Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News that the price of silver should hit a new all-time high above $50 by November.

Silver: Big Breakout & Annual Momentum

April 8 (King World News) – Michael Oliver, Founder of MSA Research: [Silver] Breakout.

The red horizontal on momentum is plotted through pivotal low closing readings (2021) and then pivotal high closing readings (2022 to 2024).

We’ve studied this situation archivally, and when we find major horizontal long- term momentum structures (in this case a flat horizontal structure encompassing several years of basing action), the outcome is dramatic and much of it occurs in the next two quarters.

And that move is almost always a massive percentage gain for silver and gold.

We’re also monitoring our silver/gold spread (report sent April 4th). The breakout of that dynamic will echo and enhance (!) this breakout.

Expect New All-Time High For Silver By November

We expect that before the 2024 election there’s a solid chance silver will be well above its $50 price highs of the past fifty years. Yes, there will likely be at least one major wobble in that move, and we’ll try to identify that event in advance. And, yes, there will no doubt be many daily wobbles/selloffs too. Our focus will be on a potential (and premature) profit-taking wobble that involves a month or more of adverse action, not just two days here or there. Stay tuned…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

The World Views Gold As Money Again

Peter Boockvar: I want to talk gold again and say again that gold is money and therefore a currency and that is the main reason it is being bought. To grab from the video clip I sent last week the 2011 exchange between Ron Paul and Ben Bernanke when Paul asked Bernanke, “Do you think gold is money?” Bernanke’s response, “No” to which Paul said “Even though gold has been money for 6,000 years, somebody reversed and eliminated that economic law?” Paul then asked, “Why do central banks hold it if it’s not money?” Bernanke said, “It’s a form of reserves” to which Paul asked, “Why don’t they hold diamonds” and Bernanke responded, “Well, it’s tradition, a long term tradition.” Paul finished by saying “Some people still thinks it’s money.”

The Ultimate Alternative To Fiat Money

Gold is not being bought as a hedge against geopolitical risk, gold is not being bought as a hedge against stocks, it’s not being bought to store with a gun (though some certainty do), it is being bought because people and central banks want an alternative to fiat currencies and that can’t be stolen/frozen or printed, particularly the dollar and it is therefore a form of money. This is not a call on the direction of the dollar, it is just that central banks in particular don’t want to hold as many dollars as they once did and that trend picked up steam after the US and EU confiscated half of Russia’s central bank reserves soon after they invaded Ukraine.

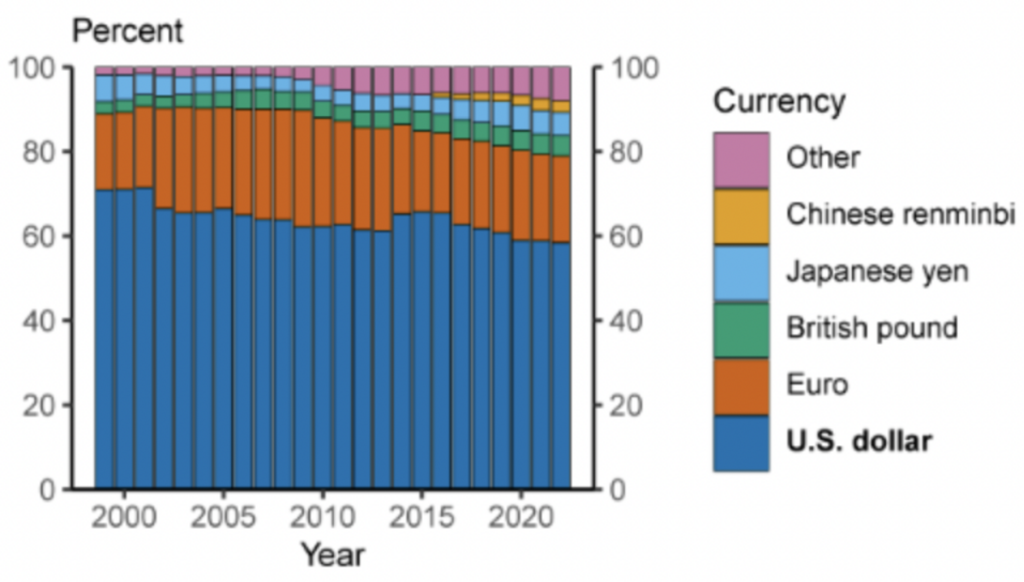

“Other” Foreign Exchange Reserves Is Gold

As of Q2 2023, global foreign exchange reserves held in US dollars was about 59%, according to the Federal Reserve. That compares with 62% in the 10 years prior, 66% in 2003 and 71% in 2019 right before the tech bubble imploded and the response of the Fed was to experiment with a 1% fed funds rate which was followed by zero and QE in the great recession that followed. Assume that in Q3 and Q4 that percentage continued to dip and rose with gold as central banks continued their torrid pace of buying gold.

Also understand that as oil continues to gain momentum in terms of transacting in currencies other than the US dollar, such as when the Chinese buy oil from Russia and the Saudi’s, the lessened need for US dollars also gives reason to hold more gold. My friend Luke Groman in his Friday’s ‘The Forest For the Trees touched upon this, ‘China and Russia are transacting in CNY, recycling those CNY into Chinese goods, with any net surpluses being stored in gold whose price rises in both CNY and RUB terms.”

From the Federal Reserve, Foreign Exchange Reserves allocation, notice ‘other’, https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-us-dollar-post-covid-edition-20230623.html

Gold Is A Hedge Against Currency Debasement

I also want to touch upon the fact that gold is an inflation hedge against currency debasement using real world examples. In 1970, right before Nixon took us off what was left of the post WWII Bretton Woods gold standard, $1 bought you about 3 gallons of gasoline. Today, that same $1 will buy one about 27% of a gallon of gasoline. In 1970 when gold was price fixed at $35 per ounce, it bought you about 100 gallons of gasoline. Today at around $2,350 per ounce, it buys you about 650 gallons of gasoline. Pretty good protection against inflation.

Let’s do this since 2000 when Greenspan was on the cusp of an unprecedented rate cutting experiment at the time which spurred gold after a 20 yr bear market. One dollar bought you about 2/3 of a gallon of gas while one ounce of gold bought you about 167 gallons. Today, as mentioned $1 will buy you about 27% of a gallon while gold will buy you 650 gallons.

The Greatest Inflation Hedge

I read that in 1970 the average price of a private year college was $1,562. According to US News and World Report it was $42,162 for the 2023-2024 school year. That’s up 27x. Gold is up 67x since then while the US dollar has lost 96% of its purchasing power. Pretty good protection against inflation.

Let’s take the CPI in totality. Since 1970, again right before we went to an all fiat financial system, it is up 7.9 times. Since 1970, gold is up 67 times. Is gold not an inflation hedge? Of course it is. There are times where it might lag but over almost 55 years since the 1971 monetary system changed, it’s done a pretty good job.

Zimbabwe thinks so too. After many years of hyperinflation, they have just replaced its local currency with a gold backed one. The Governor of their central bank said “We want a solid and stable national currency…it does not help to print money.” Their government said that the new money “shall be anchored in and backed or covered by a composite basket of foreign currency reserves and precious metals received (mainly gold) and valuable minerals.” To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by serious investors and professionals all over the world CLICK HERE.

JUST RELEASED: To listen to James Turk discuss gold closing the week at an all-time high as well as silver hitting new recent highs along with the HUI Gold Mining Index CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.