Interest rates around the world are rising and it is impacting markets across the globe. Take a look…

Interest Rates Around The World Are Rising

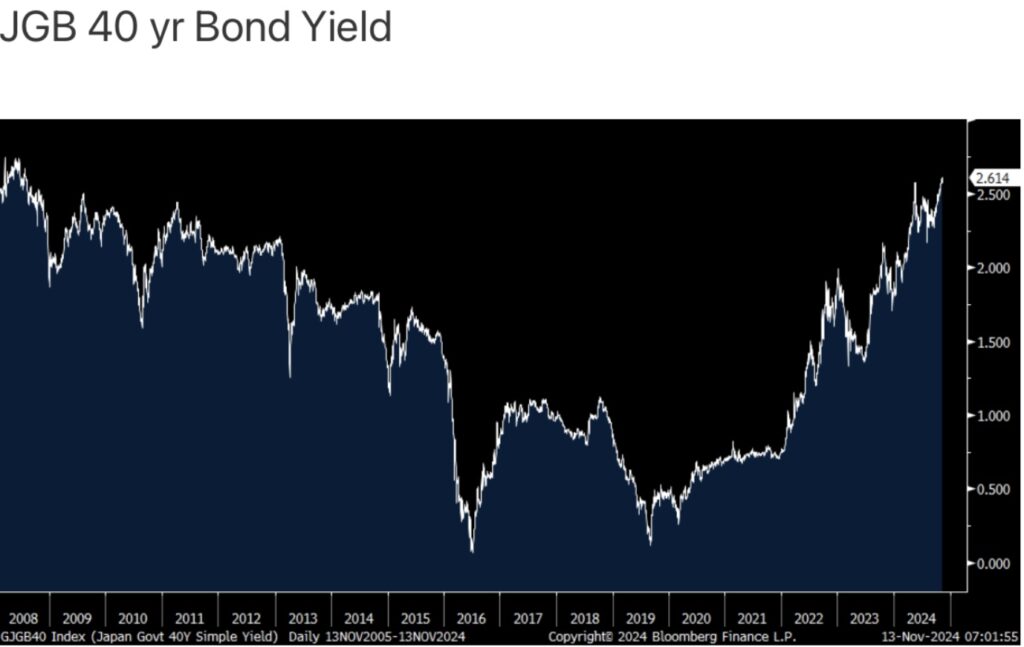

November 13 (King World News) – Peter Boockvar: Following the US rate rise yesterday, yields in Asia jumped, particularly in Japan and Australia and they are moving up again in Europe. The epic bond bubble was global when $18 trillion of negative yielding securities reached its apex in December 2020 and the unwind and bear market is global too. In particular, the Japanese 40 yr bond yield rose to the highest level since 2008 overnight and I continue to focus on this maturity because it is least influenced by what the BoJ does on the short end.

A factor too in Japanese yields was the higher than expected October PPI print where it rose 3.4% y/o/y, above the estimate of up 2.9% with the weaker yen likely a factor. The yen today by the way is teasing the 155 level again with 160 the real big level.

At a Yahoo Finance event yesterday, Neel Kashkari spoke and this stood out to me on the Fed’s balance sheet where he basically said that the bar is quite high for them to stop shrinking it.

These comments from VICI Properties, a REIT we own that focuses on the gaming and experiential side of real estate ownership, came on November 1st’s earnings call but I finally got around to read the transcript and it reveals the real world impact on the real estate industry from these meme like moves in the US Treasury market and the swift rise in rates seen over the past few months just as many thought that Fed rate cuts were going to ease the rate pain.

The 10 yr yield was just below 4.40% on that day and the question to the CEO was this referring to the rise in the yield off the 3.60% low in September, “Do you think that’s had any effect on just the propensity of your counterparts to want to transact or on just where pricing might need to be?”

Interest Rate Volatility Has Been Painful

The response, “I wouldn’t say that move over the last month has necessarily by itself been highly impactful, but it’s all been part of a period of volatility that has just been, frankly, it’s been kind of nauseating. And I do think it’s led to a level of indecision and inaction that is reflected certainly for us and what we’ve been able to come forward and tell you about. And needless to say, we very much hope that this period of volatility will soon start to pass.” This of course was just days before the election too.

“Just to traumatize that volatility. Back in 2018, the number of days in the trading year when the US 10 yr moved 10 bps or more was 3; in 2019, it was 7; in 2020, it was 16; in 2021, it was 8; in 2022, it was 46 days; it was 39 days last year. And given the volatility we’ve seen even this week, I think we’re into the 20s now. And this is really just an example of how a lot of people on both sides of the transaction table have just been trying to figure out where am I today? And where the hell am I going to be next week? And needless to say, we are among those many in both America and globally who hope things really kind of calm down next week and that the kind of volatility we’ve especially seen in the MOVE index starts to quiet down because it has definitely led to all kinds of different behaviors by investors.”…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

Rocket Mortgage

Rocket talked about the rate volatility too last night:

“Over the past few months, the market has thrown our industry almost every curveball imaginable. With inflation easing, the Fed cut rates for the first time in four years. But in an interesting twist, while the Fed lowered rates, mortgage rates did not follow suit. Instead, both the 10 yr treasury yield and the 30 yr fixed mortgage rate actually increased.” Yep.

They see things though as glass half full, “While affordability and inventory are certainly still challenges, the market is showing signs of improvement compared to last year…Our mindset reflects the importance of optimism in a world that continues to be riddled with uncertainty. That is because homeownership is and always will be the cornerstone of the American Dream.”

Home Depot

From another business highly reliant on interest rates, Home Depot:

“From a geographical perspective, storms and more favorable weather throughout the quarter drove a higher degree of variability in the performance across our divisions and four of our 19 US regions delivered positive comps.”

“As weather normalized, we saw better engagement across seasonal goods and certain outdoor projects. But, we continue to see pressure on larger remodeling projects, driven by the higher interest rate environment and continued macroeconomic uncertainty.” The pressure was mostly on kitchen and bathroom remodels.

In the quarter, “our comp transactions decreased .6% and comp average ticket decreased .8%.” Their guidance for fiscal 2024 was a comp drop of 2.5% y/o/y.

Home Purchases And Refi’s

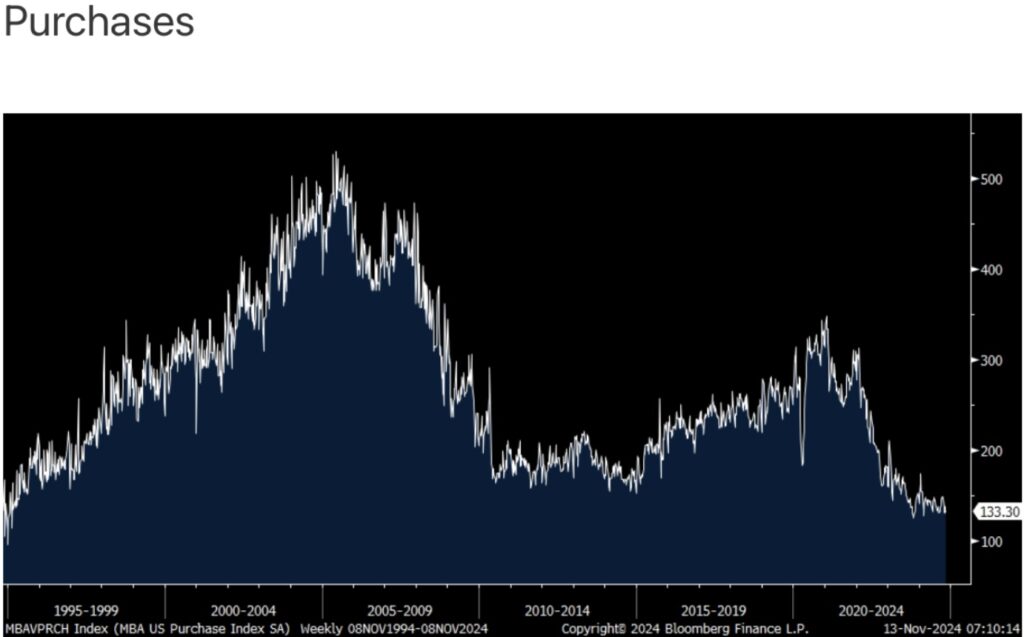

With another tick up in mortgage rates with the average 30 yr at 6.86%, up 5 bps w/o/w, mortgage apps were little changed. Purchases rose 1.9% but after dropping by 5.1% in the week before. They continue to bounce along 30 yr lows and continues to be an economic drag on all the ancillary activities that take place upon the buy and sale of an existing home.

Home Purchases Remain Collapsed Near 30 Year Lows

Refi’s fell 1.5% and are at the lowest level since June.

Home Refi’s Have Collapsed Near Lowest Level In History

JUST RELEASED!

To listen to Rob Arnott discuss how investors around the world can prepare themselves for the turbulence in global markets that lies ahead CLICK HERE OR ON THE IMAGE BELOW.

To listen to the jaw-dropping gold and silver price predictions that Nomi Prins just made CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.