Here is why gold and silver are rallying after Thursday’s takedown.

February 13 (King World News) – Alasdair Macleod: Evidence is mounting that the silver shorts on Comex and London are desperate to close their positions. Will they use the Chinese New Year holiday to this end?

In this report, we focus on silver, illustrating how silver derivatives on Comex and London are becoming irrelevant. This is because price discovery has moved to Shanghai, whose premiums are leading to physical metal being drained out of Comex and London vaults. But next week, with Shanghai closed for business, expect even greater price distortions in the days ahead. Indeed, Shanghai is closed as of now.

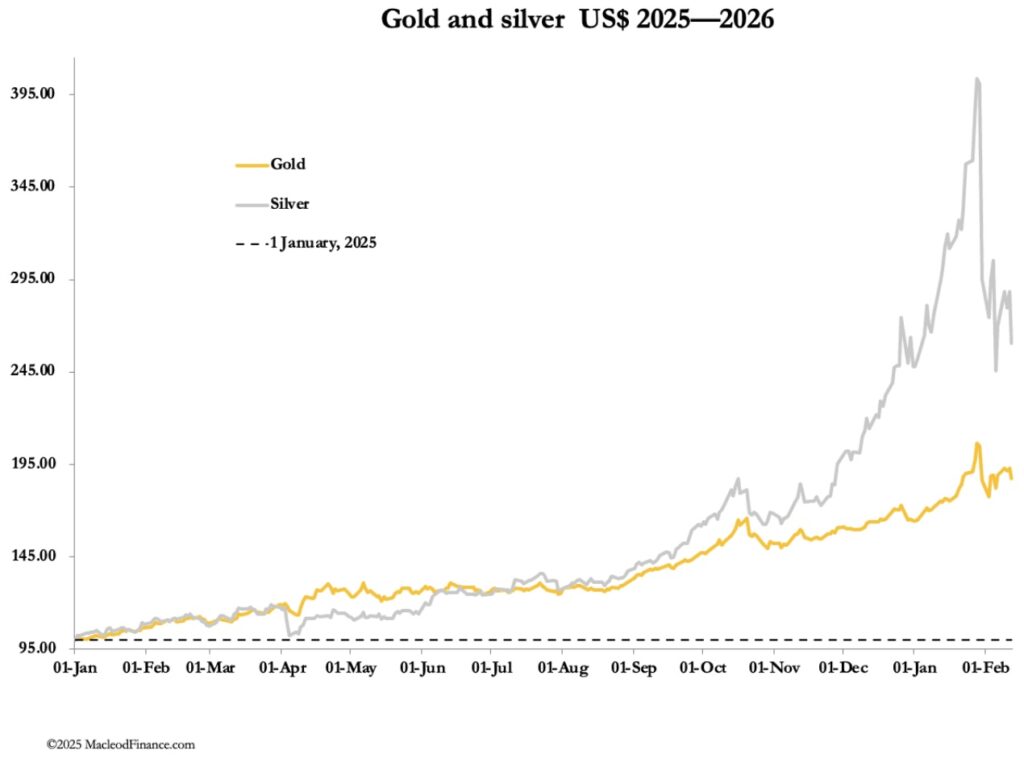

Following a solid recovery from recent unprecedented falls in gold and silver prices, yesterday they were hit again, with silver down over 10% at one stage. Prices opened a little higher this morning. In European morning trade, gold was $4950, down $20 from last Friday’s close. And silver at $77.00 was down 85 cents on balance.

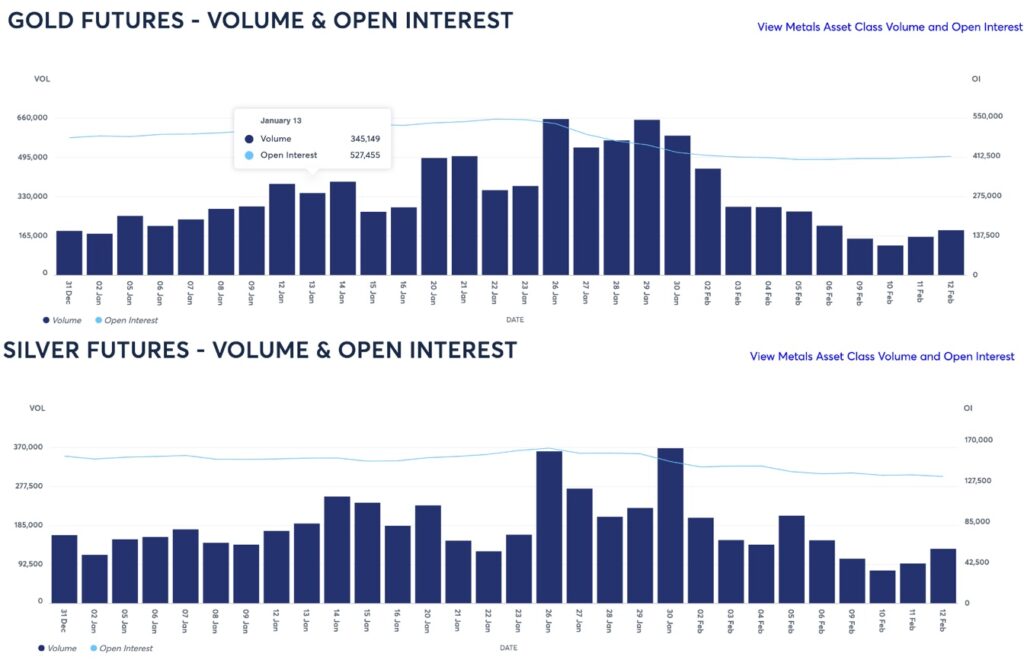

Trade volumes on Comex were very low, even below those in holiday seasons, illustrated in the snapshot below:

Ahead of yesterday’s price smash, on Tuesday silver’s volume fell to 78,296 contracts, less than half that of 31 December and one third less than on 2 January.

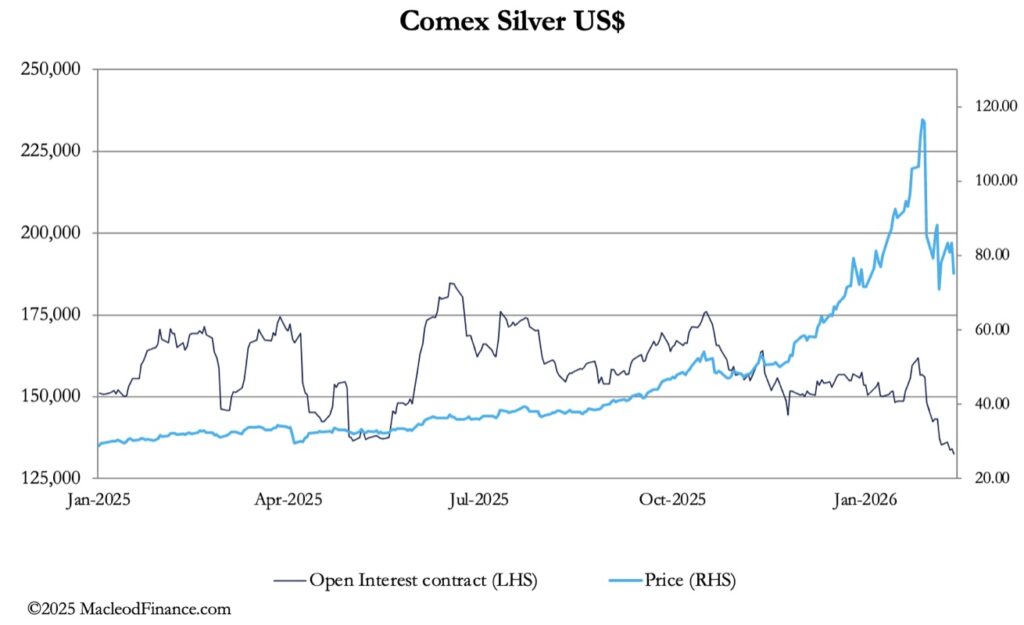

Speculative interest is extremely low, shown in the next silver chart, but a similar pattern can be seen in gold:

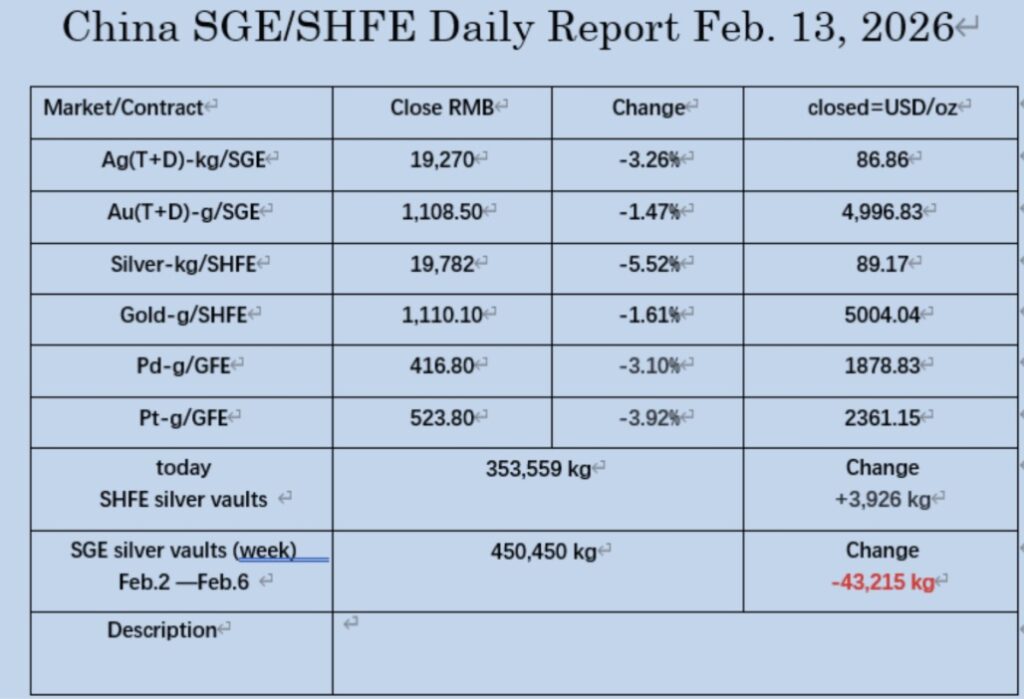

Additionally, Comex futures stand at a substantial discount to Shanghai. The next illustration shows last night’s Shanghai close:

While gold is trading in line with Comex on the Shanghai Futures Exchange, at $89.17 the silver contract was at a premium of over 13% to Comex at SHFE’s close.

Putting all this evidence together, it is clear that not only is the market being set in Shanghai and not Comex nor by implication London, but the price of silver on Comex is false. It is the price of disconnected paper bearing diminishing relavence to physical metal. But so long as this distortion continues, there will be attempts to acquire physical silver and gold by buying futures and forwards at discounted prices with a view to taking delivery.

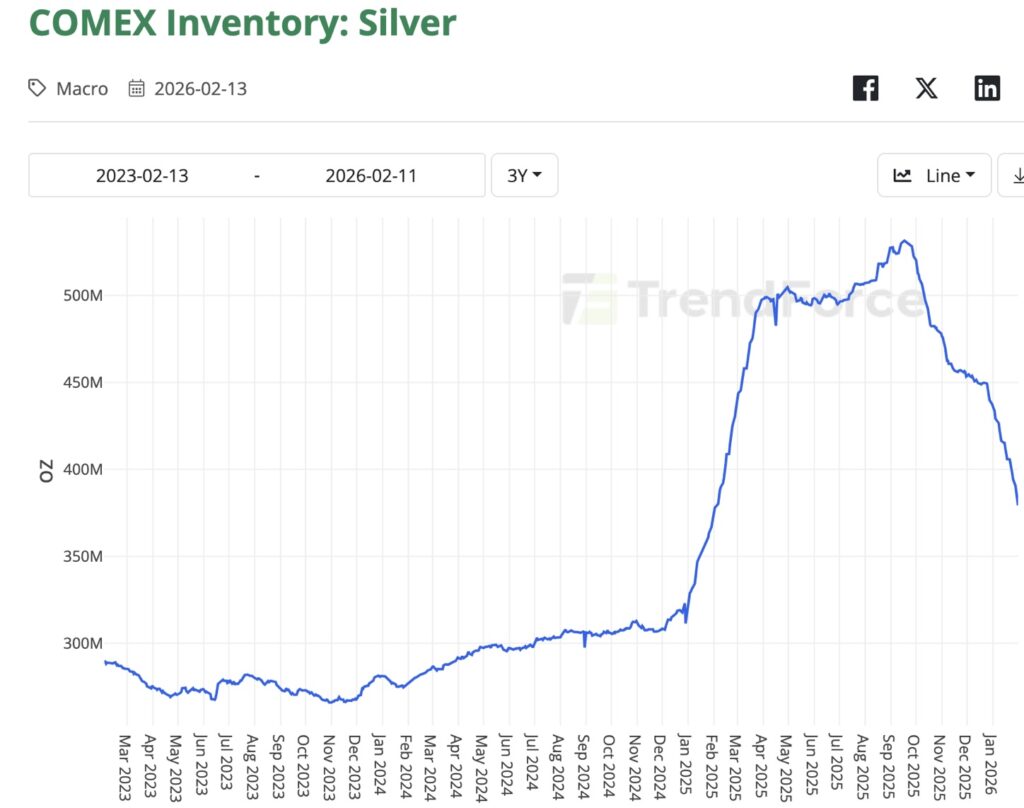

We can see the consequences in the decline in stocks in today’s Comex silver vault statistics:

5,107,820 ounces have been moved from registered as available for delivery to Eligible, which is not available for delivery. It is a noticeable trend recently. Furthermore, 2,335,797 ounces have been withdrawn from Comex vaults altogether, reducing stocks at pace This is also a continuing drain as we can see in the next chart:

Comex vaults have lost 30% of total silver stocks from early-October when London had a delivery panic driving lease rates to nearly 40%. Physical liquidity can only be restored if Comex futures trade above Shanghai prices. Until then, they will continue to be drained.

On Comex, the theoretical total available for delivery today is the equivalent of only 18,606 contracts. Meanwhile, open interest in the March future is 59,418 contracts, whose first position (when longs are allocated deliveries for which they must have the funds up front) is 26 February, a week on Thursday.

Obviously, we should expect March’s open interest to reduce ahead of that event to less than the silver available. But it is an event to be watched, following which silver available for delivery could be a serious problem.

While all this looks immensely bullish, Shanghai will be closed next week for the Chinese New Year holidays. As the true pricing centre for silver and ahead of 26 February’s first position, bullion bank traders seeking to close their Comex shorts might work together to drive paper prices lower. It might be their last chance to do so.

This is not something which we can forecast, but it is as well to be wary. While dealers in derivatives will do anything to reduce their silver losses, their risk is that vault stocks will deplete even more rapidly. It is a good example of a situation which stackers should ignore while traders get whipsawed. We appear to be seeing silver derivatives in the West becoming less and less relevant.

ALSO JUST RELEASED!

Gold: The Anti-Bubble, Plus How Do I Keep My Money? CLICK HERE.

Is Another Gold & Silver Takedown About To Happen? Plus $369 Oil And Booming Commodities CLICK HERE.

Albert Edwards – Is The NASDAQ About To Crash? CLICK HERE.

People Are Being Deceived, The Gold Bull Market Is Not Finished CLICK HERE.

Michael Oliver – Gold Bull Market Nowhere Near Its Final Climax CLICK HERE.

Astonishing! The Super Wealthy Still Don’t Own Gold As Miners Near Blastoff CLICK HERE.

$10,000 Gold And The Vault Behind COMEX CLICK HERE.

Global Banking Elite Orchestrate Shadow Bailout To Survive $5,600 Gold Peak CLICK HERE.

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Gold & Silver Open Interest Has Collapsed To Historic Low! CLICK HERE.

UPDATE: Here Is Where The Silver Market Stands After The Crash CLICK HERE.

SILVER: People Start Making Poor Decisions When Volatility Spikes CLICK HERE.

Central Banks Will Move Gold Price Much Higher CLICK HERE.

SILVER: Look At What Is At One Of The Most Undervalued Levels In History CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.