Today the man who has become legendary for his predictions on QE and historic moves in currencies and metals warned King World News that investors need to get into physical gold right now or risk losing their entire fortune.

Ride The Gold Bull Wagon Or Lose Your Fortune

January 14 (King World News) – Egon von Greyerz, Founder of Matterhorn Asset Management: With the US shooting itself in the foot again, we are now certain that this is the final farewell to the bankrupt dollar based monetary system.

More about this follows but, in the meantime, an extremely important warning:

If you have never been a goldbug, this is the time to become one.

I decided 25 years ago that the destiny of the world economy and the financial system necessitated the best form of wealth preservation that money could buy.

And physical gold performs that role beautifully just as it has done for several thousands of years as every currency or fiat monetary system has collapsed without fail throughout history.

Thus, at the beginning of this century we told our investor friends and ourselves to buy gold for up to 50% of investable liquid asset.

So at $300 we acquired important amounts of gold and have never looked back. We have of course never sold any gold but only added since.

I have never called myself a goldbug, just someone who wanted to protect assets against the risk of the destruction of the financial system including all currencies. But now is really the time to become a real gold bug.

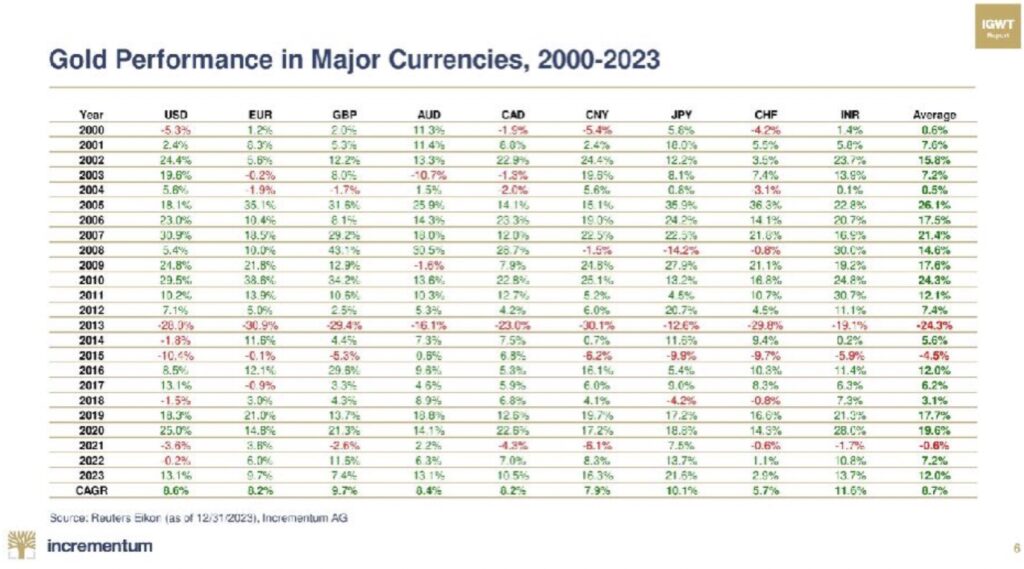

So, today just over 20 years later, gold is up 7 – 8X in most Western currencies and multiples of that in weaker economies like Argentina, Venezuela, Turkey etc.

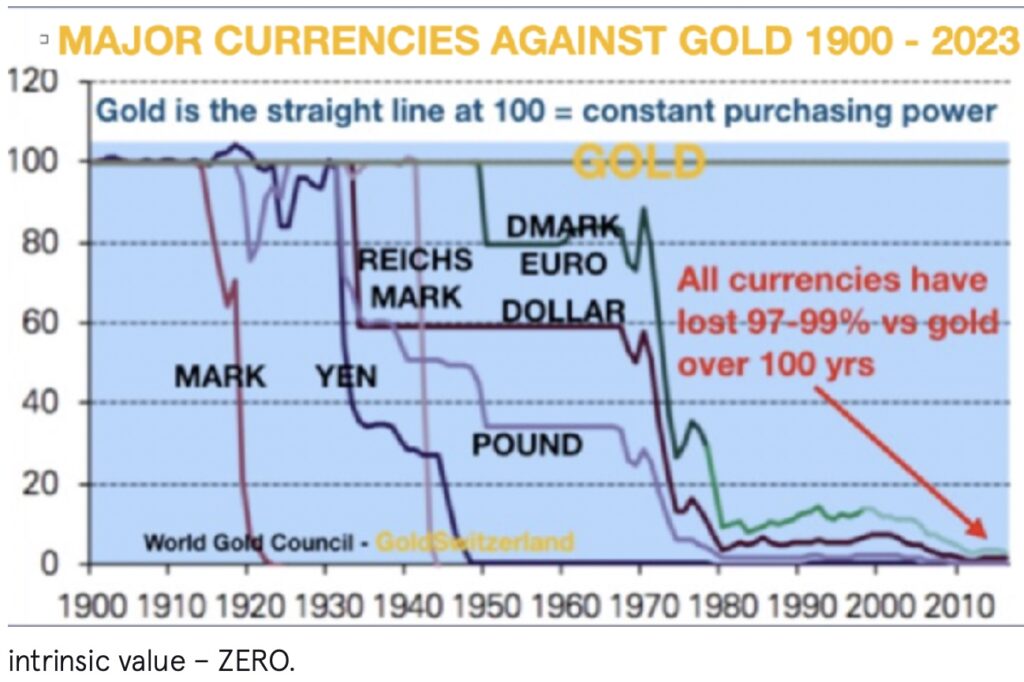

The total mismanagement of the US financial system has led to the dollar losing 98% of its value since Nixon closed the gold window in 1971. Most other currencies have followed the dollar down at varying speeds.

But now comes the really exiting phase of this race to the bottom.

We have only 2% left for the dollar based currency system goes to ZERO.

As Voltaire said in 1728, “Paper money always returns to its intrinsic value – ZERO.

What we must remember is that the dollar doesn’t just have a further 2% to fall to reach zero. Because to reach zero, it will next fall 100% from where it is today.

I know the sceptics will say that this is not possible. But these sceptics don’t know their history. Since fiat currencies’ record is perfect, no one must believe that because we live today, it is different to a 5,000 year faultless record of success, or shall we call it failure, of currencies always reaching zero…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

THE US CONTINUES TO SHOOT ITSELF IN THE FOOT

How many times can you shoot yourself in the foot and still walk upright with pride?

Well, the US government certainly has wounded itself mortally with both feet being so full of holes that there is hardly any space left for another hole.

So, the latest hole in the US dollar foot is a proposal to steal $300 billion of Russian reserves and use the funds for the reconstruction of Ukraine.

A deadline has been set for the G7 nations to come up with the detailed proposal by 24 February.

The proposal has obviously come from the US backed by its faithful lapdog the UK.

Now don’t get me wrong, I really like the US and also the UK and their people but that doesn’t mean that I concur with the idiotic decisions taken by their governments without the consent of their people.

So will 2024 be the year which, when all the evils which the West has created, erupt in the most violent chain of events political, civil wars, geopolitical, more war, terrorism, economic collapse including the fall of the monetary system.

Well the ingredients are certainly present to create a picture similar to The Triumph of Death painting by Bruegel.

We obviously hope that this is not where the world is heading but all the ingredients are sadly in place for the start of a series of events which will be both unpredictable and uncontrollable. “The Financial System has reached the End”

MOST MAJOR WARS SINCE WWII HAVE BEEN INSTIGATED BY THE US

As Merkel admitted, since the Minsk agreement in 2014, it was always the intention of the US to push Ukraine into a conflict with Russia.

This war is still going on with more than 500,000 having been killed. (Since propaganda from both sides is a major part of a war, we will never know the correct figure.)

It will obviously be very tempting for the G7 to use the $ 300 billion funds blocked stolen, for the war since many countries’ parliaments are becoming reluctant to fund this war.

So is the US and its allies going to set a precedent that should also apply for other wars?

Since the US initiated the attacks on Vietnam, Iraq, Libya, Syria and many other countries, should not the US foreign reserves be applied for the reconstruction of all these nations?

But as always, it is one rule for the mighty US and another rule for its enemies.

As Bush Jr said, “Either you are with us or you are with the terrorists.”

THE LAST PHASE OF THE DOLLAR DEBASEMENT NEXT

This very final phase of the dollar debasement to zero really started on June 29, 2022 when the US decided to seize all Russian financial assets.

That action was the nail in the coffin (as well as the shot in the foot) of the Petrodollar system. This has been in place since 1973 to support the dollar with a payment system for black gold since yellow gold was no longer supporting the dollar.

To seize a major sovereign state’s (Russia’s) assets can never end well. And then to give those assets to an enemy of that state (Ukraine) is guaranteed to seal the fate of the dollar dominant currency system and its backers.

An economically weak EU gave its support with the Brexit UK always obeying its US master’s.

A historical post mortem of this total submission to the command of the US will clearly conclude that it was totally disastrous for the German economy as well as the rest of Europe. But sadly weak leaders always make disastrous decisions.

And as the West has a massive surplus of weak leaders, it is running from one crisis to the next.

Is Treasury Secretary Yellen blind to what is happening to her economy or is she just giving the world the propaganda lies that all politicians must do to buy votes?

This is what Yellen said to House Financial Services Committee in August 2023:

“The dollar plays the role it does in the world financial system for very good reasons that no other country is able to replicate, including China. We have deep liquid open financial markets, strong rule of law and an absence of capital controls that no country is able to replicate….. But the dollar is far and away the dominant reserve asset.” –

“Deep liquid financial markets” means “we” have until now been able to create unlimited amounts of worthless fiat money. “Strong rule of law” means that whoever totally obeys the US increasingly totalitarian system, like for example the Patriot Act, is protected by the law. And as regards capital controls, FATCA (Foreign Account Tax Compliance Act) that the US forced upon the world’s finical system in 2014 has led to a total US control of the global financial system.

And as regards “the dollar is far and away the dominant reserve asset”, not for long Mrs Yellen.

Has Janet heard of de-dollarisation, has she heard go the BRICS and has she understood that the runaway debts and deficits are destroying the fabric of the US economy and financial system?

Yes of course she knows all of this and she also knows that she can’t do anything about it except to print more money. So her principal role is to keep the pretences up and hope that the system will not collapse on her watch. And then hopefully she canunscathed pass the baton to the next treasury secretary so that he/she can get the blame.

BRICS

The BRICS already has 10 members, India, China, Brazil, Russia, South Africa, Saudi Arabia, UAE, Iran, Egypt and Ethiopia.

In addition, another 30 countries want to join including for example Venezuela.

The BRICS produce just under 50% of global oil.

But if we look at oil reserves, the existing BRICS plus aspiring members like Venezuela, have over 20X the oil reserves of the US.

PEAK ENERGY

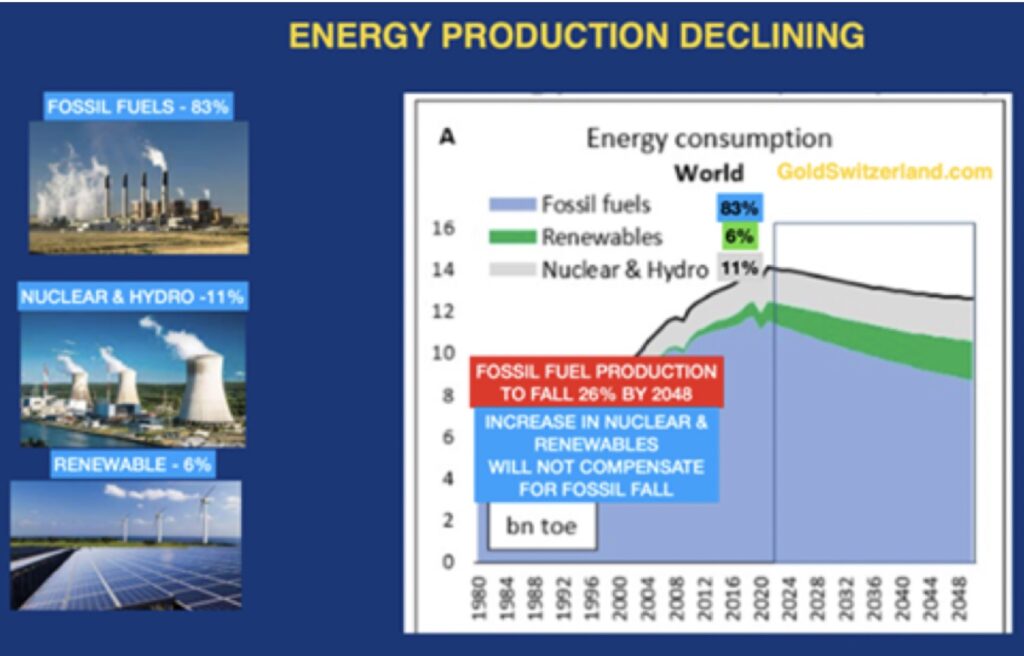

Another major economic crisis for the world is the contracting energy system.

The world economy is driven by energy which means fossil fuels. Without sufficient energy the living standards would decline fatally. Currently fossil fuels account for 83% of the world’s energy. The heavy dependence on fossil fuels is unlikely to change in the next few decades.

And as I have always believed, even electric vehicles are no longer the holy grail that world governments are trying to push onto consumers. There are just too many problems such as cost of buying and cost of repairs, range and questionable CO2 benefits. Also environmentally EVs are a disaster since batteries have a short life and cannot be recycled.

But that’s not the only problem. For the first 60-70,000 miles an EV produces more CO2 than an ordinary vehicle.

Stocks are building up of unsold EVs, exacerbated by companies like Hertz selling off 20,000 vehicles.

Also, to produce ONE battery takes 250 tons of rock and minerals. The effect is 10-20 tons of CO2 from mining and manufacturing even before the vehicle has been driven 1 meter.

In addition, car batteries cannot be recycled but go to landfill which has major environmental implications.

And as concerns renewable energy, it is unlikely to replace fossil fuels for a very, very long time even if this is a politically uncomfortable view for the climate control activists. What very few realise is that most renewable energy sources are very costly and also all dependent on fossil fuels whether it is electric cars, wind turbines or solar panels.

As the graph shows, the energy derived from fossil fuels has declined for the last few years. This trend will accelerate over the next 20+ years as the availability of fossil fuels decline and the cost increases. The economic cost of producing energy has gone up 5X since 1980.

What very few people realise is that the world’s prosperity does not improve with more debt but with more and cheaper energy.

But sadly, as the graph above shows, energy production is going to decline for at least 20 years.

Less energy means lower prosperity for the world. And remember that this is in addition to a major decline in prosperity due to the implosion of the financial system and asset values.

The graph above shows that energy from fossil fuels will decline by 18% between 2021 and 2040. But although Wind & Solar will proportionally increase, it will in no way compensate for the fall in fossil fuels. For renewable energy to make up the difference, it would need to increase by 900% with an investment exceeding $100 trillion. This is highly unlikely since the production of Wind & Solar are heavily dependent on fossil fuels.

Another major problem is that there is no efficient method for storing Renewable energy.

Let’s just take the example of getting enough energy from batteries. The world’s largest battery factory is the Tesla Giga factory. The annual total output from this factory would produce 3 minutes of the annual US electricity demand. Even with 1,000 years of battery production, the batteries from this factory would produce only 2 days of US electricity demand.

So batteries will most probably not be a viable source of energy for decades especially since they need fossil fuels to be produced and charged.

Nuclear energy is the best available option today. But the time and cost of producing nuclear means that it will not be a viable alternative for decades. Also, many countries have stopped nuclear energy for political reasons. The graph above shows that nuclear and hydro will only increase very marginally in the next 20 years.

Of course the world wants to achieve cleaner and more efficient energy. But today we don’t have the means to produce this energy in quantity from anything but fossil fuels.

So stopping or reducing the production of fossil fuels, which is the desire of many politicians and climate activists, is guaranteed to substantially exacerbate the decline of the world economy.

We might get cleaner air but many would have to enjoy it in caves with little food or other necessities and conveniences that we have today.

So what is clear is that the world is not prepared for even the best scenario energy case which entails a major decline in the standard to living in the next 20-30 years at least.

IMMINENT DECLINE OF THE WORLD ECONOMY

The above explanation, of the world economy as energy driven system, is important to grasp in order to understand the effect of the declining energy production. This decline together with the increased energy cost of producing energy will exacerbate the decline of the world economy.

To add to this longer term energy crisis which very few people discuss or fathom, the world is facing the end of the current monetary system.

Yes, the BRICS countries will over time assume the mantle of the waning Western empire.

But it won’t happen overnight, especially since the world’s second biggest economy, China, also has a debt problem almost as big as the US one.

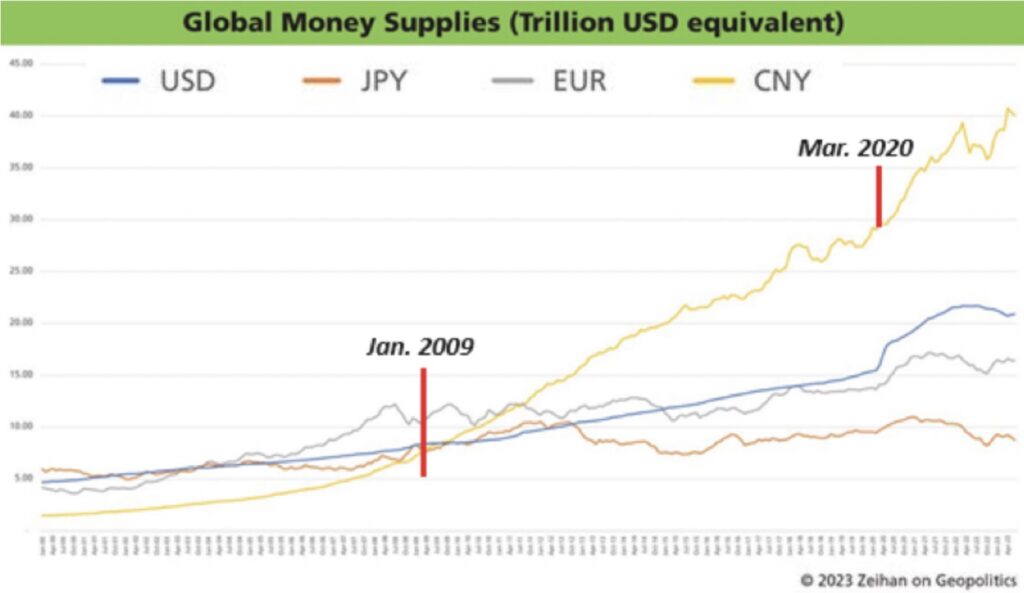

Just look at the growth of China’s money supply in this century. No country has survived such an explosion of money supply without serious consequences.

Insert

The advantage that China has is that their financial and currency system is principally domestic and can therefore be resolved “in-house”.

JUMP ON THE GOLD WAGON

No one can forecast with certainty when an event will take place.

But what we can determine with great certainty is that the risk is imminent for the world economy and the Western monetary system to go through an uncontrollable reset of proportions never seen before in history.

What we also feel certain about is that the gold price very soon will reflect the major problems that the world economy is facing.

In this century, gold has performed very strongly against all currencies as the table below shows.

Insert table

All major central banks will do all they can to support the gold price.

The BRICS and other Eastern countries will accelerate their already substantial purchases of gold. And the West, led by the US will accelerate the debt creation and spend unfathomable amounts in futile attempts to save their collapsing economies.

In June 2016 I advised investors to jump on the Goldwagon when gold was $1,300. https://goldswitzerland.com/get-on-the-goldwagon-to-10000/

Today with gold at $2,050 gold is still very cheap and anyone with some savings, small to very big, must now jump on the goldwagon and buy as much physical gold (and a bit of silver) as you can afford and then some more.

Owning gold will not solve all our problems, but it will at least give us a very important nest egg and protection against the coming financial debacle that will hit the world. This will link you directly to more fantastic articles from Egon von Greyerz CLICK HERE.

Egon von Greyerz’s Remarkable Predictions

King World News note: When it comes to the big picture, nobody in the world is better than Egon von Greyerz. He instructed his clients to put 50% of their liquid assets into physical gold when the price of gold was trading in the high $200s. It was a perfectly timed call. He has also correctly predicted the ever-increasing debt levels of the United States as well as the continuous debasement of global currencies, which has, so far, propelled the price of gold above $2,000.

I have been friends with Egon for 14 years and he has never once wavered from his prediction that many of the world’s currencies will hyperinflate, and physical gold will be the only refuge to get you safely on the other side of the Global Reset. But Egon has always stressed, and this is absolutely necessary, that the physical gold needs to be vaulted outside of the banking system. It is not too late to move your money into GoldSwitzerland, which has the best private vault system in the world. Please CLICK HERE to immediately register with GoldSwitzerland and become a client.

To listen to Alasdair Macleod discuss today’s wild trading in the gold, silver, and crude oil markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.