Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, communicated to King World News that the action in gold miners is now mirroring the 2016 bear market low. That was a fantastic time to be a buyer as the mining stocks then soared 200% in just 6 months.

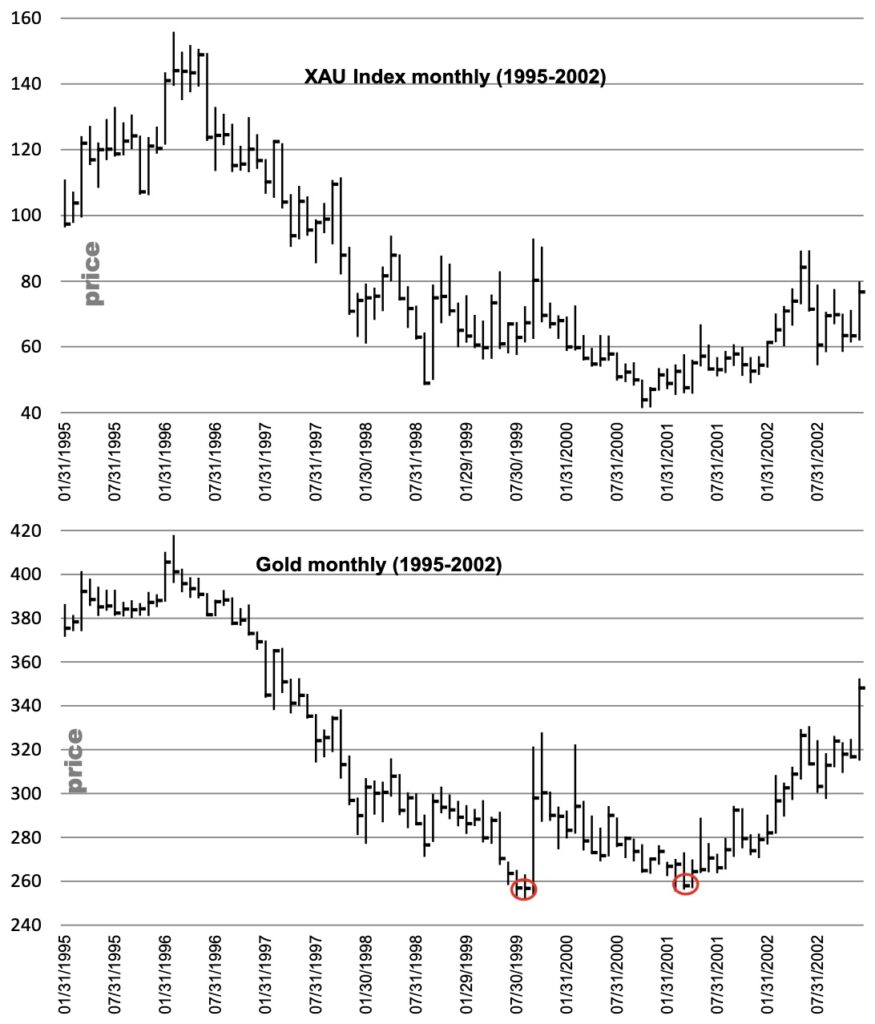

Lookback: Gold Miners and Gold (1995 to 2002)

February 12 (King World News) – Michael Oliver, Founder of MSA Research: While gold gained 35% from its 1999 low to its 2002 high (again, we’re showing these charts from the stock market’s peak to its bear low in October 2002). The XAU Index had gained 125% during 2001 to summer/fall of 2022 when the stock market finally put in a bottom.

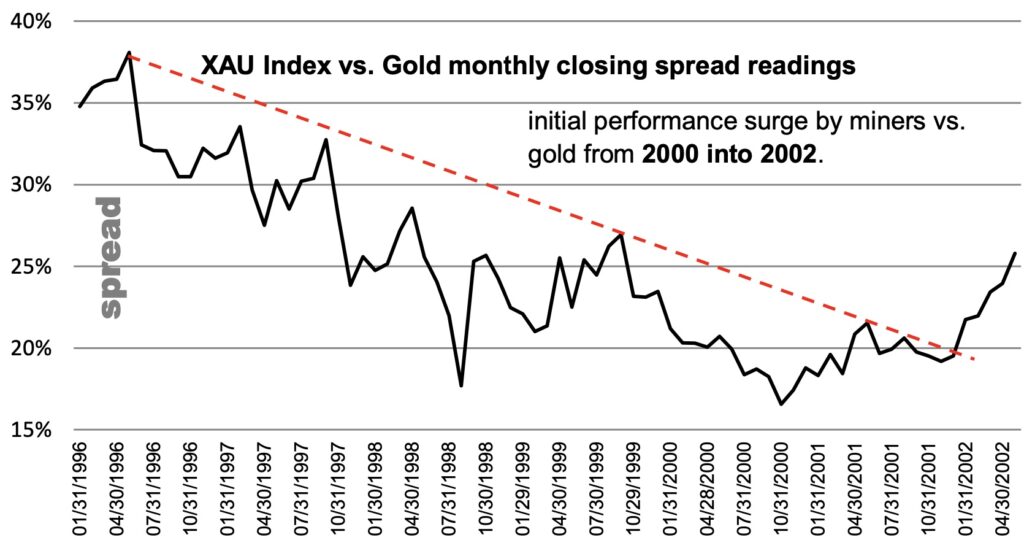

Yes, when you measure the entire gold market bull trend from 2000 to 2011, gold did outperform miners. However, there were periods in which miners outpaced gold and then declined in relative performance to gold. We deal with the current relative performance of miners vs. gold [next].

Miners vs. Gold: Then and Now

After price-chart basing in 2000 (those price charts shown on page 10) both gold and the gold & silver miners (XAU holds both) turned up with alternating periods of miner outperformance and underperformance. Gold ultimately gained more than miners when one measures the entire 2000-2011 bull trend.

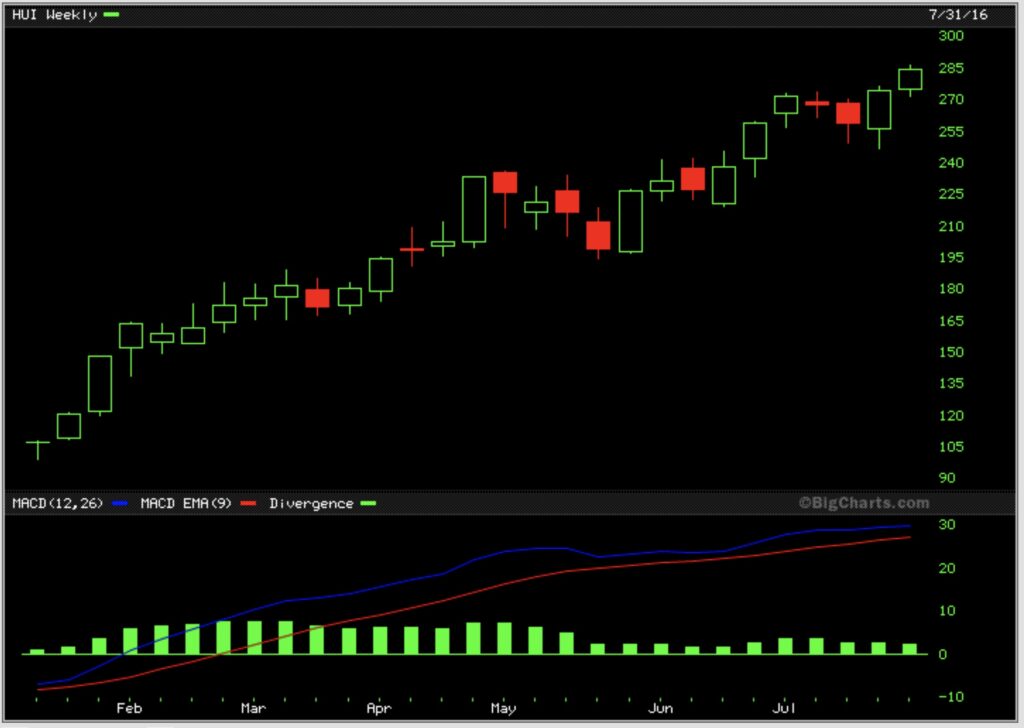

2016 Low

The current situation is different in terms of where price is. Both gold and the miners are well above their bear lows in late 2015/early 2016. GDX’s low then was 12.40; it’s now a bit more than twice that price. Gold is almost twice its late 2015 bear low of $1046.20.

King World News note: After The Mining Stocks Bottomed In Early 2016, The HUI Soared 200% In Just 6 Months!

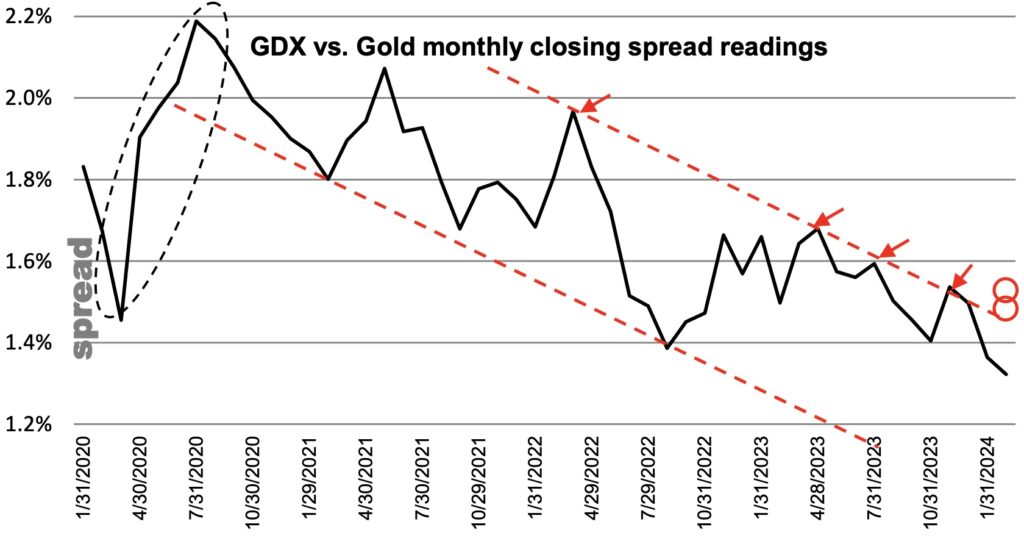

Recall the dramatic relative performance surge in miners vs. gold from early 2020 to summer highs of 2020 (ellipse on the spread chart). During that explosive leg, gold gained 43% while GDX fell just short of a triple (16.18 to 45.78). But what has happened over the past three years plus is that miners have underperformed gold, such that now both are about the same percentage above their 2015/2016 bear market price lows.

Regarding The Channel Spread Above

Regarding this spread, MSA has defined a parallel channel with the channel top now extremely well defined by four hits on that line. If the spread advances up to 1.5%, the channel will come out, and with a spread close at 1.54% (GDX’s price expressed as a percent of gold’s), then that last hit on the line several months ago will also come out for good measure. (Current spread reading is 1.32%). This breakout, once signaled, should define the onset of a new period in which miners outperform the metal. Not that it will or must last for the duration of the bull trend, but worth considering putting more emphasis on miners —given such a breakout by spread.

Yes, in fact gold did outperform miners overall in that advance. However, and this is important, there are times during that advance (periods involving several quarters) in which miners did outpace gold, and then pause and retreat in performance. A more recent example is the explosive upside in the from March 2020 low to August 2020 high in which GDX gained went from $16 to $45.78. Gold from its March 2020 low to August 2020 high went from $1451 to $2078. Miners outperformed. It took time for that outperformance surge to erode its gains. We are expecting such a surge to likely be connected with the next upside surge in that overall complex. To read the rest of this important report, which has remarkable updates on gold, silver, mining stocks and so much more (16 pages long!) you must be a subscriber. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by serious investors and professionals all over the world CLICK HERE.

***To listen to Gerald Celente discuss why 2024 is going to be a wild year and what to expect from major markets CLICK HERE OR ON THE IMAGE BELOW.

***Alasdair Macleod’s audio interview was just released discussing the Chinese public buying close to all-time record amounts of physical gold. To continue listening to Alasdair Macleod discuss the near all-time record demand for gold and what this means for the price of gold in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.