With the price of gold breaking below the $1,500 level, look at what is happening behind the scenes in the violent war in the gold market.

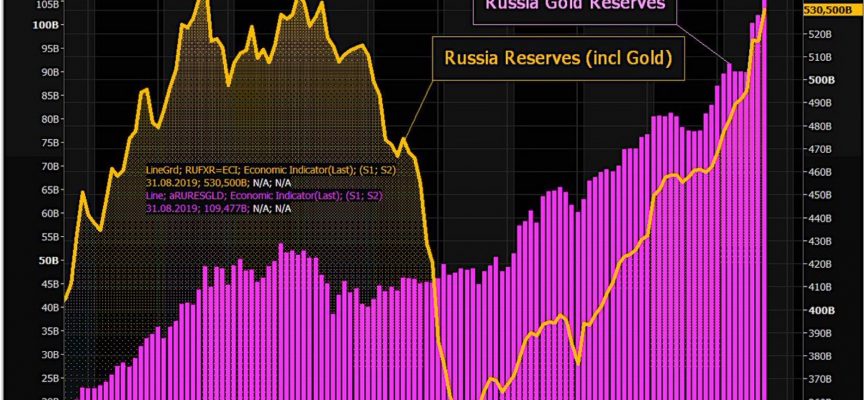

Russia’s Gold Reserves

September 9 (King World News) – Holger Zschaepitz: “Russia’s (gold) reserves hit 5 year high at $530 billion. On way to an all-time high as massive gold stash is now worth more than $100 billion. Value of Russia’s gold reserves climbed 42% in the past year. Kremlin is diversifying from US assets and gold has rallied. (See below).

Russia’s Gold Reserves Just Hit A 5 Year High!

Gold’s Correction & Record Short Bullion Banks

Alasdair Macleod: “Unless gold dips below the $1490-1500 band, even the current correction looks like a running correction, skewed to the upside…

IMPORTANT:

One of the great gold opportunities and you can take a look at this remarkable company and listen to the just-released fantastic interview with the man who runs it by CLICKING HERE OR BELOW

While one can understand that bullion banks, being record short, will be praying for a loss of bullish momentum so that they can take out the speculators’ stops, the outlook for interest rates has fundamentally altered the game against them. This is why, of the reasons that triggered this bout of profit-taking, the most important was the indication of a cut restricted to 0.25% in the Fed Funds Rate.

…But gold now needs to regain $1540+ for an immediate challenge on the $1600 level. If it happens, we can expect some bullion banks to be in trouble, which could spark state-sponsored intervention. Alternatively, a longer consolidation, with gold drifting back towards $1450 becomes a reasonable bet, given the vested interests.

The Physical Market

These are purely technical considerations, having little to do with the realities of the physical market. The extent to which Chinese and Indian buyers have been priced out of the market has been compensated for by physical ETF demand, which takes total holdings to nearly record levels. According to figures compiled by the World Gold Council, in August they increased by 122.3 tonnes, taking net demand over the last three months to 587 tonnes, an annualised rate of 2,348 tonnes.

Whatever the games played on Comex and in London forwards, physical supply remains very tight.

Here Is Where Things Stand In The Gold & Silver Markets

READ THIS NEXT! Here Is Where Things Stand In The Gold & Silver Markets CLICK HERE TO READ

More articles to follow…

In the meantime, other important releases…

Greyerz – The Greatest Illusion In World History And The Importance Of The Number 666 CLICK HERE TO READ

Look At This Massive Multi-Decade Cup & Handle Gold Breakout! Plus Other Charts That Will Below Your Mind CLICK HERE TO READ

The Global Financial Crisis Is Set To Escalate CLICK HERE TO READ

Global Central Banks Making Moves, Plus A Monetary Endgame Plan And A Look At What Hit Lowest Level Since 2016 CLICK HERE TO READ

© 2019 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged