Is this “it” for the US dollar? Plus a stunning look at gold priced in global fiat currencies.

Is This “It” For The Dollar?

August 27 (King World News) – Peter Boockvar: Whenever the US dollar starts to weaken I always wonder if this is it. ‘It’ being that ever exploding US debts and deficits actually matter in the eyes of the holders of dollars. Rather that than the dollar, along with all other fiat currencies, just being an interest rate differential play as it was beginning in June 2021 (Jay Powell said he’s thinking about trimming QE) through its peak in October 2022 (around the time the Fed finished its last 75 bps rate hike) when it rallied notably. I bring this up because just maybe, and I emphasize ‘maybe’, it will be the FX market that reflects the ever worsening US government financial situation initially instead of the US Treasury market.

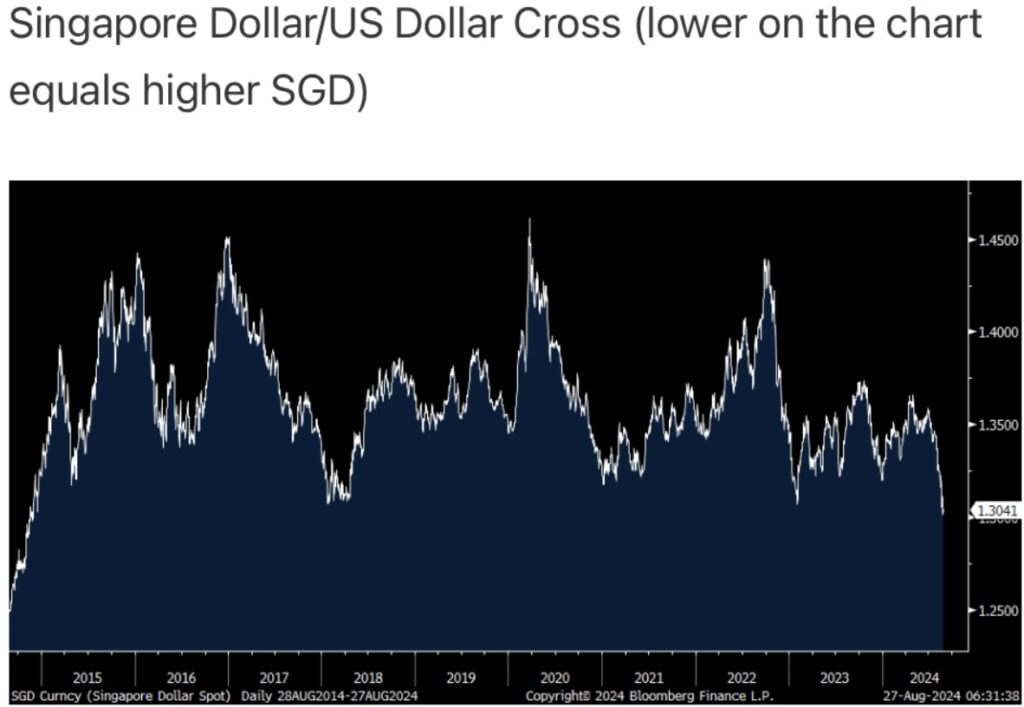

The currency that I’m focused on is the Singapore dollar because US yields remain about 100 bps above those seen in Singapore but the Singapore dollar is at a 10 yr high vs the US dollar. The Singapore budget deficit is less than .5% of GDP which compares to the US at around 6%. Yes, Singapore is a tiny nation state of just 6mm people, the size of a US major city and an amazing city it is, but fiscal responsibility in this case apparently matters for its currency. I’ve mentioned it a few times over the years but we remain bullish and long some Singapore stocks, and by extension the SGD. The Straits trades cheaply at 11x ’24 eps and with a 5.4% dividend yield.

As for the euro/yen heavy DXY, it’s at its lowest level since July 2023 where it traded then for a few days below 100. That is the key level as if it breaks there convincingly, go back to April 2022 the last time it did. Outside of gold which is at a record high, in part because of the US dollar weakness, some commodities have recently bounced with the CRB raw industrials index at a 5 week high, but they remain well below their highs. Their performance from here will be key to watch as will import prices with the weaker dollar. We remain bullish and long energy, uranium, copper, precious metals and fertilizer stocks.

As we digest last week’s Jackson Hole coffee talk, I heard again Jay Powell defer some blame on believing in transitory by saying inflation was a global thing. And while it was, a lot of it flowed out of the US. My friend Barry Knapp, who runs Ironsides Macro, hit this well in his weekend piece by saying “the seemingly politically motivated characterization of inflation as a global phenomenon, now by Chair Powell, underestimates the role of US consumption in global economic activity. The US runs a massive current account deficit, other major economies run surpluses due to having export dependent economic models. Increased US goods demand following massive fiscal stimulus drove the global supply demand goods imbalance.” https://substack.com/@ironsidesmacro

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Stunning Look At Gold Priced In Fiat Currencies

Graddhy out of Sweden: Major FIAT currencies are in a losing parabolic run vs gold. Standard FX pair charts does not reveal the debasing of FIAT currencies. You need to measure currencies vs gold.

Gold Going Parabolic Priced In British Pounds!

Gold Going Parabolic Priced In Euros!

Gold Going Parabolic Priced In Canadian Dollars!

Gold Going Parabolic Priced In Australian Dollars!

And it is vital to realize this is not gold going up, it is mainly FIAT going down.

To listen to Alasdair Macleod discuss what may cause the silver market to explode higher as well as what’s in store for gold and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.