Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News that one sector of the stock market is on the verge of a historic breakout and investors stand to make a fortune by getting involved early.

Very Important Report

January 21 (King World News) – Michael Oliver, Founder of MSA Research: The focus of this weekend’s report is the status of the gold and silver mining sector from a long-term investment perspective.

Are gold and silver miners what they look like, and will therefore always remain so—dead on the floor and never going to rise?

Or instead is this sector one of those rare investment opportunities: a long-dismissed and underpriced asset category. One that investors laugh at, while instead they chase blow-offs of sensational symbols that turn into death traps once the overpricing mania ends?

Gold Miners Are Vastly Underpriced By Any Measure

We suggest that gold miners are a vastly underpriced category by any standard of measure, and a situation that has conditioned 99% of investors into believing it’s a “forever no-good” sector.

Often the best investment opportunities set themselves up this way.

MSA accepts some of the common wisdoms about the miners: e.g., they’re vastly underperforming the metals they extract from the ground. We’re also fully aware the miners will almost always surge when gold advances, but if gold pauses or generates even a small pullback, the miners give back some or a great deal of their surge. A sickly tonal nature relative to gold, and especially so over the past three years. The opposite, for example, to the firm technical performance of the oil sector as represented by XLE when compared to its underlying commodity.

Let’s begin by looking at gold miners’ relative performance to gold going back forty years.

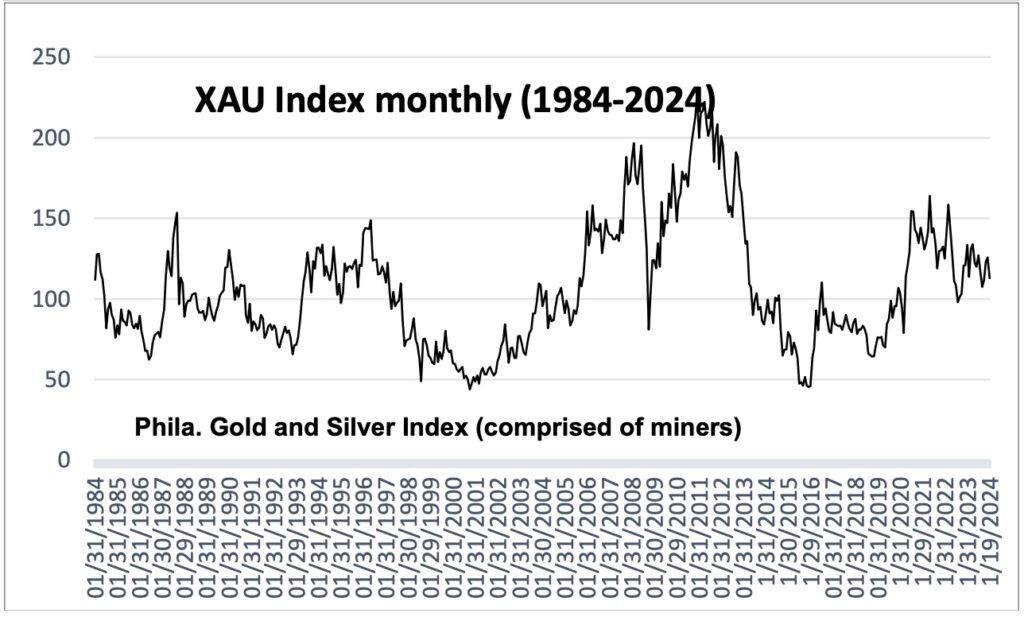

The first chart show the monthly price of gold and the XAU Index going back to 1984.

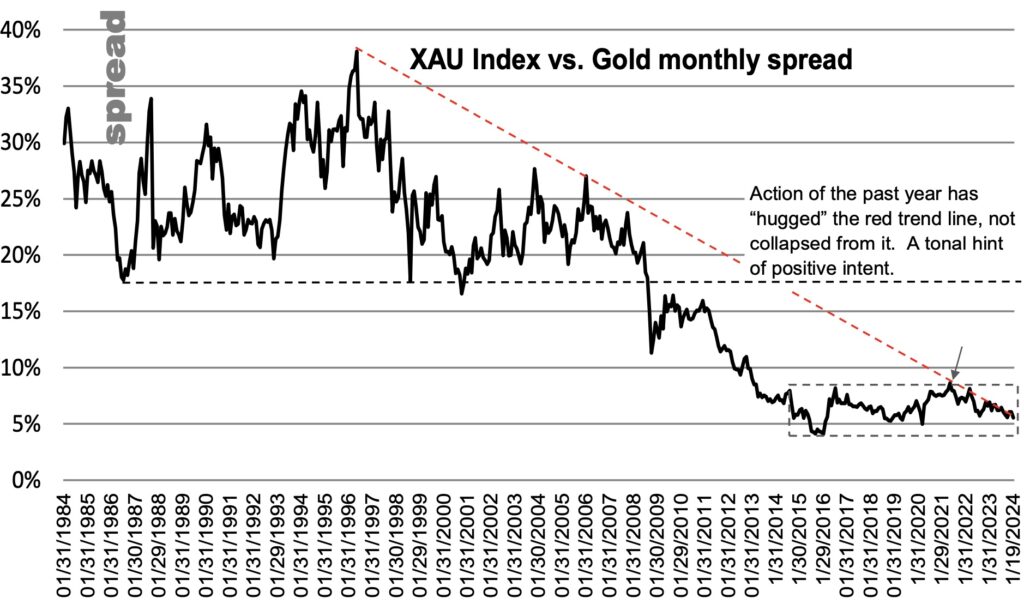

The bottom chart is the relative performance (or spread) of XAU vs. gold.

The Single Most Undervalued Sector In The World?

There are several multi-year periods where XAU handily beat gold on the upside, apparent on price and the spread. And there were also downswings where XAU lost a greater percent than gold. So it goes both ways. But since the mid-1990s XAU has declined massively in layers vs. gold.

However, there is a fact that most analysts and investors overlook. Since gold’s bear market low in late 2015 (MSA went major long- term bullish on gold and related in February 2016 just above $1140), gold has doubled in price. XAU’s current price at 113, even with the recent pullback, reflects a gain of 145% from its bear low of 45.

Yes, since the spread chart peak several years ago (the third hit on the trend line, at the arrow), miners’ relative performance has oozed back down, not collapsed.

The clear technical feature is that at this “near-zero” valuation, this spread chart looks as if it’s “had enough” and has been basing for years. Think it’s going to zero?

The spread is now at 5.565%. Close a month at 7% and the massive downtrend will be cleared. Close at 8.62% and the ten-year range will break out.

When Such A Breakout Occurs…

When such a breakout occurs…To read the rest of this incredibly important report, which has remarkable updates on gold, silver, mining stocks and so much more (12 pages long!) you must be a subscriber. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by serious investors and professionals all over the world CLICK HERE.

Nomi Prins Best Audio Interview Ever!

To listen to one of Nomi Prins’s greatest audio interviews ever where she warned the price of gold may double in 2024 CLICK HERE OR ON THE IMAGE BELOW.

Latest Audio Just Released!

To listen to Alasdair Macleod discuss the big surprise in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.