Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News that investors need to remain focused on gold’s big picture during this volatility.

Gold: Clear For The Next Takeoff

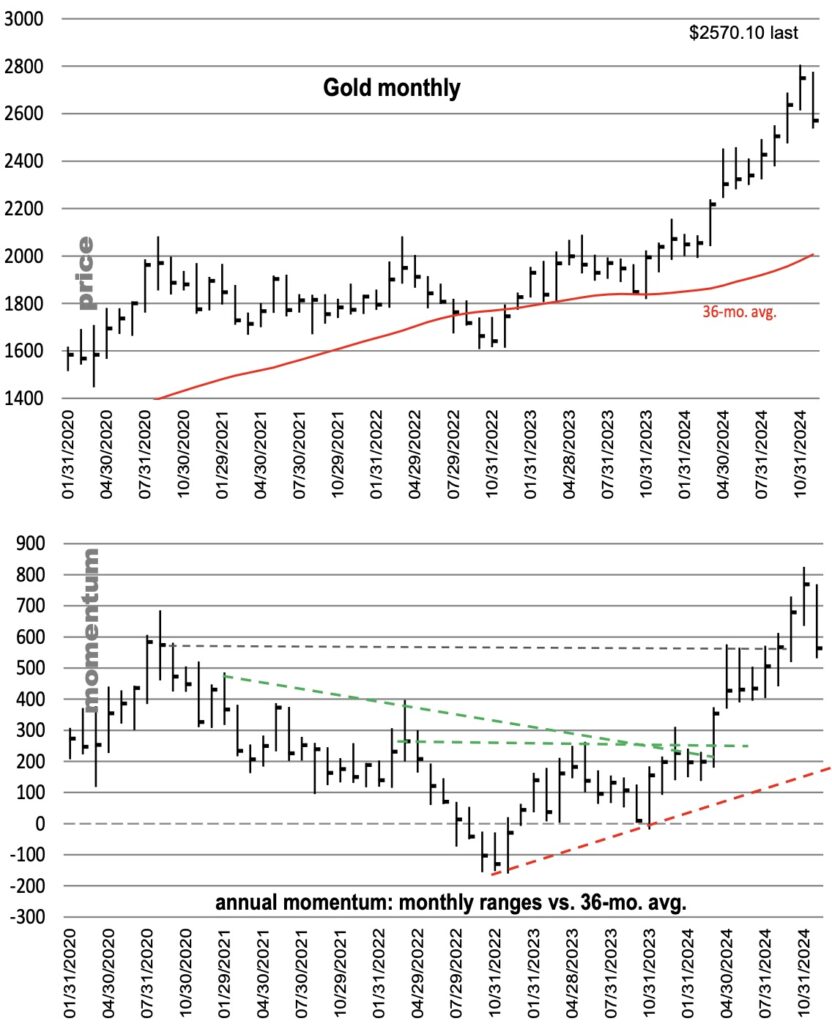

November 18 (King World News) – Michael Oliver, Founder of MSA Research: Remember the major stall/correction process that followed the surge into August 2020 (with a high of $2078)? It was range-bound for price—until that final but brief bear-trap cleansing low near $1600 (which MSA labeled as such) in September 2022.

The corrective layered decline in annual momentum during those few years developed enough structures that, once cleared, would signal the laborious correction process was over and upside was resuming. That became clear in March, when not only was the downtrend overcome, but the staircasing pattern of lower oscillator highs was ended.

If we plot (or attempt to plot) an uptrend structure now, it’s nearly impossible. We have only two pivotal lows that produce a line at levels so far below as to be meaningless. Over time the momentum action will develop a credible uptrend structure, but for now it’s simply way too early.

Instead, the pullback so far this month is on top of the range of oscillator highs from April to August this year, and also back down to around where the peak monthly closing reading was in mid-2020. Please note that the cluster from April to July of nearly flat oscillator highs was being capped by that old peak monthly close in mid-2020 (grey horizontal line). It was overcome and with a surge. It will be interesting to see if the monthly close is even just a tad higher than where it is now. That would suggest those two intersecting levels were simply support on this pullback.

And frankly, if the daily action and other short-term metrics begin to turn back up soon, it’s a distinct possibility the monthly close will be above here.

So does this month’s drop break anything major? No. Perhaps a year from now momentum might develop a structure worth watching as a defining point of major trend change.

And remember: as goes the mama market, so will go silver and the miners. Have no doubt. You must subscribe to Michael Oliver’s MSA Annual Service to read the rest of this lengthy and timely report. MSA also lists individual mining stocks in their reports that they believe will significantly outperform the HUI Gold Mining Index. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research and gain access to their research and stock picks CLICK HERE.

GET READY: A Radical 2025 Lies Ahead

To listen to Gerald Celente discuss his the radical 2025 that lies ahead as well as his predictions for gold, global markets, war, and what surprises to expect in 2025 CLICK HERE OR ON THE IMAGE BELOW.

ALSO RELEASED!

To listen to the man who helps oversee $170 billion discuss how investors around the world can prepare themselves for the turbulence in global markets that lies ahead CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.