Here is the setup ahead of the next Fed Meeting.

July 2 (King World News) – Peter Boockvar: Austan Goolsbee is not a voting member of the Fed this year but I believe is for the meeting in July as Mester has resigned and her replacement Beth Hammack doesn’t join until late August. He is proving to be the main dove and is all set to cut rates it seems. Today in Sintra, Portugal he said:

“We got to this rate when inflation was over 4%, and inflation is now down close to 2.5%, so if you sit with the rate somewhere while inflation goes down you’re tightening. The reason that you would want to tighten is if you think that you’re not on a path to 2%.”

Also:

“If employment starts falling apart or if the economy begins to weaken, which you’ve seen some warning signs, you’ve got to balance that off with how progress you’re making on the price front. The unemployment rate is still quite low, but it has been rising.”

Goolsbee cites PCE inflation at around 2.5% but if you looked instead at CPI in driving policy, the June core rate is expected to rise 3.4%. The main difference is the weights of healthcare and housing and how healthcare prices are calculated. Choose your preferred inflation stat, and monetary policy gets done differently.

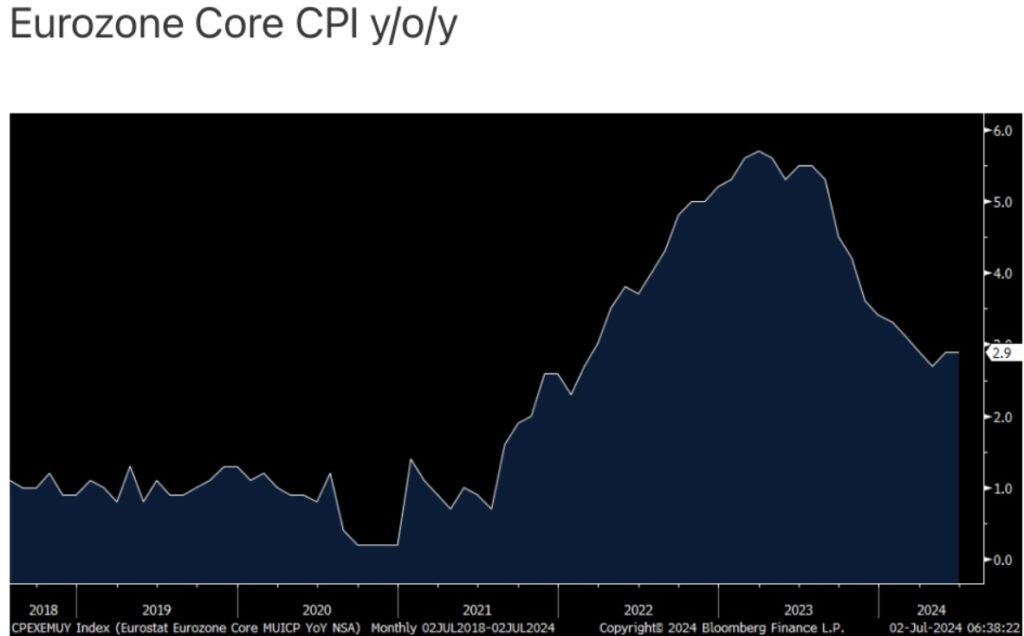

The Eurozone CPI in June, where housing is only around 6% of the calculation, rose 2.5% y/o/y as expected vs 2.6% in May. The core rate remained at 2.9%, one tenth above the estimate.

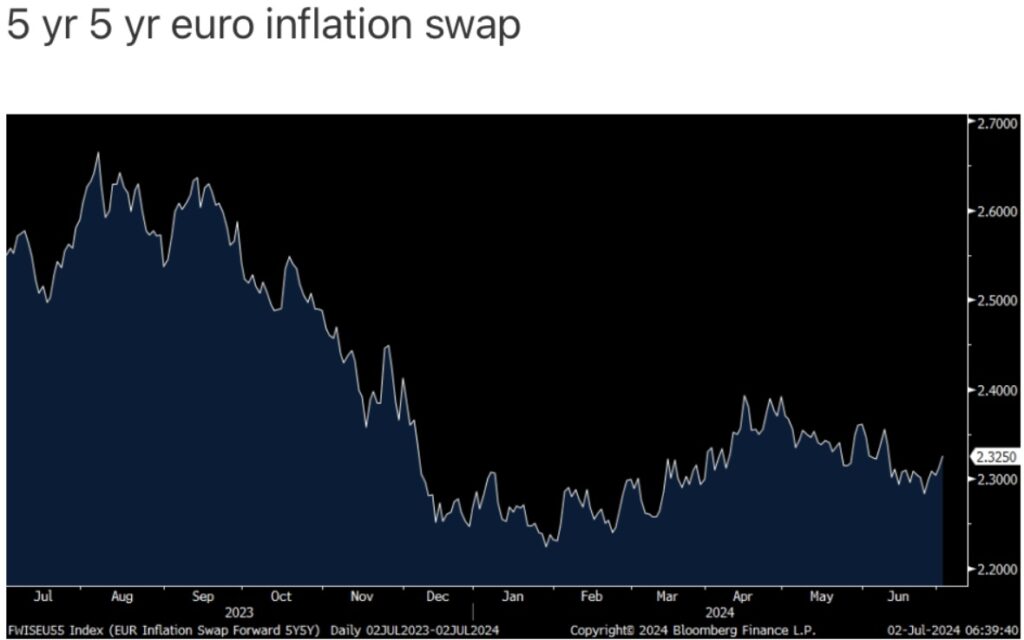

The response is slightly higher sovereign bond yields again and the 5 yr 5 yr euro inflation swap is up by 1 bp to 2.32%, a 3 week high.

How will Christine Lagarde respond to this after the rate cut last month? Also speaking in Sintra, she said:

“We are still facing several uncertainties regarding future inflation, especially in terms of how the nexus of profits, wages and productivity will evolve and whether the economy will be hit by new supply side shocks. It will take time for us to gather sufficient data to be certain that the risks of above target inflation have passed.”

So for now, that rate cut was a tweak and members debate whether we’ll see a few more by year end. The doves think they are restrictive but with REAL rates at only about 1.25%, I’m not sure what they are thinking, unless they think negative REAL rates was normal.

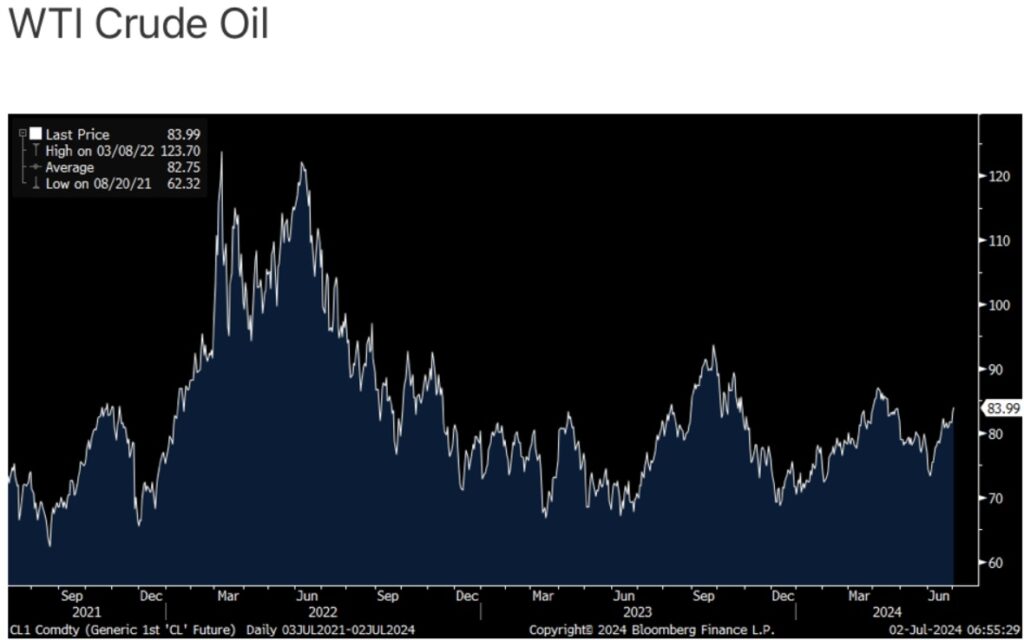

Crude Oil Rallying

Speaking of inflation, keep your eye on oil prices by the way as WTI is at a 2 1/2 month high. Said again, US rig counts keep dropping.

West Is Manipulating Gold Like Crazy

To listen to Stephen Leeb discuss everything from war to the gold and silver markets by CLICKING HERE OR ON THE IMAGE BELOW.

Just Released!

To listen to James Turk discuss why the coming global collapse will be far worse than 2008 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.