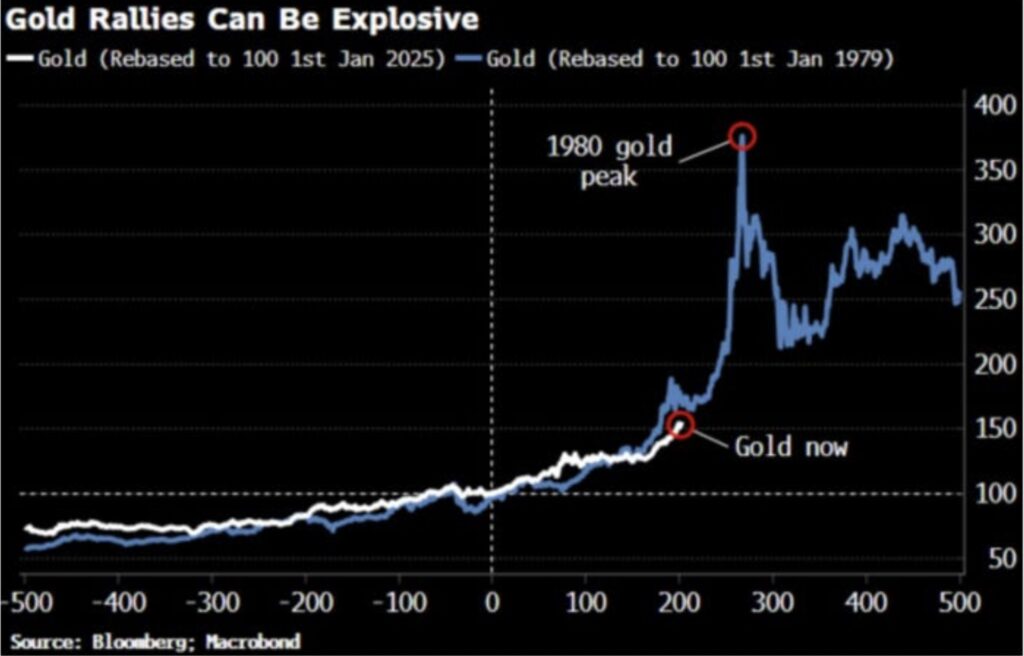

Look at how small the current gold rally is compared to the 1980 rally in gold.

Gold Rally

October 15 (King World News) – Ronnie Stoeferle at Incrementum: Gold rallies can indeed be explosive!

KING WORLD NEWS: Look At How Small The Current Gold Rally Is (WHITE LINE) Compared To 1980 Gold Rally (BLUE LINE)

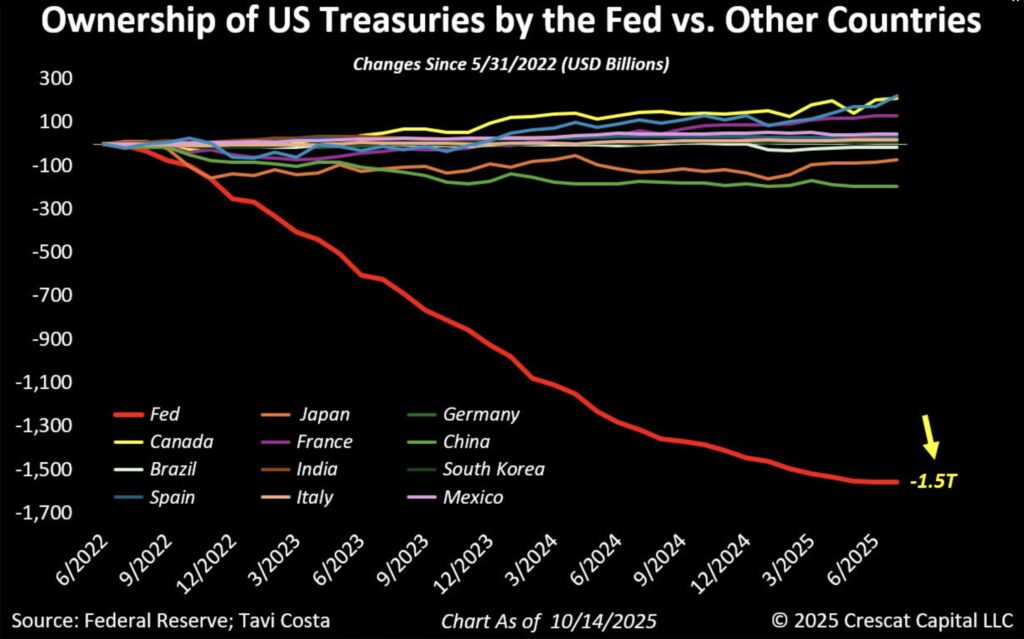

Biggest Seller Of US Treasuries

Otavio Costa: No single country or institution has reduced its Treasury holdings more significantly than the Fed in the past three years.

KING WORLD NEWS NOTE: US Fed Is Largest Seller Of US Treasuries

Eventually, the Fed — or another arm of the U.S. government — will need to step back in as the dominant buyer of Treasuries, in my view.

Ending quantitative tightening does not itself overhaul Treasury demand structurally, but it’s a necessary part of moving toward that scenario.

More importantly:

The US is steadily moving toward a framework of full financial repression, and the Fed’s policy stance will need to reflect that shift.

Another Golden Year For Gold

Gerald Celente: PUBLISHER’S NOTE: As we have greatly detailed, until gold prices spiked to the high $3,900 per ounce level, the steady rise of gold had been essentially ignored by the mainstream media. Now, no longer ignoring the facts, they are finally reporting on what is old news to Trends Journal subscribers. Here is what they are now reporting.

GOLD IS THE NEWEST “MUST-HAVE” INVESTMENT

Investors continue to pile into the gold market even as the metal’s price has broken through $4,000 in the biggest rally in half a century.

The current rally is unusual in that it was not sparked by a financial crisis. Gold’s price has climbed along with stock values, crypto, and other non-currency investments and is outperforming gold rushes during the COVID War and the 2008 Great Recession.

“We’re seeing a tug of war,” Joe Davis, Vanguard Group’s chief economist, told the Financial Times. “You’ve got the S&P pricing in an artificial intelligence supernova and you’ve got the gold camp saying, ‘we’re going to have structural deficits, we have fiscal pressure in the U.S., and I need to manage that risk’.”

“It’s gold-plated FOMO,” chief strategist Luca Paolini at Pictet Asset Management, told the Financial Times, referring to the “fear of missing out” that keeps people addicted to their smartphones. “Gold has become so big that you cannot ignore it. There comes a level when it becomes impossible not to own it.”

Even as stock markets continued their upward climb from summer into fall, gold’s demand and price kept rising as the U.S. tariff blitz, two wars, and geopolitical uncertainties drove many investors to seek a safe haven.

Also, investors are leaving the dollar—even “shorting” it or betting its value will continue to drop—but are not always sure what currency to shift into. “That uncertainty leads you straight to gold,” Nicky Shiels, an analyst at trading firm MKS Pamp, told the FT.

Gold’s price shot up another 11 percent in September alone, giving it the best month since 2011.

The gold market is “a little bit berserk,” Shiels said. A key driver has been the money flooding into exchange-traded gold funds, an easier way for individuals and institutions to take part in the rally, she noted.

The funds netted inflows of $13.6 billion in the four weeks ending 6 October, the World Gold Council reported. That has brought the total for the year to a record $60 billion, the council said.

The gold frenzy marks a shift among institutional investors as well as individuals who now invest in gold as a long-term holding as they have long done for bonds or equities, analysts told the FT.

Morgan Stanley’s advisors are now adjusting their customary suggestion of keeping 60 percent of investment in stocks and 40 percent in bonds, the FT reported. Currently, they urge clients to consider a 60-20-20 split, dividing the 40 percent equally between bonds—long considered safer than stocks—and gold.

MORE INVESTORS SEEK GOLD’S SAFETY AGAINST GOVERNMENTS’ FISCAL WOES

Gold has become the new darling of investors in part because “massive debt and populist politics threaten the value of ‘fiat’ currencies like the dollar—i.e., those backed by nothing tangible—and the central banks that issue them,” veteran Wall Street Journal columnist Greg Ip wrote in a 9 October analysis.

The woman assumed to be Japan’s next prime minister urged the Bank of Japan to keep interest rates low and plans more economic stimulus, which will involve more government borrowing. On the same day she made her statement, gold’s price broke above $4,000 for the first time.

“It wasn’t a coincidence,” Ip noted. More debt and low interest rates tend to weaken the value of national currencies.

In Britain last month, Nigel Farage, head of the populist Reform UK Party, criticized the Bank of England for selling bonds, deepening the government’s debt. France remains mired in a political crisis over the parliament’s inability to curb deficit spending.

In France and Germany, populist movements calling for the nations to abandon the euro currency are leading in political polls.

All of those events rattle national economies and make gold look like a safer place to store wealth.

Gold’s rally has progressed in three stages, according to Ip.

First, governments and central banks began stockpiling gold after Western allies froze Russia’s foreign currency reserves when it invaded Ukraine. Foreign governments are not able to seize gold bullion with the same ease they can freeze bank deposits.

Gold has replaced the euro as the second largest reserve holding among central banks, with the dollar remaining the largest.

Second, Donald Trump’s April “Liberation Day” declaration of a trade war undermined global faith in the U.S. as the stabilizing force in the world’s financial system and dollar’s role in underpinning that stability.

Third, in late August the U.S. Federal Reserve cut its interest rate to salvage the labor market even though inflation was rising again. At the same time, Trump is seeking to exert political control of the Fed, which frightens financial markets.

When Fed chair Jerome Powell’s term ends this spring, Trump is expected to appoint a replacement who will press for even deeper cuts to interest rates.

“Sovereigns, central banks, and individual investors around the world now say, ‘I now see gold as a safe harbor asset in a way the dollar used to be viewed’,” Ken Griffith, billionaire founder of the Citadel hedge fund, said in a public comment earlier this month.

That sentiment pertains not only to the dollar. The world’s collective urge to put assets into gold indicates a loss of faith in all fiat currencies, economist Robert Brooks at the Brookings Institution said in a recent analysis.

Prins Correctly Predicted Silver Would Be In The $50s This Week

To listen to Nomi Prins discuss why short sellers in the silver market are going to get destroyed, where gold is headed, what to expect from mining stocks, uranium and much more CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to Alasdair Macleod discuss the squeeze in the gold and silver markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.