Silver is now breaking out of a 45-year bullish pattern that projects new all-time highs, and this is creating a problem for the heavy short positions in the silver market.

A Historic Silver Breakout

July 22 (King World News) – Graddhy out of Sweden: Silver is breaking out on yearly time frame from a 45-year bullish pattern.

And silver miners ETF SILJ here has broken out of a 4-year bullish pattern.

KING WORLD NEWS NOTE: Junior Silver Mining Stocks Have Finally Been Getting Some Big Buying

Life-changing gains are hard to accomplish, this both because the best market opportunities for it are few, and because it takes everything you have got to do so.

When a bull resumes, it is vital to change mindset. One can not play a bull with a bearish mindset. If you doubt the bull, you will not be able to change mindset. You have to believe in the bull or you end up being a victim of the wall of worry, i.e. your own emotions. Most need help with this.

If you can not grasp the new market environment, you will be hard-wired to sell as soon as you have a little profit, since you will expect the sideways-down and big drops from the bear market to continue. And if you sell too soon, you will have messed up the great entry and opportunity, if you were able to pull the trigger at the very lows that is, which most cannot either.

Japan’s Massive Debt/GDP Has Consequences

Peter Boockvar: … Bloomberg is reporting that “Bank of Japan officials see little need to shift their policy stance of gradually raising interest rates in the wake of Prime Minister Shigeru Ishiba’s latest election setback, according to people familiar with the matter.”

They’ve been so ‘gradual’ with the rate hikes that Ishiba lost his parliamentary support from both sides of the house because of the voter pushback against inflation rising faster than wages. That said, they still plan on raising interest rates according to “the people” cited in the article so there remains higher JGB yield risk which will continue to have global repercussions depending on to what extent. The BoJ meets next week and no change in policy is expected yet as they await to see the results of the trade negotiations with the US side.

Finally, with respect to JGB yields and the possible consequence of the election results, “While the outcome of the election doesn’t change the BoJ’s policy trajectory for now, some officials see a need to monitor any upward impact on inflation if the government does indeed loosen fiscal policy considerably, the people said. The officials see risks rising for inflation after price growth turned stronger than they expected mainly due to a surge in rice prices and other food-related items, they said.” I believe we are not out of the woods with respect to the risk of rising long-term interest rates and I do expect a continued rise in global long-term interest rates.

Speaking Of Inflation

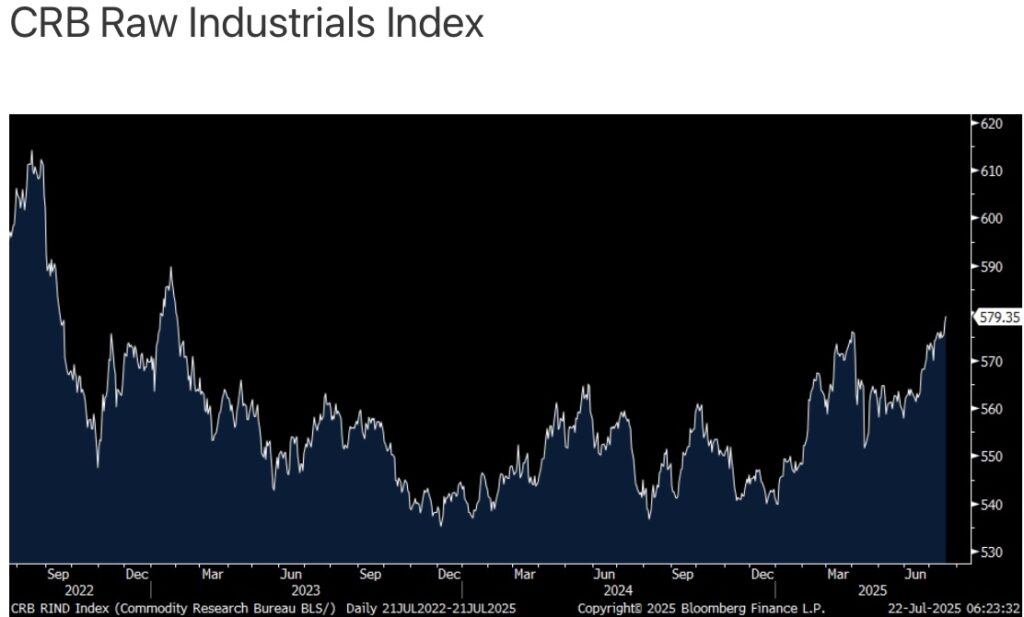

Speaking of inflation, the CRB raw industrials index has broken out to the upside as it closed yesterday at the highest level since February 2023. I argued a few weeks ago that this was shaping up to be a good looking chart. What I like about this index is that it includes some commodities that don’t trade on markets and thus are not speculated on. They are also all spot prices. The index includes burlap, print cloth, tin, copper scrap, rosin, wool, cotton, rubber, zine, hides, steel scrap, lead scrap and tallow.

What To Do?

King World News note: More “transitory” inflation is on the way as commodities have entered an another secular bull market. This will add more fuel to the already turbocharged gold bull market. Use any weakness to continue accumulating physical silver as it remains the cheapest hard asset on the planet. The HUI Gold Mining Index and the XAU Gold Mining Index are hitting new recent highs. Continue to accumulate high-quality companies that mine gold and silver, and especially the high-quality junior exploration stocks.

US May Begin Stockpiling Silver As Strategic Reserve

To continue listening to Nomi Prins discuss why this would make the price of silver skyrocket as well as her thoughts on gold, uranium, and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect next in the gold, silver and mining share markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.