Here is a look at inflation, plus real estate and immigration.

Concerned There Is Not Enough Inflation, WTF?

September 23 (King World News) – Peter Boockvar: Once purchasing power is lost, it is lost forever and Federal Reserve Governor Chris Waller inadvertently made that perfectly clear when he spoke on Friday. He told CNBC in an interview that “What’s got me a little more concerned is inflation is running softer than I thought.” He’s ‘concerned’ after we just experienced a 21% jump in the cost of living since February 2020? Tell that to the shopper at Walmart or Dollar General. Remember ‘average inflation targeting’? That was a policy that the Fed implemented in August 2020 and turned out to be one of the most disastrous policy initiatives in their history dating back to 1913.

It was defined as this, “On price stability, the FOMC adjusted its strategy for achieving its longer-run inflation goal of 2 percent by noting that it “seeks to achieve inflation that averages 2 percent over time.” To this end, the revised statement states that “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.” We know that policy initiative completely blew up on them.

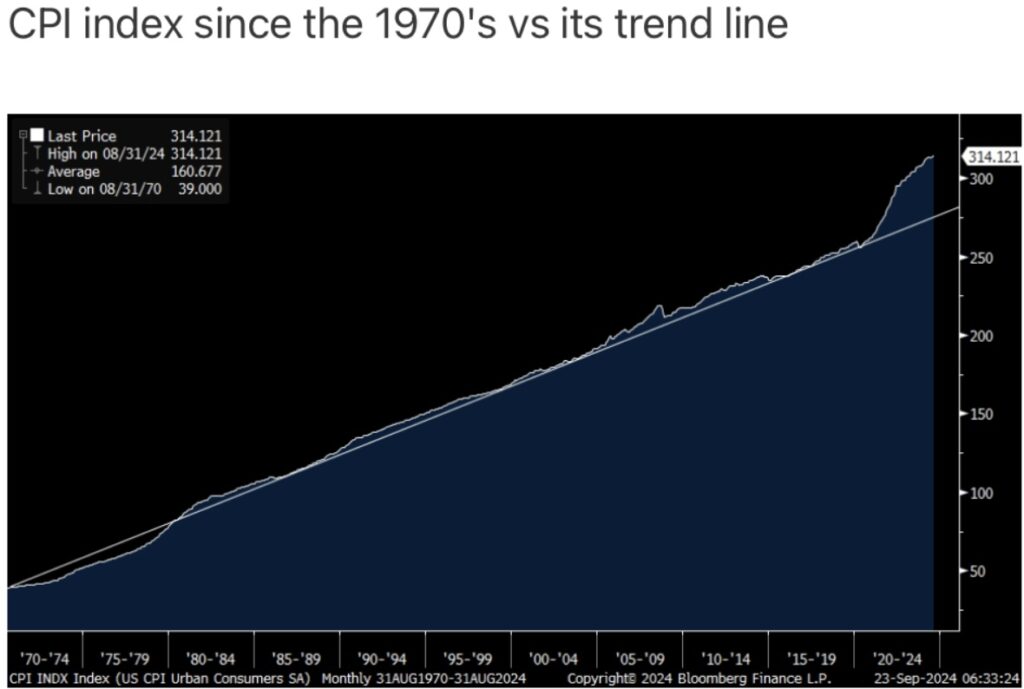

Governor Waller implicitly confirmed that this inflation symmetry policy is out the window as if they stuck to it, they would have to tolerate a period of time of deflation in order to ‘average’ out the recent period of high inflation at 2%. I’ll include a chart here again of how much inflation rose above its long term trend line and say again, once purchasing power is lost, it is lost forever because central bankers won’t let you get it back.

Real Estate Plus Immigration

From Lennar’s Friday conference call:

“While demand has been and should remain strong, the supply of homes remains constrained. The well documented chronic housing shortage is a result of years of underproduction. This shortage has been exacerbated by continuing shortfalls in production driven by restrictive land permitting and higher impact fees at local levels and higher construction costs across the housing landscape.”

And, “Mayors and Governors across the country have become acutely aware of the housing shortage and shortfall in their respective geographies…Awareness has begun to give way to the first signs of action, and more recently, even the national narrative has begun to acknowledge the need for programs that activate supply.”

“Of course, affordability has been a limiting factor for demand and access to home ownership to date. Inflation and interest rates have hindered the ability of average families to accumulate a down payment or to qualify for a mortgage. Higher interest rates have also locked households in lower interest rate mortgages and curtailed the natural move-up as families expand and need more space. Rate buy-downs and incentives have enable demand to access the market to date.”

They also touched on the impact of the sharp rise in immigration. “On one hand, the influx of the immigrant population has expanded the labor pool and therefore offset the pressure on construction cost increases. On the other hand, the increase in population requires more supply of dwellings to house that growing population.”

One Of The Most Important Interviews Of 2024

To listen to one of Michael Oliver’s most important interviews of 2024 where he issues a major crash warning for the US stock market and discusses what will happen with gold and the rest of global markets CLICK HERE OR ON THE IMAGE BELOW.

Another Record High For Gold!

To listen to James Turk discuss the wild trading in the gold and silver markets as well as what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.