Look at what just collapsed to the lowest level since 2012.

December 12 (King World News) – Peter Boockvar: When I saw the story late yesterday that Ford is cutting production of its EV powered F-150 truck by half in 2024 all I could think of was the massive amount of government incentivized construction spend on everything renewable, including multiple battery plants, that is being constructed not because the demand is there but only because of the tax/grant incentives to do so. Thus if correct, after this spending binge we could then have huge over capacity and a lot of wasted, misallocated capital. I certainly won’t be surprised.

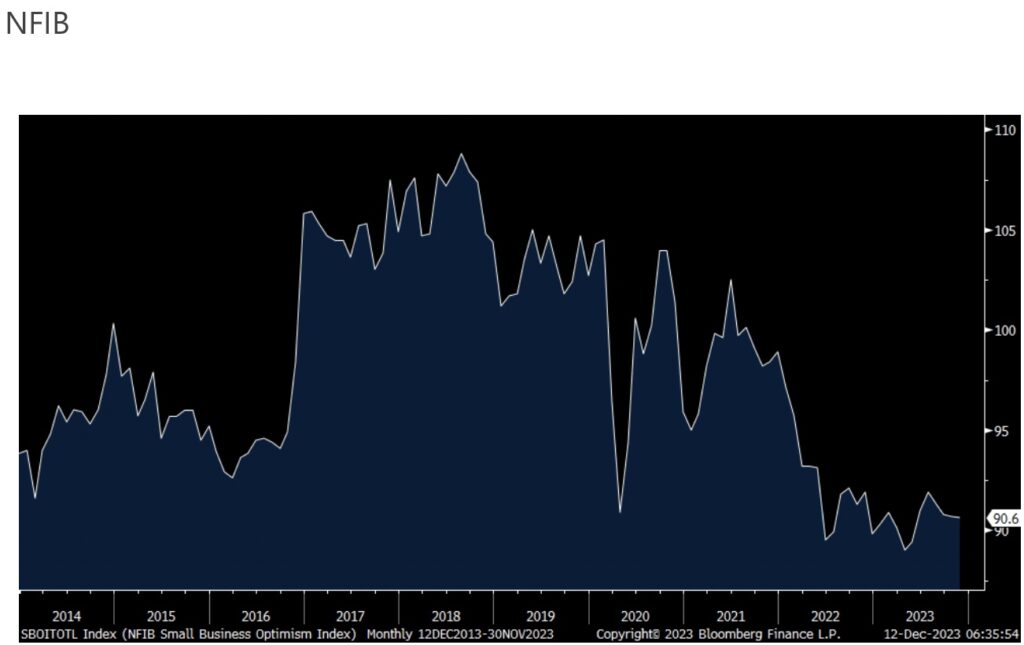

The NFIB small business optimism index for November was 90.6, little changed from the 90.7 seen in October and 90.8 in September but it is the least since May and bouncing around weak levels.

Plans to Hire rose 1 pt after falling by 1 pt last month. Job openings fell by 3 pts. On the pay side, current compensation was unchanged but there was a 6 pt jump in compensation plans to 30% which is the most since October 2022 just as we thought that maybe income growth was moderating.

Further, capital spending plans fell 1 pt m/o/m to the weakest level since April which is coincident with the earnings trends holding at the lowest level since August 2022. Also, those that Plan to Increase Inventory was down by 3 pts to -3%, so don’t expect any restocking anytime soon and thus keeping pressure on manufacturing if the case. Those that Expect a Better Economy remained very weak at -42%, though up one percentage point. Those that Expect Higher Sales rose 2 pts to -8% and there was a 2 pt rise in Good Time to Expand.

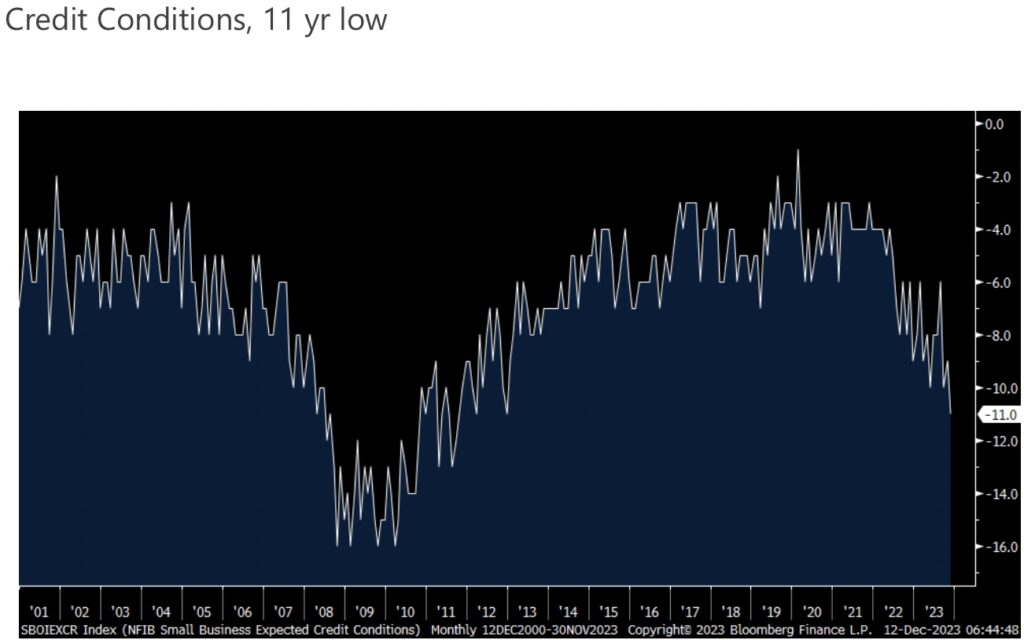

There was a 2 pt deterioration in credit conditions to the toughest since 2012…

Credit Conditions Have Collapsed To Lowest Level Since 2012!

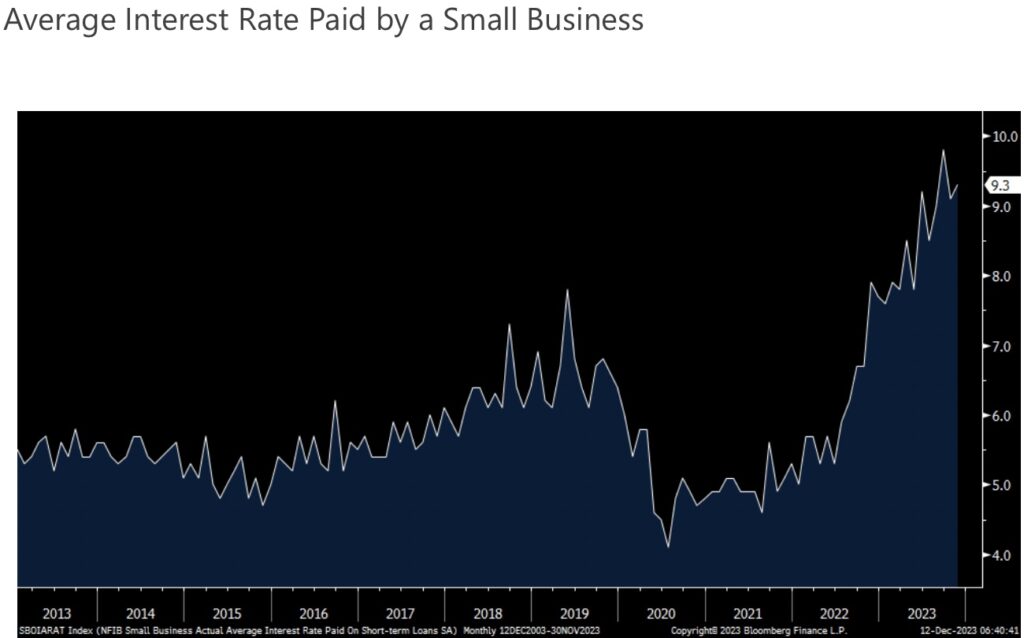

… at the same time the average borrower is paying 9.3% for loans.

Finally, and ahead of CPI today, the Higher Selling Prices component fell 5 pts to 25% to match the recent low seen in July.

According to the NFIB, “the single most important problem in operating their business” was labor quality at 24% of owners surveyed, up 1 pt while inflation was at 22%, unchanged from October but down 10 pts y/o/y.

Bottom line, small business confidence at a 6 month low of 90.6 compares with the 50 yr average of 98 as inflation, labor and cost of capital worries are the main concerns. It’s been now about two years below that long term average. There is nothing market moving here but more anecdotal highlighting the challenges that small business continues to face, even more so now with the cost of capital at almost 10%.

ALSO JUST RELEASED: The Shocking Truth About The Silver Market CLICK HERE

ALSO JUST RELEASED: Bankruptcy Filings Are Skyrocketing CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.