Global markets are still reeling with the NASDAQ crashing 10% in just 2 trading days as the Dow plunges another 2,000.

Navigating ‘Crashenomics’

April 4 (King World News) – Alasdair Macleod: Trump’s tariffs are imploding the global credit bubble destroying everyone’s wealth. But the wise will see this as an opportunity to stack the ultimate refuge cheaply — gold and silver.

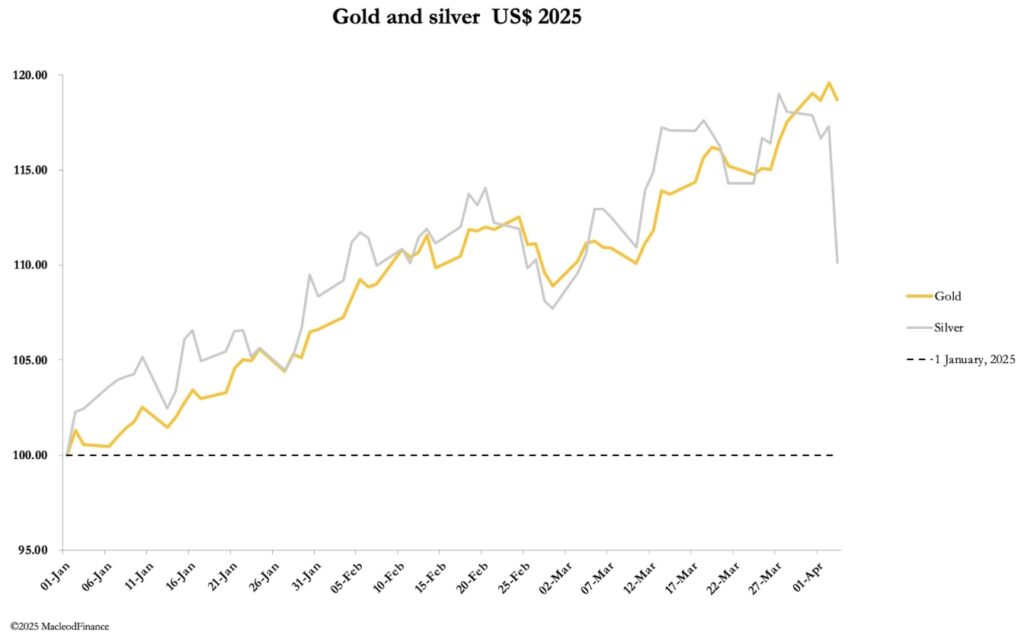

Due to indiscriminate asset liquidation to pay for mounting losses in equities, gold and silver values fell this week. In European trade this morning, gold was $3095, down $27 from last Friday’s close, but silver was very hard hit at $31.34, down a whopping $2.76. Most of the damage happened yesterday (Thursday) in the wake of Trump’s tariff announcement the previous afternoon.

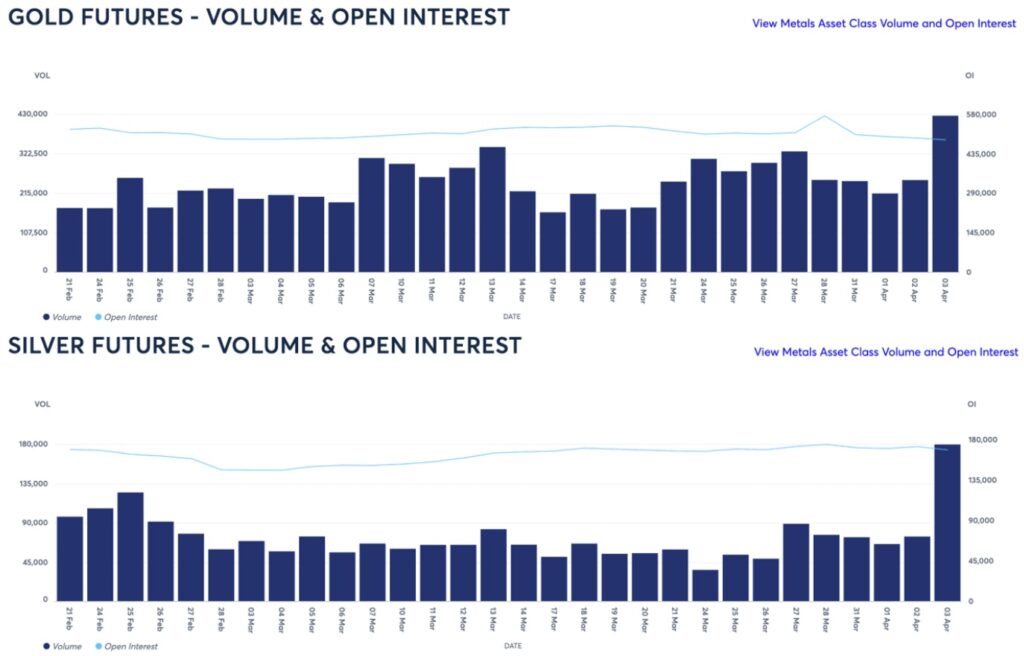

Unsurprisingly, yesterday’s Comex volumes were exceptionally high, particularly in silver:

Undoubtedly, the reason gold has held up so well is due to central bank bullion demand, absent in the case of silver. Consequently, silver seems set to suffer further volatility, perhaps testing support at its 1-year moving average currently at $30.47.

There are enormous opportunities in a market equity crash, not only by shorting previous highfliers and nimble trading. In the context of precious metals, we should examine outcomes of similar episodes in the past as well as rationally analysing market psychology.

The last time we had a similar crisis was in the great financial crisis of 2008, when gold fell by 30% before rising to all-time highs at $1920 three years later. The S&P 500 Index halved between November 2007 and February 2009, creating substantial losses for investors, whose selling to cover them was indiscriminate. Once the crisis passed, the rationale for selling fiat currencies for gold returned, particularly given the mounting debt problems in the euro.

In other words, the risks of exposure to credits’ values were greater following the GFC, and the selling was just a temporary phenomenon — a lesson for today.

This time, gold is unlikely to be hit so hard for three basic reasons. The first is that credit risks subsequent to a bear market onset are demonstrably greater today. Secondly, investor exposure to gold in western capital markets is negligible so there is little to actually sell. And lastly, central banks are not only keen buyers of any bullion coming onto the market but are almost certainly restricting market liquidity by reducing gold leasing supply.

The absence of central banks in the silver market explains why the silver price is more vulnerable to price markdowns. But again, the widespread equity market panic is temporary and as is in the case of gold this is a buying opportunity for stackers.

What we are seeing is an initial panic, whereby investors are expected to derisk their portfolios by reducing equity exposure and investing in bonds. This is the basis of all regulatory textbooks, which don’t even mention precious metals and commodities. And we have seen government bond yields decline accordingly:

But as the credit bubble continues to deflate, the risks to the banking system and the global economy will increase, which will inevitably be reflected in rising bond yields to discount those risks.

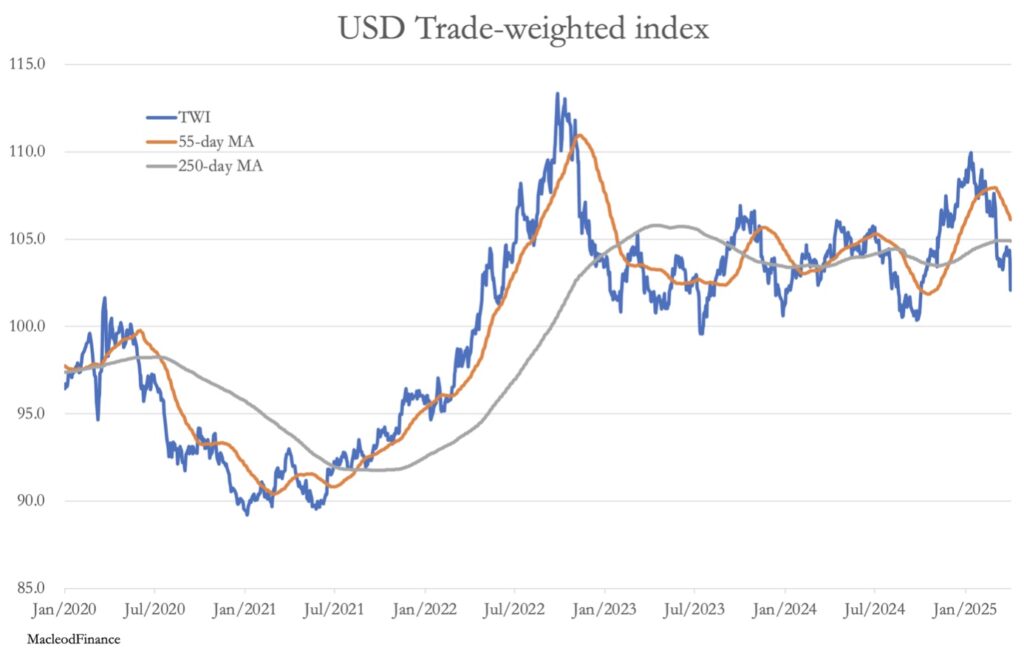

The easiest development to grasp is the certain liquidation of foreign holdings in equities. The market with the greatest exposure, which is about $15 trillion, is that of the US. Foreigners will not hold onto US equities in a credit implosion, not only selling them but also selling the dollars raised instead of buying bonds. This is already reflected in the US$’s trade-weighted index:

This chart has turned very sour and seems set to break down through the key 100 level as foreigners sell their dollars to repatriate funds to their domestic currencies.

It is at this point that risks for the dollar will suddenly seem to be intractable. A declining dollar will spur rising prices along with higher tariffs on foreign imports. The inevitable recession from the combination of imploding credit and trade tariffs will also intensify the federal government’s debt trap, requiring higher interest rates and bond yields to stabilise the dollar.

That is unlikely to be permitted easily by a reluctant Fed. With the possible exception of Germany, all other G7 nations are in similar debt traps. It is inevitable that being only credit their currency values will decline as well. All against what?

The only answer it can be is valued in gold and possibly silver, which since ancient times have been money without counterparty risk in everyone’s common law.

That’s why the current market turmoil is a heaven-sent opportunity to preserve personal wealth by getting out of collapsing credit into real money — gold and silver.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.