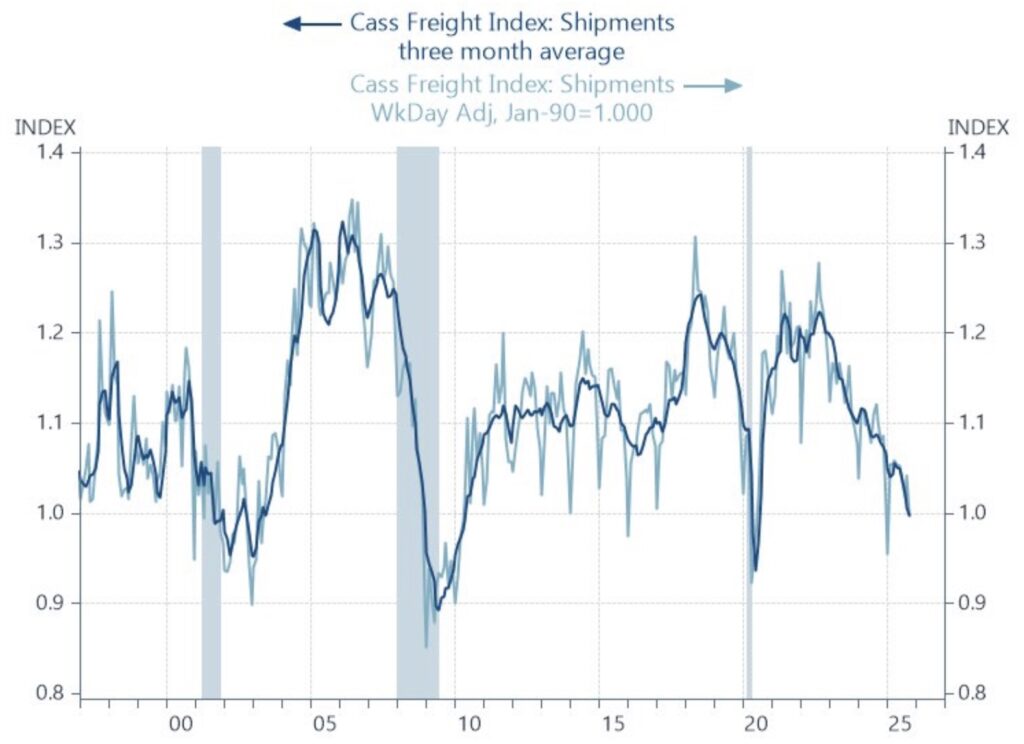

Look at what has collapsed to the lowest levels last seen during the 2020 panic.

Economic Deterioration Continues

November 17 (King World News) – Otavio Costa: The Cass Freight index is now back to levels last seen during the pandemic.

Unlike the labor data, this can’t be spun as an AI-displacement narrative.

It’s a clear sign that economic activity is deteriorating sharply.

Major rate cuts still ahead of us, in my view.

Euphoria & Panic

Peter Boockvar: The Citi Panic/Euphoria index measuring sentiment on the stock market is now at .79, almost 2x the Euphoria threshold of .41. The chart had to be widened out to include the new print seen on Saturday.

With this disclaimer from Citi, we must take note:

“The panic/euphoria model is a gauge of investor sentiment. It identifies “Panic” and “Euphoria” levels which are statistically driven buy and sell signals for the broader market. Historically, a reading below panic supports a better than 95% likelihood that stock prices will be higher one year later, while euphoria levels generate a better than 80% probability of stock prices being lower one year later. Currently the reading at or above 0.41 indicates euphoria and anything at or below -0.17 indicates panic.”

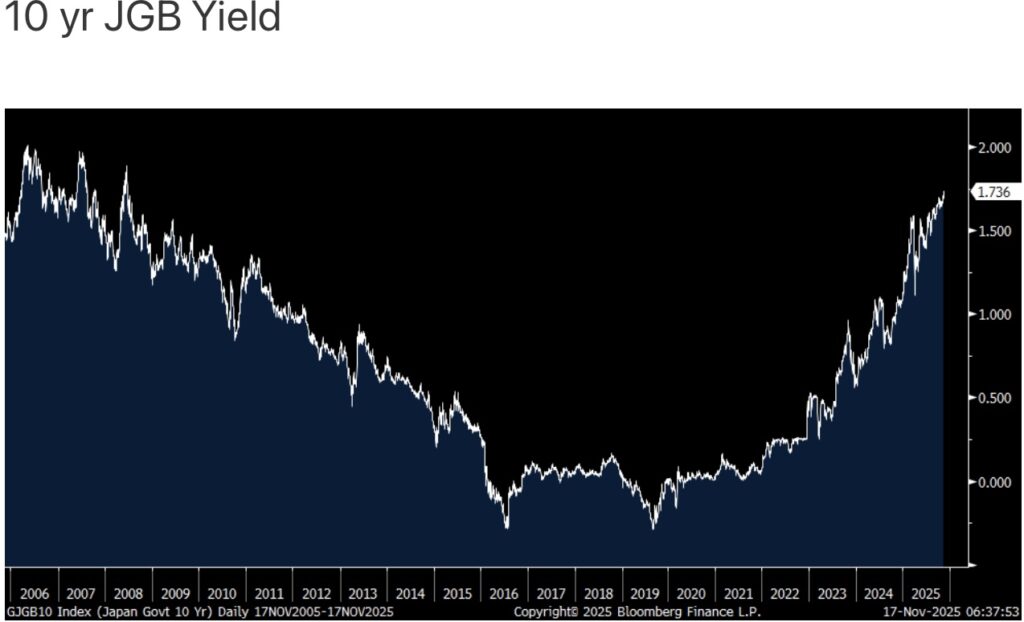

Meanwhile In Japan

Excessive debts and deficits matter in Japan as the 10 yr yield rose to a fresh 17 yr high overnight, up 2.6 bps to 1.74% in response to the fiscal spending proposals that are coming from the administration of the new PM.

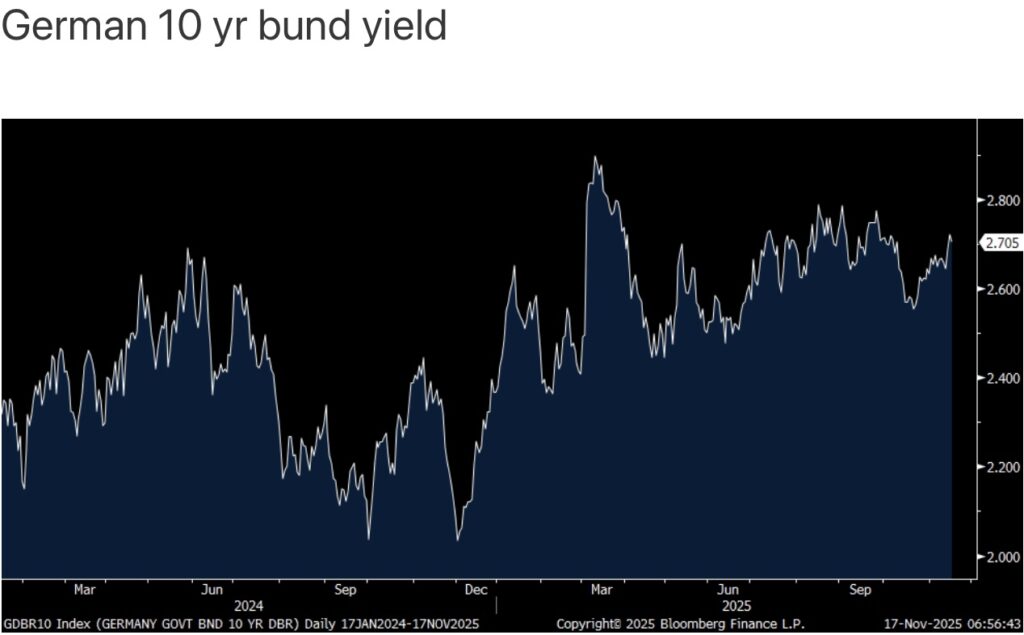

The 30 yr yield was up by 4.5 bps to 3.27% and the 40 yr yield was higher by 5.2 bps to 3.61%. The 10 yr inflation JGB breakeven was up by 5 bps to 1.60%. Also of relevance is that the move higher in the long end is happening irrespective of what the BoJ is doing with short term rates, which currently remains nothing, though I think they hike next month. Sounds familiar as the Federal Reserve has cut rates by 150 bps and the 10 yr yield is barely lower since. And in Europe, the ECB has cut its deposit rate by 200 bps since June 2024 and the German 10 yr bund yield and the French 10 yr oat yield are higher over this time frame.

The same can be said for long end gilt yields since the BoE started cutting its base rate. I remain a long duration bond bear.

Jaw-Dropping Price Predictions

To listen to Nomi Prins’s jaw-dropping predictions for gold, silver and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Here Is The Big Picture As Gold Price Remains Above $4,000 CLICK HERE.

ALSO JUST RELEASED: Nomi Prins – China Is Buying A Lot More Gold Than They Are Reporting CLICK HERE.

ALSO JUST RELEASED: The Metals Shortage Is Real And This Time It’s Global CLICK HERE.

ALSO JUST RELEASED: Silver Price Remains Radically Undervalued vs 1980 High CLICK HERE.

ALSO JUST RELEASED: Another Day In Clown World: Look At What Just Collapsed CLICK HERE.

ALSO JUST RELEASED: Silver Bull Market Just Getting Started, Plus Gold & Silver Email CLICK HERE.

ALSO JUST RELEASED: END STAGE: We Are Witnessing The Liquidity Addiction That Will End Disastrously CLICK HERE.

ALSO JUST RELEASED: Remember 2008? Risk Has Never Been Higher CLICK HERE.

ALSO JUST RELEASED: 3 Fascinating Emails And Gold Will Soar Even Higher CLICK HERE.

ALSO JUST RELEASED: Fascinating Email From A Man Who Grew Up In The 1970s CLICK HERE.

ALSO JUST RELEASED: CHINA GOLD MARKET IN TURMOIL: West vs East At The Poker Table CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.