With the Dow plunging 372, the Nasdaq tumbling 157 or 2.56%, the US Dollar Index breaking well below the psychologically important 98 level, and gold surging more than $20, today a legendary short seller warned the stock markets will accelerate to the downside, but gold will see buying.

By Bill Fleckenstein President Of Fleckenstein Capital

May 17 (King World News) – The stock market actually cared about a bit of negative news for once, at least early on, as the indices fell by about 1% thanks to the current edition of the Trump Travails…

IMPORTANT:

To find out which company the richest man in China has invested in, one that

Rick Rule and Sprott Asset Management are pounding the table on that

is quickly being recognized as one of the greatest investment

opportunities in the world – CLICK HERE OR BELOW:

The Key To a Good Swing Is the Follow-Through

Most of this decline was forecast by the overnight trading in the SPOOs after the news broke, and when I saw that I told myself I would only take action on this break if they buried the market in the afternoon, which is something that we haven’t seen in a very long time. That would indicate to me that the exhaustion I have been discussing might actually have taken place.

I have said before many times, and again recently, that when a mania is in force basically nothing can stop it, but after it is exhausted almost anything can take it down. This latest bit of Trump news is actually meaningful, because a huge portion of the recent stock market rally has been predicated on all the great things Trump would do quickly and painlessly (as I have also noted many times) and, at a minimum, I expect his agenda will be thwarted for quite some time.

“Now, You Know What Solves It? When the Economy Crashes…”

It has also been apparent from day one, as I noted the day after the election, that Trump was going to increase uncertainty, but that thought has been ignored. What has also been clear is that, in addition to everything else, the Democrats and many of the Republicans were going to try to obstruct him at every turn simply out of spite and dislike regardless of what the policy was. The point being, the expectations that had accumulated were never going to be met and we could be in for a protracted period of political in-fighting and not accomplishing much.

If the stock market decides that is the case and tanks, then all of a sudden the economic data will be looked at differently and the whole storyline of the Fed’s miraculous economic recovery will once again be called into question because it is all B.S. to begin with. (It would seem to me that the FX market has figured that out before the stock market has.)

In any case, in the all-important afternoon trading, they actually sold them again (though they didn’t really “bury” them), so I just took a little action, shorting more IBM and buying a slug of INTC puts. (I didn’t go crazy but there is always tomorrow.) By day’s end the market was almost 2% lower, with momentum, concept, and tech stocks hit especially hard (as they deserved to be, given that their outperformance due to multiple expansion was just hot air). That led to a 2.5% loss for the Nasdaq. I wouldn’t be shocked to see rapid downside acceleration sometime soon, but that is not new news from me.

Away from stocks, green paper was quite a bit weaker, oil was a nonevent, fixed income enjoyed the chaos and went nuts, while the metals were mixed with silver flat as gold added 1.5%. The miners had a lame day. A couple did well while most just flailed.

Assay What Now?

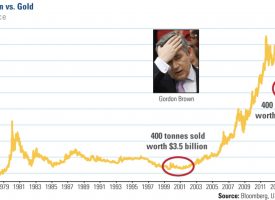

As everyone knows, gold was sold on the back of a Trump victory, but when you think about that, it seems crazy given everything that has gone on. Despite whatever good Trump may still do, the fact is that he is the walking embodiment of uncertainty and that, combined with potentially a fresh look at what the Fed has accomplished, ought to be supportive of gold.

Included below are two questions and answers from the Q&A’s with Bill Fleckenstein.

Question About The Action In The Mining Stocks

Question: Hi Bill – I have noticed that the gold miners including the juniors have not really participated in the recent gold rally, they have moved at best as much as gold (e.g. again this am despite the huge price increase in gold). Do you see any issue with this for the miners and the gold price going forward? Thx.

Answer from Fleck: “It is what it is. They lead, they lag, sometimes it matters, other times it doesn’t. The juniors have most likely also been impacted by the fear associated with the GDXJ rebalancing as well.”

Question: Bill, long time observer going back to the 1980’s. I am hoping to pick your mind on a medium-term horizon. Walking through the streets of Manhattan, where I have lived for 30+ years, the expanding number of empty retail locations and unused commercial space is truly astounding. As I think this through, the implications to the maintenance costs of Apartment owners is not pretty as the loss of the subsidy to the overall apartment building from no longer collecting retail rents will cause individual homeowner monthly maintenance costs to rise and hence put future downward pressure on home prices. There is investible opportunity here, I can feel it, and wonder if you have a view point of the types or classes of securities that would benefit from an overall change in the real estate environment in major cities.

Answer from Fleck: “That is a very astute observation, but I know of no way you can really capture that idea.”

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

KWN has just released one of Bill Fleckenstein’s greatest audio interviews ever and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: James Turk – We May Be In The Early Stages Of A Massive Short Squeeze In The Gold Market CLICK HERE.

***KWN has already released the fascinating audio interview with Rick Rule discussing stock picks for gold, silver, and uranium, as well as the big picture for the gold and silver markets and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.