We have just witnessed a historic event in the silver market. In fact, this is the first time in history this has happened in the silver futures market.

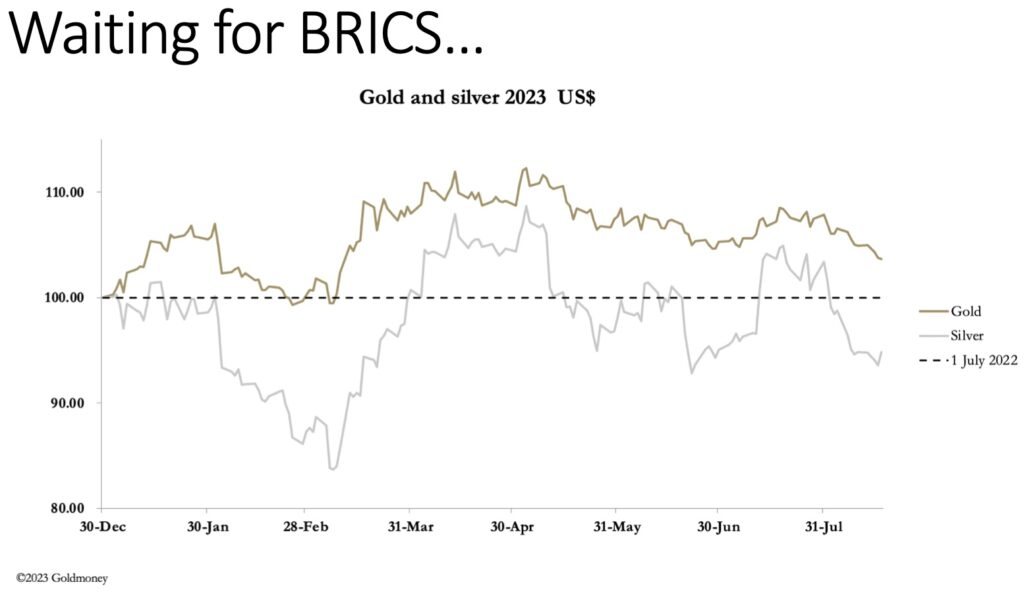

Waiting for BRICS…

August 19 (King World News) – Alasdair Macleod, head of Research at Goldmoney: The sell-off in precious metals which started in late July continued this week, but its momentum slowed with silver even showing a modest gain on the week so far. In early European trading, gold was $1892, having traded down to $1885 yesterday, for a net fall of $19 on the week. Silver was $22.78 having traded down to $22.30 on Tuesday but is up just 10 cents from last Friday’s close.

On Comex, turnover in the gold contract was subdued, but in silver it was moderate to healthy.

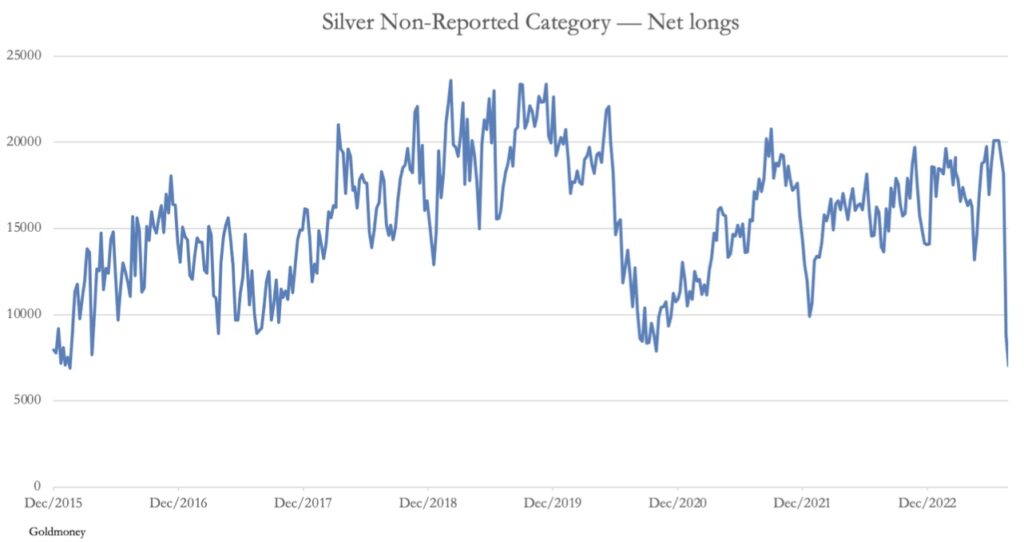

In silver, the Commitment of Traders report for 8 August showed the Managed Money category was net short 3,781 contracts, with very low levels of longs and shorts making the balance. It seems that the trading community has withdrawn from this contract. And the Swaps unusually are sitting on net longs of 499 contracts. It is the Non-Reported category which has sold down its net long position. This is up next.

HISTORIC UNWIND IN SILVER:

First Time In History Non-Reported Net Long Positions In Silver Have Seen Such A Historic Collapse!

With Open Interest on Comex being low (it has been lower recently, down to 114,421 on 3 July, compared with 137,406 on Wednesday), silver is ripe for a substantial bear squeeze, when interest in gold resumes.

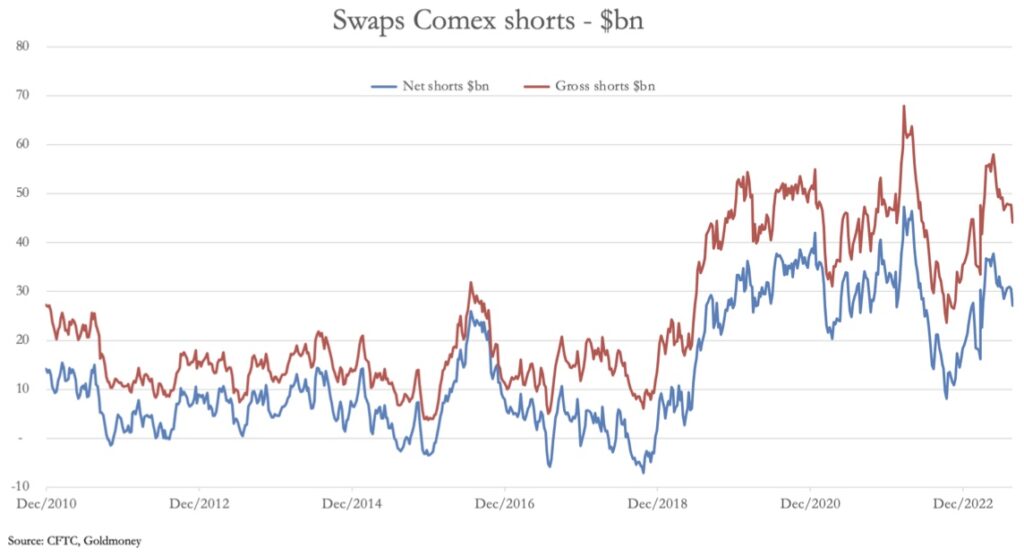

Paper markets assume two things are working against gold: a dollar which appears to have stabilised recovering from recent lows, and rising interest rates. In the last fortnight, it has become apparent that lower interest rates are even further away, and government bond yields are continuing to rise. US, Eurozone, and UK bond yields are hitting multi-year highs. For the Swaps trying to recover their shorts, this is manna from Heaven but there is some way for them to go, as the next chart illustrates.

These are comprised mostly of bullion bank trading desks, which face two problems. Senior dealers are probably on holiday, leaving their juniors with instructions not to do anything rash, and this coming week sees the BRICS summit in Johannesburg, which could have a significant impact on the gold price. Additionally, the September gold contract on Comex is approaching expiry, and they will want to control the price so that the $1900 strike op7ons expire worthless.

In that sense, this week’s dip below $1900 can be regarded as testing the water. But the BRICS summit starts next Tuesday, and over the course of the two-day meeting, either rumours of a new trade settlement currency backed by gold will be confirmed or laid to rest. Gold backing any currency is like a Dracula to fiat currencies, and the gold/dollar relationship can be expected to react accordingly.

But the BRICS conference is against a background of both the rouble and renminbi falling against the dollar, as the cost of the Ukrainian war and the return of instability in China’s residential property market are in the headlines again. But what is more important is the decline of China’s exports, which indicates that US and European economies are contracting as interest rates continue to rise. The ghost of the 1970s is back…to continue listening to Alasdair Macleod discuss the plunge in gold and silver prices, the historic BRICS meeting that will take place next week and so much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.