Look at who just said silver might spike above $500.

Silver

December 8 (King World News) – Graddhy out of Sweden: Been saying that silver can go to $60-$70 during this breakout, and now, silver is almost at $60 level. History is in the making.

My long term target is still $370. Can spike to $500+ at end of bull. Now almost at $60 – take that in!

KING WORLD NEWS NOTE: Silver May Spike To $500

Monetary Madness Running Into Trouble

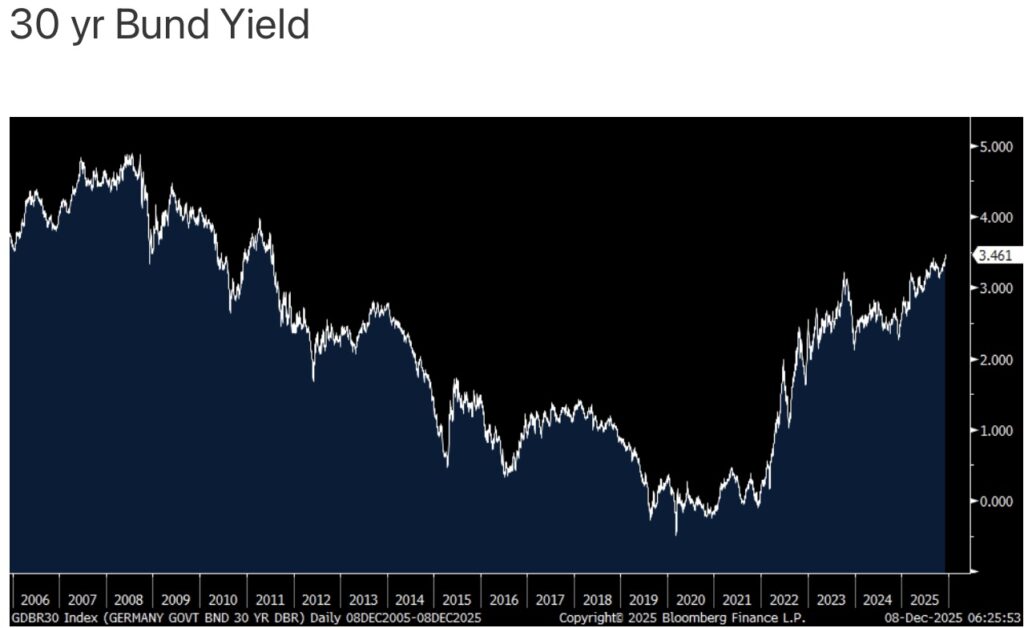

Peter Boockvar: Yes, the ECB has cut its deposit rate by 200 bps since June 2024 to 2% but the German 30 yr bund yield is trading today at its highest level since July 2011 at 3.46%, up about 70 bps since the beginning of June 2024.

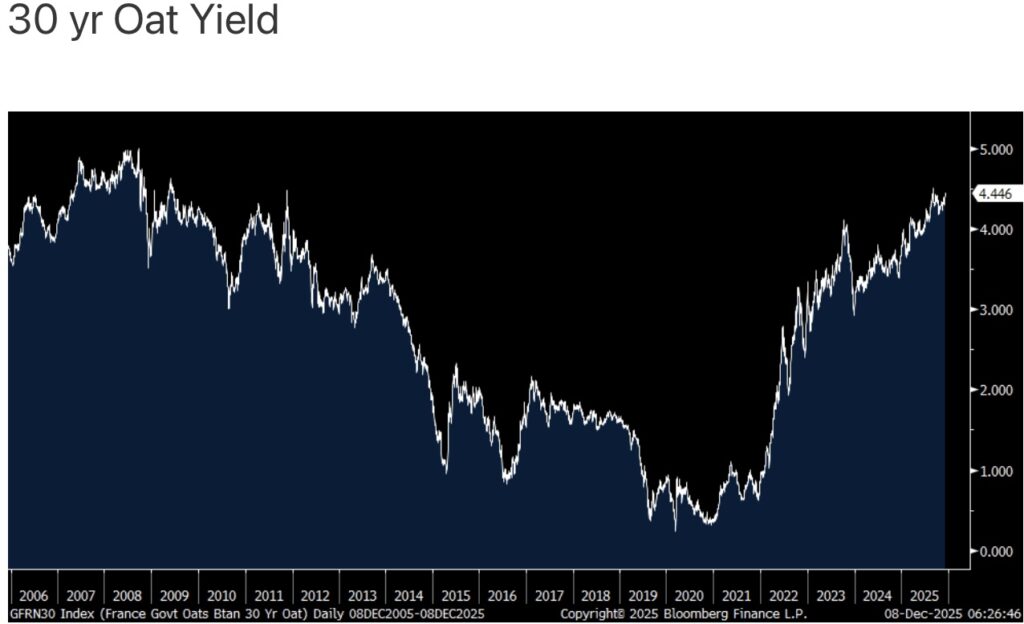

The French 30 yr oat yield is just 5 bps from a level last seen in 2009 and up almost 100 bps since June 2024.

The BoE started cutting rates in July 2024 and its 30 yr yield, while off its multi decade high seen in early September, is up about 60 bps since early July 2024. The US 30 yr yield at 4.81% today is up about 90 bps since September 2024 when the Fed cut 50 bps to start their cutting cycle and at 4.81% is back to the highest yield of 2024 in April 2024 right before the downtrend to 3.93% on the day of that September 2024 FOMC meeting.

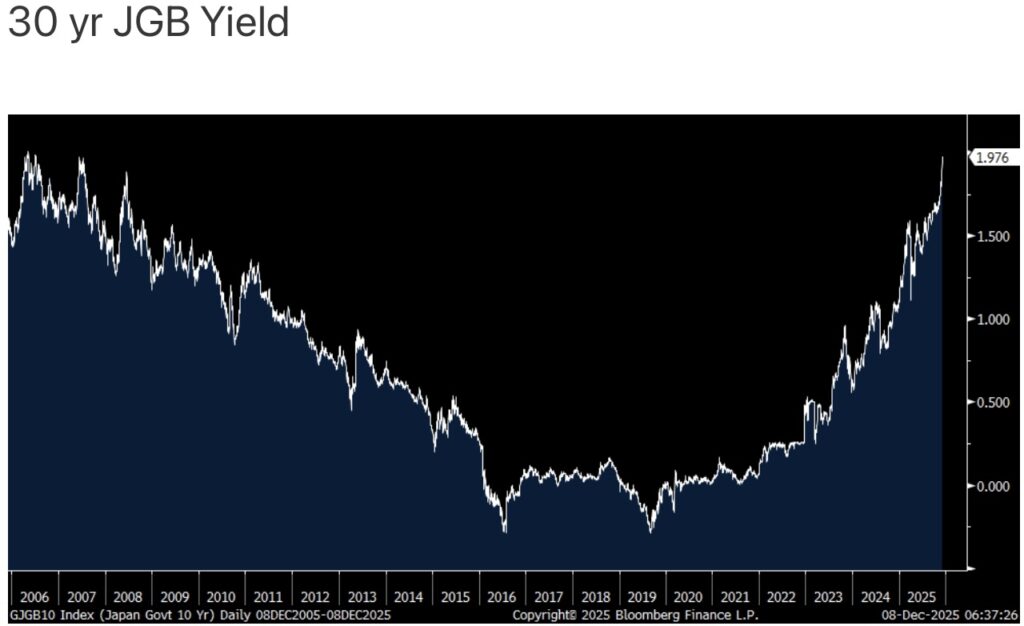

With the Japanese, while they should hike rates on December 19th, it’s obvious that the longer end of their yield curve has tightened already. The 10 yr JGB yield is up 30 bps from the last day of October to a fresh 19 yr high today at 1.98% (rounding from 1.976%) and by 87 bps this year, thus a near doubling.

Their 30 yr yield at 3.40% is just 2.8 bps from its high over the past 26 years since it was first introduced.

So, we’ve gotten all these rate cuts, with another Fed one this week, and totaling 175 bps since last year, and most likely one from the BoE next week and the rest of some important yield curves have clearly gone their own separate way. Bottom line, I continue to believe we are in a much different bond market than the one we saw over 40 yrs of falling rates that ended in 2022. Whether it’s debts and deficits that now matter and/or still lingering inflation concerns, whatever it is, central bankers no longer have control over their entire yield curves they try to influence.

I’ll be hyperbolic for a quick second and finish on this by saying again, when we had $18 trillion of negative yielding bonds back in December 2020, it was the biggest financial bubble in the history of financial bubbles in terms of dollars. And now we continue to see the unwind in longer duration sovereign bonds that I believe will carry on.

Just Released!

To listen to Alasdair Macleod discuss silver approaching $60 and the surprising reasons why it surged to new all-time highs CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Silver Lease Rates Explode In China As Gold Consolidation Continues CLICK HERE.

ALSO JUST RELEASED: Silver Short Squeeze Continues With Shortages Of Physical Metal Across The World CLICK HERE.

ALSO JUST RELEASED: Yes, Gold, Silver, Copper, But Take A Look At This Metal CLICK HERE.

ALSO JUST RELEASED: They Have Lost Control, Plus Another Gold & Silver Bull Catalyst CLICK HERE.

ALSO JUST RELEASED: Greyerz – This Man’s Predictions For The World Are Absolutely Terrifying CLICK HERE.

ALSO JUST RELEASED: 2026 WARNING: Expect More Interventions And A Scorched Economy CLICK HERE.

ALSO JUST RELEASED: We Are Headed Toward Crisis And The Destruction Of Fiat Currencies CLICK HERE.

ALSO JUST RELEASED: Besides Silver, Take A Look At This Metal CLICK HERE.

ALSO JUST RELEASED: Silver Futures Near $60 As Gold, Copper & Oil Markets Heat Up CLICK HERE.

ALSO JUST RELEASED: More Metal Shortages Plus The Road To $10,000 Gold CLICK HERE.

ALSO JUST RELEASED: Friday’s Comex Shutdown And The Wild Trading In Silver After It Reopened CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.