflation breakevens continue higher as well. I’ll argue again, the Fed’s path to some easy rate cutting cycle will not be easy and I believe will be more of a tweak. Market expectations for a fed funds rate by 3% or less by next year is overly optimistic right now because of multiple complicating factors, as while economic growth might slow and the unemployment rate could still go higher, if this port strike lasts a while and/or oil prices shoot higher and/or China is successful in generating economic growth of note again are the offsets.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.